|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣的紀錄高潮正在激發山寨幣季節的猜測和影響的公司。我們將分析英國財政部的作用和市場趨勢。

UK Treasury Watch: Bitcoin Surge Lifts Companies Amidst Crypto Optimism

英國財政部觀看:比特幣激增提升公司在加密樂觀中

Bitcoin's meteoric rise, surpassing $118,000, has triggered a wave of optimism, with analysts eyeing potential benefits for companies and the broader altcoin market. The UK Treasury's stance and evolving market dynamics are key factors to watch.

比特幣的流星崛起超過了118,000美元,引發了一波樂觀,分析師希望為公司和更廣泛的Altcoin市場帶來潛在的好處。英國財政部的立場和不斷發展的市場動態是要關注的關鍵因素。

Bitcoin's Bull Run: More Than Meets the Eye

比特幣的公牛運行:不僅僅是眼睛

While Bitcoin's record-breaking price grabs headlines, seasoned crypto analysts like VirtualBacon emphasize the bigger picture. Historically, Bitcoin leads, with altcoins trailing until liquidity shifts favorably. A genuine altcoin season requires a sustained decline in Bitcoin’s dominance. The analyst warns that a genuine altcoin season requires a sustained decline in Bitcoin’s dominance, marked by lower highs and lower lows in Bitcoin’s dominance metrics over a more extended period.

儘管比特幣的創紀錄的價格吸引了頭條新聞,但像VirtualBacon這樣的經驗豐富的加密分析師強調了更大的前景。從歷史上看,比特幣領先,山寨幣一直落後,直到流動性轉移。真正的Altcoin季節需要比特幣的統治地位持續下降。分析師警告說,真正的Altcoin季節需要比特幣的統治地位持續下降,這在更長的時間內以比特幣優勢指標的較低高點和較低的低點為特徵。

Ethereum and Solana: Glimmers of Hope?

以太坊和索拉納:希望的閃爍?

The ETH/BTC ratio is showing signs of promise, establishing a higher low for the first time since January 2022. A close above 0.024 BTC this week could signal a significant breakout, benefiting altcoins like Solana (SOL), which has already seen gains through automated trading strategies.

ETH/BTC的比率顯示出承諾的跡象,自2022年1月以來首次建立了較高的低點。本週的接近於0.024 BTC以上的接近可能會明顯突破,使Solana(Solana(SOL))受益,該替代幣已經通過自動交易策略而獲得了替代。

Liquidity is Key

流動性是關鍵

The Global Liquidity Index is forming a higher low, and a break above previous highs from April and September 2024 could signal a shift in market conditions. The Federal Reserve's subtle moves, like the $11 billion repo injection and proposed changes to the Supplementary Leverage Ratio (SLR) for major banks, are expanding liquidity without directly cutting interest rates. Historically, such shifts in Fed policy tend to influence cryptocurrency markets even before the mainstream financial media catches up.

全球流動性指數形成的低點,從2024年4月和9月開始,突破以上的高點可能表明市場狀況發生了變化。美聯儲的微妙舉措,例如110億美元的回購注入以及對主要銀行補充槓桿率(SLR)的擬議更改,正在擴大流動性而無需直接降低利率。從歷史上看,即使在主流金融媒體追趕之前,美聯儲政策的這種轉變也傾向於影響加密貨幣市場。

The Fed's Next Move: A Potential Catalyst

美聯儲的下一步行動:潛在的催化劑

The upcoming Federal Open Market Committee (FOMC) meeting on September 17 is crucial. Current projections indicate a significant likelihood of an interest rate cut in the fourth quarter. Expanding repo operations and SLR adjustments could create a more conducive environment for altcoins.

即將在9月17日舉行的聯邦公開市場委員會(FOMC)會議至關重要。當前的預測表明,第四季度有很大的可能性降低利率。擴大回購操作和SLR調整可能會為Altcoins創造更有利的環境。

Companies Riding the Crypto Wave

騎加密浪潮的公司

While specific company names aren't explicitly mentioned in the provided text, it's reasonable to infer that companies involved in cryptocurrency mining, blockchain technology, and digital asset management are likely to benefit from the Bitcoin surge. This could range from increased investment to higher valuations and greater market confidence. It is important to keep an eye on those markets in the future.

儘管提供的文本中未明確提及特定的公司名稱,但可以合理地推斷出參與加密貨幣挖掘,區塊鏈技術和數字資產管理的公司可能會從比特幣湧現中受益。這可能從增加投資到更高的估值和更高的市場信心。將來關注這些市場很重要。

Final Thoughts: Are We There Yet?

最終想法:我們在那裡嗎?

Bitcoin continues to perform well, and with Ethereum and Solana showing signs of recovery, the groundwork for an altcoin season appears to be forming. The full realization of this potential will require further confirmation and time, so buckle up and enjoy the ride! The crypto rollercoaster is about to get even wilder.

比特幣繼續表現良好,以太坊和索拉納(Ethereum)和索拉納(Solana)顯示出恢復的跡象,Altcoin季節的基礎似乎正在形成。全面實現這種潛力將需要進一步的確認和時間,因此請搭扣並享受旅程!加密過山車即將變得更加荒謬。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 模因硬幣躁狂症:狗狗,佩佩和加密貨幣預售熱潮

- 2025-07-22 21:59:55

- 探索模因硬幣景觀:Dogecoin,Pepe和Crypto Presals的興起。發現為什麼投資者轉向具有實際實用性的項目。

-

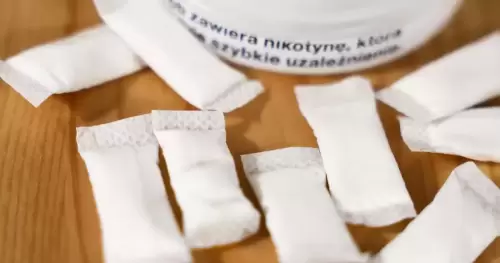

- 尼古丁小袋:對青少年牙齦健康的甜蜜威脅?

- 2025-07-22 21:49:09

- 尼古丁小袋正在越來越受歡迎,尤其是在青少年中。但是,這些甜味的小袋是否會對他們的牙齦健康造成嚴重破壞?讓我們潛入風險。

-

- 與1 XBET得分:足球和大型比賽的指南

- 2025-07-22 21:47:03

- 通過1xbet最大化您的足球投注策略,獲取內部勺子。從2025年婦女歐洲歐元到加密賭注,發現獲勝的趨勢和見解。

-

-

-

- 比特幣的市場份額:空中的另類季節?

- 2025-07-22 21:27:35

- 儘管比特幣的價格飛漲,但隨著山寨幣的增長勢頭,其市場份額仍在下滑。 alt季節終於來了嗎?

-

- 比特幣ETF看到流出,但是投資格局仍然很強

- 2025-07-22 21:06:37

- 比特幣ETF經歷了1313.5萬美元流出的逆轉,而以太坊ETF飆升。戰略利潤和多元化標誌著不斷發展的加密投資格局。

-

- XRP,比特幣,ripplecoin:2025年導航加密貨幣景觀

- 2025-07-22 20:07:27

- 深入了解2025年XRP,比特幣和Ripplecoin的發展動態,突出了關鍵趨勢,機構興趣和未來的前景。

-