|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

以太坊(ETH)继续以显着的速度从集中式交流中流出。仅在过去的七天中,净流出就超过了3.8亿美元

Ethereum (ETH) continues to flow out of centralized exchanges at a significant rate. Over the past seven days alone, net outflows surpassed $380 million, according to blockchain analytics firm IntoTheBlock.

以太坊(ETH)继续以显着的速度从集中式交流中流出。根据区块链分析公司Intotheblock的数据,仅在过去的七天中,净流出就超过了3.8亿美元。

This reduction in exchange-held ETH reflects growing investor accumulation into self-custody and could point to a tightening supply narrative that has historically preceded price rallies.

这种减少交换的ETH的减少反映了投资者不断增长的自我群体积累,并可能表明供应叙事的紧缩叙事历史上已经先于价格集会。

ETH Accumulation Persists Despite Price Volatility

尽管价格波动,ETH积累仍然存在

Data shows Ethereum’s net flows from exchanges were consistently negative between April 24 and May 1, with a particularly large outflow recorded on April 26. This behavior suggests that investors were utilizing short-term price blips to buy and withdraw ETH into self-custody.

数据表明,以太坊的交流净流量在4月24日至5月1日之间始终是负面的,在4月26日记录了流出量特别大。这一行为表明投资者正在利用短期价格漏斗来购买和将ETH撤回自我客户。

Despite price fluctuations throughout the week, ETH ended the period on a positive note, climbing back above $1,840. Analysts interpret sustained exchange outflows as a bullish sign as reduced supply on exchanges lowers the risk of sell pressure and may create the conditions for a breakout if demand increases.

尽管整个星期的价格波动,但ETH还是以积极的声音结束了这一期间,却回落了1,840美元以上。分析师将持续的交换流出解释为看涨的标志,因为交换的供应减少会降低销售压力的风险,如果需求增加,则可能会为突破带来突破的条件。

(Chart: Glassnode)

(图表:玻璃节)

On-chain data also shows that the largest Ethereum holders, known as "whales," are either maintaining their positions or continuing to accumulate, even as the second-largest cryptocurrency has massively underperformed Bitcoin this cycle.

链上的数据还表明,即使第二大加密货币在本周期中,最大的以太坊持有人,称为“鲸鱼”,要么维持其位置或继续积累。

CryptoQuant analyst Darkost pointed out that wallets holding over 100,000 ETH have increased by about 3% since August 2024, which he sees as an indication of “smart money” positioning. He added that since 2020, the proportion of ETH held by large wallets has been gradually decreasing, but now that trend seems to be reversing.

加密分析师Darkost指出,自2024年8月以来,拥有100,000多个ETH的钱包增长了约3%,他认为这表明“聪明”的定位。他补充说,自2020年以来,大钱包持有的ETH比例逐渐减少,但是现在这种趋势似乎正在逆转。

More bullish on-chain data that may be setting up Ethereum for a major rebound

更多看涨的链链数据可能正在为重大反弹设置以太坊

Darkost also noted that the number of active addresses has remained stable despite ETH’s price decline. He observed considerable selling pressure in the derivatives market, although it may be subsiding. Notably, Net Taker Volume went positive on April 23 and 24, which could signal the beginning of a bottoming process if the trend continues.

Darkost还指出,尽管ETH的价格下跌,活动地址的数量仍然保持稳定。他观察到衍生品市场的销售压力很大,尽管它可能正在缓解。值得注意的是,净接收者的数量在4月23日至24日为正,这可能表明,如果趋势持续下去,则可以表明底部过程的开始。

These metrics run contrary to the “Ethereum is dead” narrative, he said. In essence, despite ETH currently trading around 62% below its 2021 all-time high, on-chain data indicates enduring strength and strategic accumulation.

他说,这些指标与“以太坊死了”的叙述相反。从本质上讲,尽管ETH目前的交易量低于其2021年历史最高的链链数据,但仍表明持久的力量和战略积累。

How to approach ETH

如何接近ETH

In summary, while some encouraging long-term signals exist, on-chain data still reflects a lingering pessimism around ETH, Darkost concluded. He also noted that open interest has dropped significantly and trading volume remains low, both of which highlight the cautious market sentiment.

总而言之,尽管存在一些令人鼓舞的长期信号,但链上数据仍然反映出围绕ETH的悲观情绪,Darkost得出结论。他还指出,开放兴趣已经大大下降,交易量仍然很低,这两者都强调了谨慎的市场情绪。

The most prudent approach may be to await a clear invalidation of the bearish trend or, at most, engage in a light dollar-cost averaging (DCA) strategy, he said.

他说,最谨慎的方法可能是等待看跌趋势的明显无效,或者最多从事轻盈的美元平均战略(DCA)策略。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 关于新集会的谣言再次巡回演出。

- 2025-05-03 23:15:13

- 专家认为,XRP价格在接下来的几周内可以再上涨75%,越来越多的交易员坚信,新的付款代币递减(RTX)悄然结合在一起。

-

-

-

-

- 当比特币攀登和Pepeto准备发射时,市场情绪变为正面

- 2025-05-03 23:05:13

- 加密市场的情绪表现出明显的乐观迹象,因为恐惧和贪婪指数的变化更高,这表明投资者信心正在增长。

-

-

- 在Crypto Twitter上找到下一个大加密的最终指南

- 2025-05-03 23:00:12

- 在加密货币的超级快速世界中,在其他所有人加入船上之前找到下一个大事是许多投资者的最终目标。

-

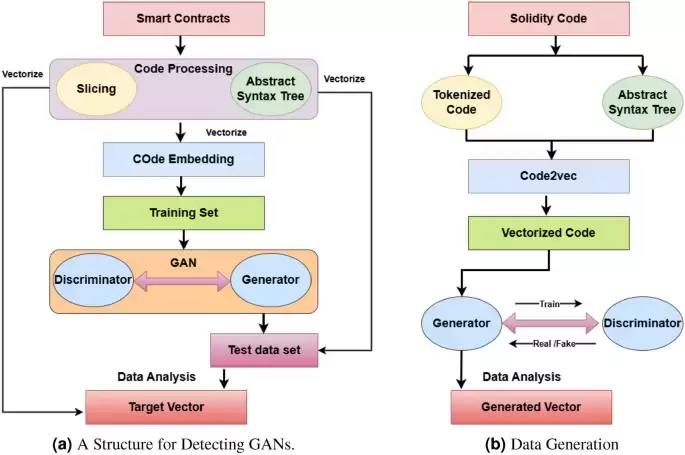

- 用于检测智能合约中整数溢出漏洞的生成对抗网络

- 2025-05-03 22:55:13

- 由于快速区块链技术开发,银行,医疗保健,保险和物联网已采用了智能合约(SC)