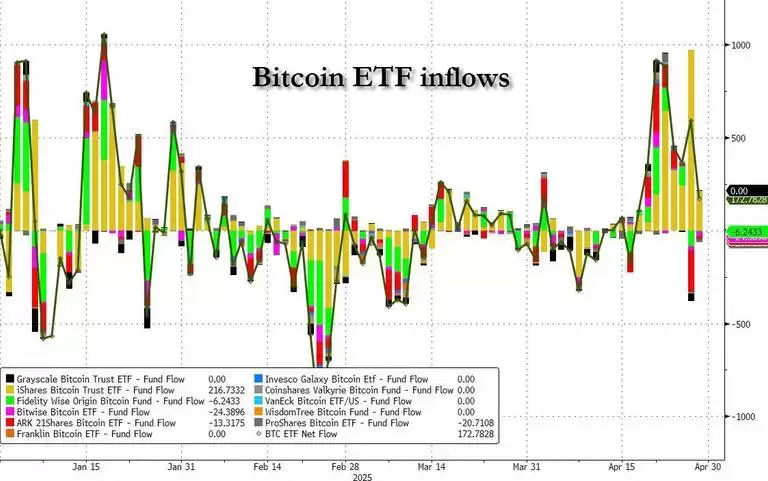

美国比特币交易所交易资金(ETF)在2025年4月30日的八天流入纪录中休息了一段休息,流出了5630万美元

U.S. Bitcoin exchange-traded funds (ETFs) encountered a brief interruption in their eight-day period of inflow with $56.3 million in outflows by April 30, partly driven by investor unease ahead of GDP and PCE figures. However, over the course of April, Bitcoin ETFs saw a net inflow of around $2.96 billion, and ETF providers boosted their holdings by 32,521 BTC to reach a new all-time high of 1,337,814 BTC, valued at $128 billion. This constitutes 6.4% of all Bitcoin ever mined. The U.S. market holds the majority with a 87% share of global Bitcoin ETF assets.

美国比特币交易所交易的资金(ETF)在八天的流入期间遇到了短暂的中断,到4月30日,流出了5630万美元,部分是由投资者不安的GDP和PCE数字驱动的。但是,在四月的过程中,比特币ETF的净流入约为29.6亿美元,ETF提供商将其持股量增加了32,521 BTC,达到了新历史最高的1,337,814 BTC,价值1280亿美元。这占有史以来所有比特币的6.4%。美国市场占全球比特币ETF资产的87%份额。

On May 1, U.S. Bitcoin ETFs returned to net inflows, notching up $422.5 million as BlackRock led the way with $351 million in buys, part of a 13-day streak that has seen the asset manager buy 37,000 BTC. This renewed inflow came as Bitcoin prices remained slightly below $97,000 and the cost basis ribbon for short-term holders returned to profitability, suggesting potential positive market momentum. In contrast, Ether (ETH) ETFs displayed weaker performance with continued net outflows on May 1, despite a $6.5 million inflow on the same day and ETH prices remaining above $1,800. Fidelity was the main buyer in ETH ETFs recently, while Grayscale encountered significant selloffs. The slight outflow on April 30 and early May was linked to investor caution toward economic data, but inflows resumed as prices rebounded, with BlackRock playing a key role in sustaining ETF demand.

5月1日,美国比特币ETF返回净流入,赚了4.225亿美元,因为贝莱德以3.51亿美元的购买方式领先,这是13天连胜的一部分,这是资产经理购买37,000 BTC的一部分。这种新的流入量是因为比特币价格略低于97,000美元,而短期持有人的成本基础丝带恢复为盈利能力,这表明潜在的积极市场势头。相比之下,尽管同一天有650万美元的流入,但Ether(ETH)ETF的性能较弱,净流出持续流出,而ETH价格的流入量仍超过1,800美元。 Fidelity最近是ETH ETF的主要买家,而Grayscale遇到了重大抛售。 4月30日和5月初的轻微流出与投资者对经济数据的谨慎有关,但随着价格反弹的流入恢复,贝莱德在维持ETF需求方面发挥了关键作用。