|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在过去的24小时内,加密货币价格在过去的24小时内均下降,这是由于加深美中贸易紧张局势引发的更广泛的风险资产抛售。

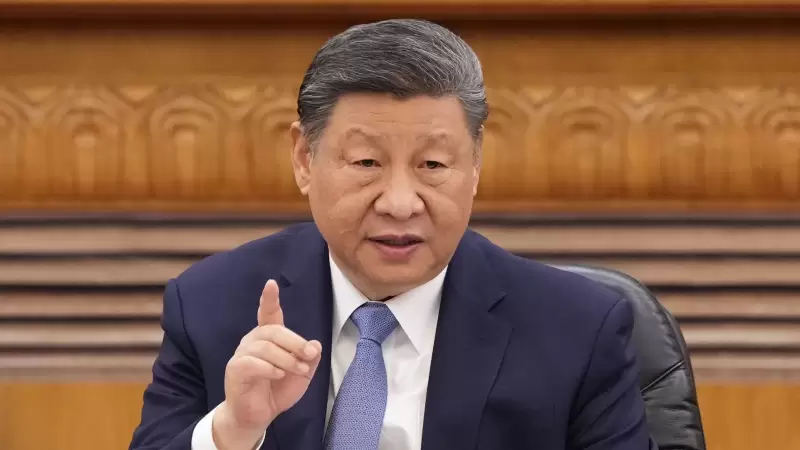

Cryptocurrency prices are down across the better part of the board over the last 24 hours amid a wider risk asset sell-off triggered by deepening U.S.-China trade tensions.

在过去24小时内,加密货币价格在董事会的大部分时间下降,这是由于加深美中贸易紧张局势触发的更大风险资产抛售。

The White House said China now “faces up to a 245% tariff on imports” and imposed new restrictions on chip exports to the country. Bitcoin (BTC) fell more than 2.2% while the broader market, measured by the CoinDesk 20 (CD20) index, declined 3.75%.

白宫说,中国现在“面临245%的进口税率”,并对向该国的芯片出口施加了新的限制。比特币(BTC)下降了2.2%以上,而Coindesk 20(CD20)指数衡量的更广泛的市场下跌了3.75%。

Nasdaq 100 futures are also down, losing more than 1% while S&P 500 futures dropped 0.65%.

纳斯达克100期货也下降了,损失了1%以上,而标准普尔500年期货下跌0.65%。

While bitcoin has remained notably stable as the trade war escalated, some metrics suggest the bull run may have ended.

尽管随着贸易战争的升级,比特币仍然非常稳定,但一些指标表明牛市可能已经结束。

The largest cryptocurrency slipped below its 200-day simple moving average on March 9, suggesting “the token’s recent steep decline qualifies this as a bear market cycle starting in late March,” Coinbase Institutional said in a note

Coinbase Institutional在一份票据中说,最大的加密货币在3月9日低于其200天简单移动平均水平以下,这表明“令牌最近的急剧下降将其作为熊市周期从3月下旬开始。”

A risk-adjusted performance measured in standard deviations known as the Z-Score shows the bull cycle ended in late February, with subsequent activity seen as neutral, according to Coinbase Institutional’s global head of research, David Duong.

根据Coinbase机构的全球研究负责人David Duong的说法,在称为Z得分的标准偏差中测得的风险调整性能显示了2月下旬的牛周期结束,随后的活动被视为中性。

“The chart pattern and Z-Score both suggest that the crypto bull market, which began in December 2022, has ended,” Duong said.

杜恩说:“图表模式和Z分数都表明,始于2022年12月的加密牛市已经结束。”

Still, the resilience cryptocurrency prices have shown is “undoubtedly good for the market,” as it lets traders “look more seriously at using premium to hedge — supporting the case for allocating into spot,” said Jake O., an OTC trader at crypto market maker Wintermute.

尽管如此,弹性货币价格已经显示出“无疑对市场有益”,因为它使交易者“更加认真地看着使用Premium来对冲 - 支持分配现场的案例,” Crypto Maker Maker Maker Maker Wintermute的OTC Trader。

“In response, several prime brokers have shifted their short-term models from underweight to neutral on risk assets, noting that the next move will likely be driven by ‘real’ data,” Jake O. Said in an emailed statement.

Jake O.在一封电子邮件声明中说:“作为回应,几家主要经纪人将其短期模型从体重不足转移到了风险资产中性,并指出下一步可能会由“真实”数据驱动。”

That “real data” is coming in soon enough, with the U.S. Census Bureau set to release March retail sales data, and Fed Chair Jerome Powell delivering a speech on economic outlook.

美国人口普查局将发布3月的零售数据,而美联储主席杰罗姆·鲍威尔(Jerome Powell)发表了有关经济前景的演讲,因此“真实数据”即将到来。

Tomorrow, the U.S. Department of Labor releases unemployment insurance data and the Census Bureau releases residential construction data, while the ECB is expected to cut interest rates.

明天,美国劳工部发布了失业保险数据,人口普查局发布了住宅建筑数据,而欧洲央行则有望降低利率。

The shakiness in risk assets has benefited gold. The precious metal is up around 26.5% year-to-date to above $3,300 per troy ounce, contrasting with the U.S. Dollar Index’s 9% drop. Stay alert!

风险资产的不稳定使黄金受益。贵金属年龄上涨约26.5%,至每盎司3,300美元以上,与美元指数的下降9%形成鲜明对比。保持警觉!

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 比特币显示出更便宜的数据信号,分析师关注黄金轮动

- 2026-02-01 05:39:01

- 最近的数据表明,比特币的价格比 2017 年更具吸引力,分析师观察到黄金的潜在转变以及长期持有者积累的增加。

-

-

-

-

-

- 奥兰公园的持久魅力:硬币和邮票展览蓬勃发展

- 2026-02-01 04:39:19

- 奥兰公园继续其作为收藏家充满活力的目的地的传统,其硬币和邮票展览吸引了稀有发现和社区精神的爱好者。

-

- 通货膨胀的顽固控制:降息希望渺茫,比特币狂野

- 2026-02-01 04:32:01

- 顽固的通胀数据正在推迟美联储降息预期,在市场准备收紧货币政策之际,给比特币的短期前景蒙上阴影。

-

- 以太坊的边缘:突破流动性陷阱,着眼突破

- 2026-02-01 04:16:32

- 以太坊市场就像是在走钢丝,波动剧烈。高杠杆、稀薄的流动性以及方向之争决定了其目前在潜在的飙升和棘手的“流动性陷阱”之间的斗争。