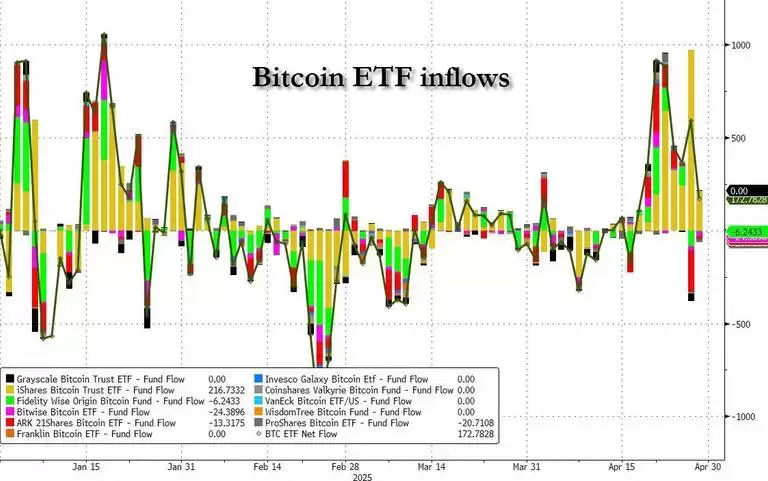

U.S. Bitcoin exchange-traded funds (ETFs) experienced a break in their eight-day inflow streak on April 30, 2025, with $56.3 million in outflows

U.S. Bitcoin exchange-traded funds (ETFs) encountered a brief interruption in their eight-day period of inflow with $56.3 million in outflows by April 30, partly driven by investor unease ahead of GDP and PCE figures. However, over the course of April, Bitcoin ETFs saw a net inflow of around $2.96 billion, and ETF providers boosted their holdings by 32,521 BTC to reach a new all-time high of 1,337,814 BTC, valued at $128 billion. This constitutes 6.4% of all Bitcoin ever mined. The U.S. market holds the majority with a 87% share of global Bitcoin ETF assets.

On May 1, U.S. Bitcoin ETFs returned to net inflows, notching up $422.5 million as BlackRock led the way with $351 million in buys, part of a 13-day streak that has seen the asset manager buy 37,000 BTC. This renewed inflow came as Bitcoin prices remained slightly below $97,000 and the cost basis ribbon for short-term holders returned to profitability, suggesting potential positive market momentum. In contrast, Ether (ETH) ETFs displayed weaker performance with continued net outflows on May 1, despite a $6.5 million inflow on the same day and ETH prices remaining above $1,800. Fidelity was the main buyer in ETH ETFs recently, while Grayscale encountered significant selloffs. The slight outflow on April 30 and early May was linked to investor caution toward economic data, but inflows resumed as prices rebounded, with BlackRock playing a key role in sustaining ETF demand.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.