A deep dive into the Balancer exploit, uncovering the rounding error that led to a $116 million loss and its implications for DeFi.

Balancer, once a DeFi darling, faced a harsh reality check when a rounding error in its BatchSwap feature led to a $116 million exploit. Let's break down what happened and why it matters.

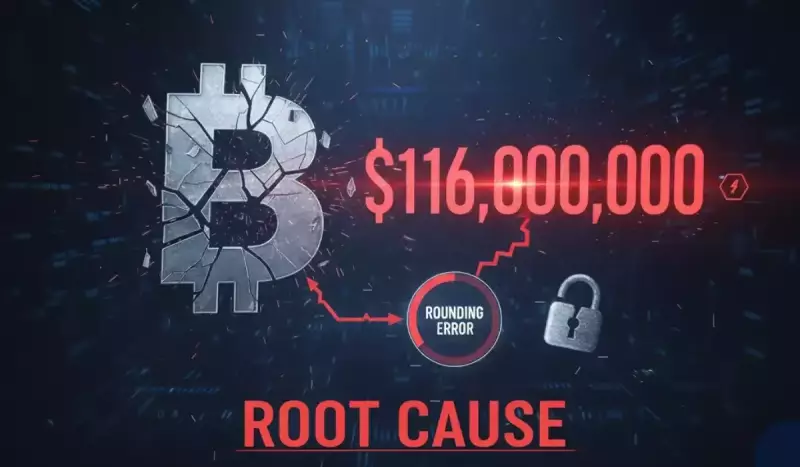

The Root Cause: A Tiny Rounding Error, Massive Impact

The culprit? A subtle rounding error in the "upscale" function of Balancer's v2 vault's BatchSwaps feature. This function, designed to save gas fees by combining multiple swaps, had a flaw. Instead of always rounding down when calculating token prices, it sometimes didn't, creating tiny discrepancies. Hackers exploited this, using flash loans to manipulate balances and drain funds. Think of it as finding a minuscule crack in a dam – seemingly harmless, but capable of unleashing a torrent.

The Timeline: From Discovery to Damage Control

The exploit, discovered on November 3, 2025, quickly escalated, targeting Balancer v2 Stable Pools and Composable Stable (CSP) v5 Pools across multiple blockchains, including Ethereum, Base, Avalanche, Arbitrum, Optimism, Gnosis, Polygon, Berachain, and Sonic. Initial estimates of $70 million ballooned to over $128 million within hours. The attack targeted Balancer Pool Tokens (BPT), manipulating pool prices during batch swaps.

The Aftermath: Recovery Efforts and DeFi's Vulnerability

Balancer and its security partners sprang into action, pausing affected pools, disabling new pool creation, and halting rewards for vulnerable pools. They even offered a 20% white hat bounty. Some funds were recovered, thanks to the efforts of StakeWise, BitFinding, and Base MEV bots, amounting to millions. Berachain validators halted their network to prevent further damage. It's like a frantic, multi-team effort to bail out a sinking ship.

Why This Matters: A Wake-Up Call for DeFi

This exploit isn't just about Balancer; it highlights a fundamental challenge in DeFi: the composability paradox. The same features that enable innovation also multiply systemic risk. As one security expert put it, it was a "trust collapse, not just a hack." Even protocols with multiple audits can harbor hidden vulnerabilities. This incident underscores the need for stronger risk management infrastructure in the DeFi space and a more nuanced understanding of smart contract risk.

The Human Element: Trust and Credibility

Beyond the technical aspects, this incident underscores the importance of trust and credibility in the decentralized world. As one developer pointed out, people follow people they trust, not just whitepapers. Projects led by visible, consistent, and credible builders are more likely to succeed. The Balancer exploit serves as a stark reminder that in DeFi, resilience is never guaranteed, not even after eleven audits.

Looking Ahead: A More Resilient DeFi?

The Balancer exploit was a painful lesson, but it's also an opportunity to learn and build a more resilient DeFi ecosystem. Stronger risk management, a deeper understanding of smart contract vulnerabilities, and a focus on trust and credibility are essential. It's like DeFi is going through its awkward teenage years, full of growing pains, but with the potential to mature into something truly remarkable. And who knows, maybe Balancer will even make a comeback story worthy of a Hollywood script!