|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

以太坊(ETH)刚刚在数字资产世界中取得了重大胜利,美国证券交易委员会(SEC)批准了期权交易

The U.S. Securities and Exchange Commission (SEC) has approved options trading for several exchange-traded funds (ETFs) that track the Ethereum (ETH) price, opening up new avenues for investors to engage with the cryptocurrency.

美国证券交易委员会(SEC)已批准了跟踪以太坊(ETH)价格的几家交易所交易基金(ETF)的期权交易,为投资者提供了与加密货币互动的新途径。

This move is pivotal for Ethereum, merging the decentralized finance (DeFi) and cryptocurrency markets with the traditional financial landscape. Investors can now opt to trade on bullish or bearish movements in the iShares Ethereum Trust (ETHA), recently launched by BlackRock (NYSE:BLK).

这一举动对以太坊至关重要,将分散的财务(DEFI)和加密货币市场与传统的金融格局合并。现在,投资者可以选择以贝莱德(NYSE:BLK)推出的iShares以太坊信托(ETHA)的看涨或看跌运动进行交易。

The approval of options trading on Ethereum-based ETFs is a significant development, creating new opportunities for institutional investors to participate in the cryptocurrency market.

批准基于以太坊ETF的期权交易是一个重大发展,为机构投资者提供了参与加密货币市场的新机会。

It is also a testament to the growing acceptance of digital assets within traditional financial institutions.

这也证明了传统金融机构中数字资产日益增长的证明。

Several firms, including BlackRock, have already launched options trading on their Ethereum ETFs. For instance, BlackRock began options trading on iShares Ethereum Trust (ETHA) on Monday, July 10, on the Nasdaq ISE.

包括贝莱德在内的几家公司已经在以太坊ETF上推出了期权交易。例如,贝莱德(BlackRock)于7月10日星期一在纳斯达克ISE上开始在Ishares以太坊信托(ETHA)上进行期权交易。

Meanwhile, Circle (NYSE:CCIV) and FTX are offering options contracts on Ethereum futures through the Cboe BZX Exchange (ticker: BZG).

同时,Circle(NYSE:CCIV)和FTX通过CBOE BZX Exchange(股票:BZG)提供以太坊期货的期权合同。

The SEC's approval of options trading on Ethereum ETFs is a game-changer for the cryptocurrency, bringing it one step closer to the institutional market.

SEC对以太坊ETF的期权交易的批准是加密货币的改变游戏规则,使其更接近机构市场。

While Ethereum's market capitalization is still relatively small compared to Bitcoin's, this development could bring significant attention and capital from institutional investors.

尽管与比特币相比,以太坊的市值仍然相对较小,但这种发展可能会引起机构投资者的大量关注和资本。

Many institutions have been slow to enter the cryptocurrency market due to the lack of traditional investment products, but options trading could be a key factor in increasing institutional participation in Ethereum.

由于缺乏传统投资产品,许多机构进入加密货币市场的速度很慢,但是期权交易可能是增加机构参与以太坊的关键因素。

The ability to trade options on Ethereum-based ETFs provides investors with additional tools to manage their risk exposure, speculate on price movements, and hedge against potential volatility.

在基于以太坊的ETF上交易期权的能力为投资者提供了其他工具来管理其风险敞口,推测价格变动以及对冲潜在波动性。

This could spark an influx of new institutional money into Ethereum, further legitimizing it as an asset class and enhancing its appeal to a wider range of investors.

这可能会使新的机构资金涌入以太坊,进一步将其作为资产类别合法化,并增强其对更广泛投资者的吸引力。

Ethereum Faces Bearish Sentiment, But This Could Be the Turnaround It Needs

以太坊面临看跌的情绪,但这可能是它需要的周转

Experts are optimistic that the SEC's approval of options trading could serve as a catalyst for a potential recovery in Ethereum, which has faced recent sharp losses and bearish sentiment.

专家们乐观地认为,SEC对期权交易的批准可以作为以太坊潜在恢复的催化剂,这已经面临着最近的巨大损失和看跌感情。

Ethereum has seen significant headwinds in recent weeks, with concerns about its price momentum and broader market trends.

以太坊最近几周引起了巨大的逆风,对其价格动力和更广泛的市场趋势感到担忧。

Despite the bearish outlooks, the SEC's approval of options trading on several Ethereum-based ETFs could be a crucial turning point.

尽管看跌了前景,但SEC对几个基于以太坊ETF的期权交易的认可可能是一个至关重要的转折点。

The introduction of options trading offers investors a way to manage exposure to ETH while providing greater flexibility to short-term price fluctuations. This addition could spark renewed interest in Ethereum as a viable investment vehicle.

期权交易的引入为投资者提供了一种管理对ETH的接触的方式,同时为短期价格波动提供了更大的灵活性。这种增加可能引起人们对以太坊的新兴趣,作为可行的投资工具。

As institutions begin engaging more with Ethereum, it could help stabilize its price and attract new investors, potentially leading to a reversal of the recent bearish trend.

随着机构开始与以太坊的更多参与,它可以帮助稳定价格并吸引新的投资者,这可能导致最近看跌趋势的逆转。

What's Next for Ethereum ETFs and the Broader Crypto Market?

以太坊ETF和更广泛的加密市场的下一步是什么?

With Ethereum's options trading now in play, the next few months could see increased market activity as institutional investors explore new ways to engage with the asset.

随着以太坊的期权交易目前正在发挥作用,随着机构投资者探索与资产互动的新方式,接下来的几个月可能会增加市场活动。

As more firms follow BlackRock's lead and launch their own Ethereum-based ETFs with options, liquidity could improve, making ETH a more attractive investment for both retail and institutional investors.

随着越来越多的公司遵循贝莱德(BlackRock)的领先优势并推出了自己的以太坊ETF的选择,流动性可以改善,使ETH成为零售和机构投资者的更具吸引力的投资。

The Ethereum ETF approval is also a watershed moment for the broader crypto market, highlighting the growing integration of digital assets into traditional financial systems.

以太坊ETF批准也是更广泛的加密货币市场的分水岭,强调了数字资产不断增长的传统金融系统的一体化。

As Ethereum continues to mature, this approval could serve as a crucial stepping stone toward wider acceptance and further adoption in mainstream finance.

随着以太坊继续成熟,这种批准可以作为对更广泛接受并进一步采用主流金融的至关重要的垫脚石。

Stay tuned for updates as Ethereum navigates this new era of institutional involvement and options trading, which has the potential to significantly reshape the market landscape.

随着以太坊在机构参与和期权交易的这个新时代,请继续关注更新,这有可能显着重塑市场格局。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 孤立区块链的时代即将结束?

- 2025-05-20 17:30:13

- 这无疑是ChainLink发送的强信号,该信号刚刚激活了Solana上的CCIP互操作性协议。

-

- 5个最佳模因硬币要在6月之前购买,直到2026年

- 2025-05-20 17:30:13

- 随着加密市场仍然充满投机能源的脉动,模因硬币继续提供一些最不对称的机会

-

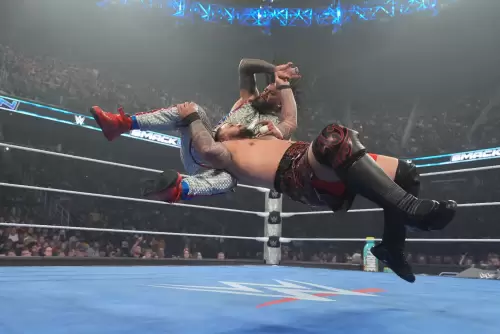

- 如果您想了解美国,请观看职业摔跤比赛

- 2025-05-20 17:25:13

- 有一个受欢迎的俗语,“如果您想了解美国,请观看职业摔跤比赛。”虽然它可能是毛病的,并且有些简化

-

-

- 这次加密公牛奔跑的最后大幅崛起即将到来。这是3个要看的Altcoins

- 2025-05-20 17:20:13

- 根据许多加密专家和技术分析师的说法,这款加密牛跑步的最终大幅增长即将推出。现在,市场正在侧向移动

-

- 你可知道?

- 2025-05-20 17:20:13

- 加密货币的世界非常活跃。价格可以在几秒钟内上涨或下降。因此,对此类问题有可靠的答案对投资者至关重要。由Etmarkets。

-

-

- 比特币超级英雄:曼多CT的改变游戏规则指南

- 2025-05-20 17:15:14

- 在数字货币重新定义财富的时代,曼多CT的比特币超级英雄:什么是比特币?作为投资者浏览复杂世界的灯塔

-