|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特币显示在整合数周后持续恢复的迹象,技术指标表明可能朝着100,000美元的成绩转移。

Bitcoin (BTC) is showing signs of a sustained recovery after weeks of consolidation, with technical indicators suggesting a possible move towards the $100,000 mark. Recent on-chain data and trading patterns hint at renewed bullish sentiment as investors are holding their positions, potentially creating strong support at current levels.

比特币(BTC)显示合并数周后持续恢复的迹象,技术指标表明可能朝着100,000美元的成绩转移。最近的链上数据和交易模式暗示,随着投资者的职位,新的看涨情绪可能会在当前水平上创造强大的支持。

As central banks maintain cautious policy stances and institutional interest in crypto remains elevated, Bitcoin is once again emerging as a focal point for traders seeking high-upside opportunities. This rebound also coincides with a broader uptick in risk assets, highlighting renewed optimism in global financial markets and reinforcing Bitcoin’s role as a barometer of investor sentiment.

随着中央银行保持谨慎的政策立场和对加密货币的机构利益的提升,比特币再次成为寻求高层机会的交易者的焦点。这种反弹还与风险资产的更大增长相吻合,强调了对全球金融市场的新乐观情绪,并增强了比特币作为投资者情绪晴雨表的作用。

MVRV bounce mirrors past bull cycle setup

MVRV弹跳镜子过去的牛周期设置

MVRV弹跳镜子过去的牛周期设置

The Market Value to Realized Value (MVRV) ratio, a critical indicator for Bitcoin’s market cycle, has rebounded off the mean value of 1.74.

实现价值(MVRV)的市场价值是比特币市场周期的关键指标,其平均值为1.74。

According to Glassnode, this level has typically marked the early stages of major price rallies. A similar trend was observed in mid-2024 when a bounce off this level was later followed by a sharp surge in BTC prices during the yen carry trade unwind. That move saw Bitcoin hit a temporary peak before entering a period of correction.

根据GlassNode的说法,此水平通常标志着主要价格集会的早期阶段。在2024年中期,当时在日元携带贸易期间,BTC价格急剧上涨,在2024年中期观察到了类似的趋势。在进入校正期之前,锯锯比特币达到了临时峰。

The current rebound off the same ratio level suggests a bullish setup may be unfolding again. The market’s structure appears to be repeating, with the MVRV ratio acting as an early signal.

当前的反弹相同的比率水平表明,看涨的设置可能会再次展开。市场的结构似乎正在重复,MVRV比率充当早期信号。

$61.6B in BTC creates price cushion between $95K and $97K

$ 61.6B的BTC创建价格垫子在$ 95K至$ 97K之间

$ 61.6B的BTC创建价格垫子在$ 95K至$ 97K之间

According to blockchain analytics firm IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, around 649,600 BTC were purchased between $95,193 and $97,437. At current prices, this holding represents a value of over $61.6 billion.

根据区块链分析公司Intotheblock的数据(IOMAP)型号(IOMAP)型号的数据,大约649,600 BTC的价格在95,193美元至97,437美元之间。以目前的价格,该股票的价值超过616亿美元。

This accumulation zone is critical because it provides a solid support base for Bitcoin if current holders avoid selling prematurely to break even.

该累积区是至关重要的,因为如果当前持有人避免过早销售以破裂,它为比特币提供了坚实的支持基础。

As seen in the chart above, when such large volumes are absorbed within a narrow range, it either forms a strong support floor or becomes a resistance if sentiment weakens. In this case, the bullish setup is strengthened by the assumption that holders are in no rush to sell, especially with Bitcoin nearing the psychological $100,000 level.

如上图所示,当如此大的体积在狭窄范围内吸收时,它要么形成强大的支撑地板,要么如果情绪削弱,则会成为阻力。在这种情况下,从持有人不急于销售的假设来加强看涨的设置,尤其是比特币接近心理上的100,000美元水平。

The high level of demand within this range may act as a springboard.

此范围内的高需求可能充当跳板。

If BTC manages to climb above $97,437, this zone could flip into lasting support, further boosting bullish momentum.

如果BTC设法攀升到97,437美元以上,则该区域可能会转向持久的支持,从而进一步提高看涨的势头。

However, if investor sentiment shifts and selling pressure increases, this support could be broken, altering the market’s short-term outlook.

但是,如果投资者的情绪变化和销售压力增加,这种支持可能会被打破,从而改变了市场的短期前景。

Bitcoin price eyes breakout above $95,761

比特币价格眼睛突破超过$ 95,761

比特币价格眼睛突破超过$ 95,761

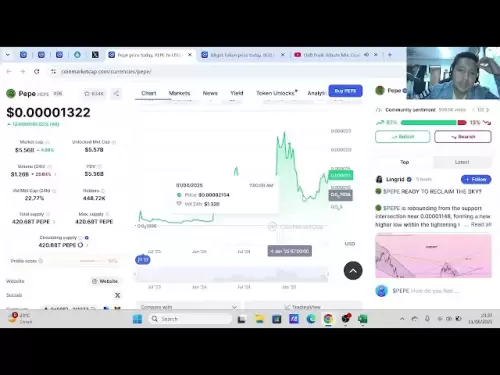

Bitcoin is currently trading at $95,429, showing signs of a steady short-term uptrend over the past three weeks.

比特币目前的交易价格为95,429美元,显示出过去三周的短期上升趋势的迹象。

The key level to watch in the near term is $95,761.

在短期内观看的关键水平为95,761美元。

Source: CoinMarketCap

资料来源:CoinMarketCap

BTC has been consolidating just below this resistance zone for about a week, and a breakout could trigger a rally towards $98,000.

BTC在此阻力区以下固结了大约一周,而突破可能会触发集会至98,000美元。

The current price action suggests that BTC is attempting to secure $93,625 as support. If successful, this would open the way for a move to $98,000 and eventually $100,000.

当前的价格行动表明,BTC试图获得93,625美元的支持。如果成功,这将为搬迁至98,000美元而最终100,000美元开辟道路。

These levels are both psychologically significant and technically relevant due to previous market activity.

由于以前的市场活动,这些水平在心理上具有重要意义,并且在技术上相关。

On the downside, failure to hold $91,521 could send BTC down to $89,421.

不利的一面是,如果不持有$ 91,521的价格可能会将BTC降至89,421美元。

A fall below this support would invalidate the current bullish trend and signal a possible return to market indecision.

低于此支持的下降将使当前的看涨趋势无效,并表示可能返回市场犹豫不决。

Traders are closely monitoring price behavior near these levels for confirmation of the next move.

交易者正在密切监视这些水平附近的价格行为,以确认下一步。

Technical setup favours short-term gains

技术设置有利于短期收益

技术设置有利于短期收益

The ongoing price movement reflects rising investor confidence, backed by a mix of technical and on-chain indicators.

持续的价格变动反映了投资者的信心不断上升,并在技术和链上指标的组合中支持。

The MVRV ratio’s bounce, large-scale buying at key price zones, and a visible uptrend in trading activity all contribute to a positive sentiment around Bitcoin.

MVRV比率的反弹,以关键价格区域的大规模购买以及可见的交易活动上升趋势都在比特币周围产生了积极的情绪。

If momentum holds, the resistance zone between $97,437 and $98,000 could soon be tested.

如果势头保持稳定,则很快就会对阻力区域介于97,437美元至98,000美元之间。

Breaking through it would not only affirm the bullish thesis but also bring the $100,000 target within realistic reach.

突破它不仅会肯定看涨的论文,而且还将这项$ 100,000的目标带入现实。

However, any signs of reversal will require caution as sentiment remains sensitive to macroeconomic cues and regulatory developments.

但是,任何逆转迹象都需要谨慎,因为情绪仍然对宏观经济提示和监管发展敏感。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 稳定币可能终于有了重要的时刻

- 2025-06-12 14:00:22

- 根据Coinbase的第二季度加密报告,2025年可能是该数字资产类别的突破年。

-

- 正如比特币昨晚收回了$ 110k的门槛时,以太坊(ETH)随之而来

- 2025-06-12 13:55:22

- 以太坊令人印象深刻的价格涨幅遵循了大量的机构投资,特别是通过ETF。

-

- 寻找2025年最受欢迎的加密货币?这是4个要考虑的硬币

- 2025-06-12 13:55:22

- 当您在2025年寻找最受欢迎的加密货币时,选择合适的购买时间至关重要。本指南将查看具有这些重要功能的4个硬币。

-

- 以太坊(ETH)的价格目前正在证明其能力是领先的市场Altcoin。

- 2025-06-12 13:55:21

- 在市场资本化的十大加密货币中,以太坊在过去24小时内取得了最高的收益。

-

- 比特币(BTC)短暂触摸了$ 110,000的水平

- 2025-06-12 13:55:21

- 比特币(BTC)在确认美国和中国已经达到了框架交易后,在周二短暂触及了110,000美元的水平

-

-

-