|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密貨幣新聞文章

Virtuals Protocol (VIRTUAL) is one of the hottest recovering tokens, boosting several other AI agents.

2025/05/06 21:15

Virtuals Protocol (VIRTUAL) has been one of the hottest recovering tokens, boosting several other AI agents. However, on-chain data shows VIRTUAL has shifted to whale wallets, which control most of the supply.

Virtuals Protocol (VIRTUAL) has seen more funds from whales, signaling accumulation in the past weeks. VIRTUAL recovered along with other AI agent tokens and is now about 63% down from its peak after weeks of smart money inflows.

The buying interest of VIRTUAL led to a concentration of the token in the hands of top traders and whales. According to Solana on-chain data, about 93% of VIRTUAL tokens are held in the top 100 wallets.

On-chain data from Bubblemaps also shows heightened activity on the Gate.IO exchange, with a cluster of wallets linked to the centralized market for high-frequency transfers.

Virtuals Protocol open interest grows

Virtuals Protocol has drawn in smart money wallets, further solidifying the positioning of whales. A total of 63.7% of VIRTUAL tokens are unlocked, leaving a significant part in large wallets, prepared for long-term unlocks and community rewards. In the past few weeks, new whale accumulation shifted the token distribution toward the larger wallets.

Virtuals Protocol raised $16.6M in various funding rounds, with the largest share of fundraising in the form of an IDO on Fjord Foundry. The protocol also held several smaller VC-funded rounds, with no significant team or contributor allocations.

VIRTUAL went through a period of increased buying interest, pushing the price to a one-month high above $1.80. The token stepped back to $1.66, still leading the general recovery of the AI agent narrative.

Derivative trading for VIRTUAL rose in the past month from its recent lows of $15M. Derivative positions are now worth more than $111M, showing renewed bets in the token’s performance.

Currently, long positions are slightly dominant, though there were attempts to short the asset. Derivative trading is independent of the accumulation of VIRTUAL. Traders are still making a speculative bet that the platform will recover and trade in a higher range.

VIRTUAL rose on increased activity in April

In the past month, activity on Virtuals Protocol picked up after two months of extremely low activity.

Activity on Solana remained almost unchanged, but Base users picked up again. In April, active wallets creating and interacting with agent tokens reached 10K daily once again.

The AI agent ecosystem is also concentrated in a few top projects, including AIXBT, GAME, SAM, VADER, and LUNA. AVA is another trending token, though with a smaller market capitalization. In total, the value of AI agent tokens is back above $570M.

AI agent tokens are also relatively concentrated in a small community. Despite resembling memes, a much smaller circle of owners is bought into these assets.

On-chain data shows just 9,792 individual wallets hold AI agent tokens, suggesting whale and insider accumulation. Virtuals Protocol aims at expanding the ability to create agents, yet the ecosystem seems to be made of large-scale projects and is also controlled by whales.

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

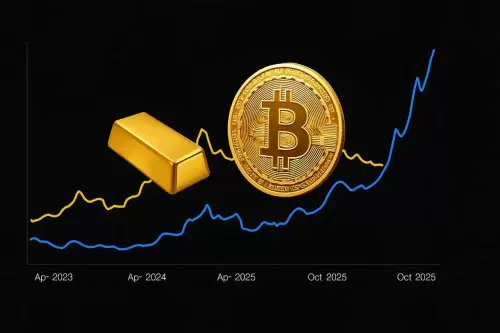

- 加密,黃金和比特幣:數字淘金熱的紐約分鐘

- 2025-07-13 20:30:16

- 比特幣的激增重新點燃了加密貨幣與黃金辯論。數字資產是新的避風港,還是黃金的光澤仍然強?讓我們分解。

-

- 印度加密式igaming:捷頓,盧納貝特和不斷發展的景觀

- 2025-07-13 20:50:16

- 通過對Jetton,Lunarbet的見解以及加密法規的影響,探索印度加密式igaming的動態。

-

- XRP價格,鯨魚和付款令牌:加密貨幣的新時代?

- 2025-07-13 20:35:16

- 探索XRP價格的動態,鯨魚的影響以及像Remittix在不斷發展的加密環境中的付款代幣的上升。

-

-

- 鼻子交易機器人:模因硬幣預售不僅僅是炒作

- 2025-07-13 18:30:16

- Snorter Bot(Snort)以其公用事業驅動的模因硬幣的方式引起了轟動,其預售籌集了超過150萬美元。這是下一件大事嗎?

-

-

-

-