|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

摩根大通(JPMorgan Chase)通过Kinexys,先驱者,碳信用令牌化,以提高自愿碳市场的透明度和效率。这是ESG的未来吗?

JPMorgan, Kinexys, and Carbon Credits: Tokenizing a Greener Future?

JPMORGAN,KINEXYS和CARBON ARDITS:使得更绿色的未来?

JPMorgan Chase, through its blockchain division Kinexys, is diving headfirst into tokenizing carbon credits, aiming to inject much-needed transparency and efficiency into the often murky voluntary carbon market. Buckle up, because this could be a game-changer for how we approach ESG.

摩根大通(JPMorgan Chase)通过其区块链分区的Kinexys首先潜入碳信用量,旨在将急需的透明度和效率注入通常模糊的自愿碳市场。扣紧,因为这可能是我们如何接近ESG的游戏改变者。

Kinexys' Blockchain Strategy: A Shot of Integrity

Kinexys的区块链策略:完整性的镜头

Kinexys isn't just dabbling; they're building a blockchain-based system with S&P Global, EcoRegistry, and the International Carbon Registry (ICR) to digitize carbon credits. These tokens represent verified reductions of one metric ton of CO₂ emissions. The key? Smart contracts that create an un-tamperable audit trail. Think of it as Fort Knox for carbon credits, ensuring no counterfeits or double-spending.

Kinexys不仅涉足;他们正在使用S&P Global,EcoreGistry和International Carbon Registry(ICR)建立一个基于区块链的系统,以数字化碳信用。这些令牌代表经过验证的减少一吨套装的排放。钥匙?智能合约会创造出不受欢迎的审核步道。将其视为碳信用额的诺克斯堡,确保不假冒或双人支出。

Traditional carbon registries have struggled with transparency, but Kinexys aims to fix that. By combining blockchain with ICR and EcoRegistry validation, they're creating a solid source of truth. This addresses major headaches like fraud, duplication, and incompatible records that have plagued the voluntary carbon markets.

传统的碳注册机构一直在透明度上挣扎,但Kinexys旨在解决这个问题。通过将区块链与ICR和生态学验证相结合,他们创造了一个可靠的真理来源。这解决了困扰自愿碳市场的欺诈,重复和不兼容的记录等重大头痛。

JPMorgan's ESG Ambitions Get a Boost

摩根大通的ESG野心得到了提升

This move isn't out of the blue. JPMorgan has been exploring real-world asset (RWA) tokenization. Kinexys even pulled off a cross-chain settlement with tokenized U.S. Treasuries. Now, this carbon-focused pilot doubles down on JPMorgan's climate finance footprint. A recent long-term agreement with Canadian carbon capture firm CO₂80 to remove 450,000 metric tons of carbon shows they're serious about investing in climate solutions.

这一举动并不是蓝色的。摩根大通一直在探索现实世界中的资产(RWA)令牌化。 Kinexys甚至与令牌化的美国国库达成了跨链定居点。现在,这种以碳为中心的飞行员在摩根大通的气候财务足迹上翻了一番。最近与加拿大碳捕获公司Co₂80的一项长期协议,以删除450,000公吨的碳,表明他们很认真地投资于气候解决方案。

The big picture? JPMorgan wants to offer biodiversity or water-use credits through a tokenized system, creating a comprehensive ESG portfolio. With S&P Global providing market intelligence, tokenized carbon credits could even become composable collateral within decentralized financial (DeFi) systems.

大局?摩根大通希望通过令牌化系统提供生物多样性或水利用信用,从而创建全面的ESG投资组合。随着标准普尔全球提供市场情报,令牌化的碳信用额甚至可能成为分散的金融(DEFI)系统中的组合抵押品。

My Take: A Necessary Evolution

我的看法:必要的进化

The voluntary carbon market needs a serious makeover. The current system is often opaque and fragmented, leading to trust issues and hindering progress. Kinexys' blockchain model offers a potential solution by providing accountability and seamless integration with sustainability goals. I think this initiative has the potential to not only increase transparency but also drive more investment into carbon reduction projects, which are crucial for meeting global climate goals. If successful, this pilot could set a new standard for the industry.

自愿碳市场需要进行认真的改头换面。当前的系统通常不透明且分散,导致信任问题并阻碍进步。 Kinexys的区块链模型通过提供问责制和与可持续性目标的无缝集成提供了潜在的解决方案。我认为,该计划不仅有可能提高透明度,而且还可以推动对减少碳化碳项目的更多投资,这对于实现全球气候目标至关重要。如果成功,该飞行员可以为行业树立新标准。

The Future Looks Green (and Tokenized)

未来看起来绿色(和令牌化)

With the increasing demand for credible ESG tools, JPMorgan, through Kinexys, is positioning itself as a major player in shaping how institutions approach carbon markets. If this pilot succeeds, Kinexys could become an industry leader in transparency, efficiency, and trust.

随着对可信ESG工具的需求不断增长,JPMorgan通过Kinexys将自己定位为塑造机构如何接近碳市场的主要参与者。如果该飞行员成功,Kinexys可能会成为透明,效率和信任的行业领导者。

So, will tokenized carbon credits save the planet? Maybe not single-handedly, but they're a step in the right direction. And hey, who doesn't love the idea of blockchain making the world a little greener? It's about time Wall Street got its hands dirty (in a good way!).

那么,标记化的碳信用额会保存地球吗?也许不是单枪匹马,但它们朝着正确的方向迈出了一步。嘿,谁不喜欢区块链使世界更绿的想法?大约是时间华尔街弄脏了手(以一种很好的方式!)。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

- 比特币,自由和杠杆:在新加密时代解锁财务火力

- 2025-07-04 04:00:15

- 探索比特币如何超越简单投资的发展,为财务自由和现实世界应用中的杠杆作用提供了新的途径。

-

- Luna Crypto崩溃:从数十亿美元失去到一个安静的复出?

- 2025-07-04 02:35:18

- 探索戏剧性的露娜加密货币崩溃,目前的状态,以及它是建立稳定的未来还是面临另一个崩溃。

-

-

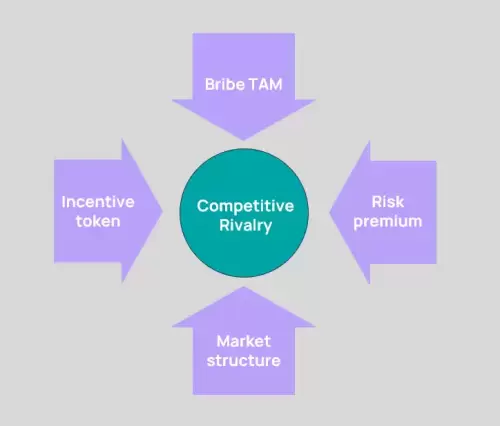

- 贿赂的四种力量:解码加密动机的动力

- 2025-07-04 02:35:18

- 探索加密货币中的“四个动力,四个力量”,特别是在酒中,揭示了激励措施的效率及其对代币持有人的影响。让我们潜入!

-

- Solana Defi积累:骑波浪还是只是在努力?

- 2025-07-04 02:40:12

- Solana Defi认为有趣的积累趋势。从Memecoin的潮流到机构ETH的购买,我们深入介绍了加密货币的心脏。

-

-

- 比特币的公牛运行:标准特许和ETF流入效应

- 2025-07-04 00:30:13

- 标准特许预测,到2025年,在ETF流入的推动下,比特币将达到200,000美元。这对加密的未来意味着什么?