|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

一位加密的作者已经讨论了比特币短期持有人如何提供有关何时退出的提示。

An analyst at CryptoQuant has discussed how one indicator may be able to provide hints about when it may be time to exit and enter Bitcoin.

CryptoQuant的一位分析师讨论了一个指标如何提供有关何时退出和输入比特币的提示。

In a recent Quicktake post, the analyst talked about distributing and accumulating BTC based on the behavior of the short-term holders. The short-term holders (STHs) are the investors who bought their coins within the past 155 days.

在最近的QuickTake帖子中,分析师讨论了基于短期持有人的行为分发和累积BTC。短期持有人(STH)是在过去155天内购买硬币的投资者。

These holders make up for one of the two main sides of the Bitcoin market, with the other cohort being known as the long-term holders (LTHs). The STHs, in contrast to the HODLers, tend to be quickly responsive to market events, so their metrics easily display changes.

这些持有人弥补了比特币市场的两个主要方面之一,另一个队列被称为长期持有人(LTHS)。与霍德尔(Hodlers)相比,STH倾向于快速响应市场事件,因此他们的指标很容易显示变化。

The indicator related to the STHs that the quant shared is the Spent Output Profit Ratio (SOPR). This metric tells us about whether the investors are selling their coins at a profit or loss.

与STH相关的指标表明,量子共享的是用过的产出利润率(SOPR)。该指标告诉我们投资者是出于利润或损失而出售其硬币。

The SOPR determines this by looking at the transaction history of each wallet taking part in a sell transaction to see what price it received its coins at. Transfers where this previous price is lower than the spot price are put in the profit sales, while those of the opposite type in the loss ones.

SOPR通过查看每个钱包的交易历史记录参加卖出交易来决定这一点,以查看其收到的硬币的价格。转移以前的价格低于现货价格的利润销售中,而损失损失的价格相反。

When the value of the indicator is greater than 1, it means the holders as a whole are realizing a net amount of profit. On the other hand, it being under the mark suggests the dominance of loss-taking.

当指标的价值大于1时,这意味着持有人整体上实现了净利润。另一方面,它在标记之下表明造成损失的主导地位。

Now, here is a chart that shows the trend in the Bitcoin SOPR specifically for the STHs over the last few years:

现在,这是一张图表,显示了过去几年专门针对STH的比特币SOPR的趋势:

As is visible in the above graph, the analyst has highlighted two zones for the indicator. The lower zone, shaded in green, corresponds to a notable degree of loss taking from the STHs. According to the quant, it’s usually a good time to start accumulating Bitcoin whenever the STHs are displaying this behavior.

如上图中可见,分析师突出了两个指标的区域。绿色阴影的下部区域对应于STH的显着损失程度。根据量化,每当STH显示此行为时,通常是开始积累比特币的好时机。

Similarly, the red zone, which corresponds to profit-taking from this cohort, could represent a distribution opportunity for the cryptocurrency. From the chart, it’s apparent that neither of these zones perfectly captures tops and bottoms in BTC’s price, so the analyst calls for only gradual selling and buying when the indicator enters the respective regions.

同样,与该队列的利润相对应的红色区域可能代表加密货币的分销机会。从图表来看,显然,这些区域都没有完美地捕获BTC价格的上衣和底部,因此分析师要求在指标进入相应地区时仅逐步销售和购买。

During the lows earlier in the year, the STH SOPR dipped into the green zone, implying this group was showing capitulation. With the recent price rally, the metric has recovered back above the 1 mark, but so far, it hasn't yet broken into the red area.

在今年早些时候的低谷期间,STH SOPR浸入了绿色区域,这意味着该组显示了投降。随着最近的价格集会,该指标恢复了1大关,但到目前为止,尚未破坏红色区域。

As such, at least going by this indicator, the time to start distributing Bitcoin may not be here yet.

因此,至少通过此指标,开始分发比特币的时间可能还不在这里。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 买家花费了超过1.4亿美元来抢购$ trump Meme Coins

- 2025-05-14 06:25:13

- 4月23日,该数字货币宣布其截至5月12日的前220名持有人将被邀请与总统共进晚餐。

-

-

-

- 缩小到以太坊(ETH)的差距,Cardano(ADA)变得越来越受欢迎

- 2025-05-14 06:15:13

- 同样,Remittix(RTX)凭借其创造性的方法来提出越来越多的兴趣。

-

-

- XRP期货即将到来,CME集团扩大了代币的机构采用

- 2025-05-14 06:10:13

- 正式发布会定于5月19日举行,使其成为XRP市场的关键日期。这一举动遵循了主要金融平台中XRP采用的势头的增加。

-

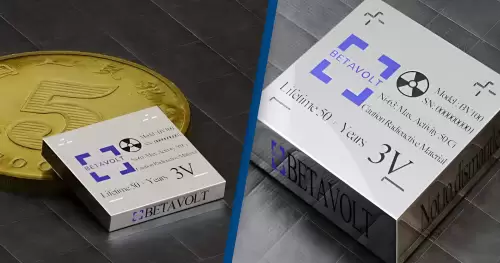

- 引入世界的第一个核电池,比硬币小,持续了100年

- 2025-05-14 06:10:13

- 在可能永远改变能源储能的未来的飞跃中,中国推出了一个小于硬币的核电池,该核电池比几十年没有一次充电了。

-