|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

深入了解圍繞特朗普的加密貨幣,WLF所有權變化以及Stablecoins日益增長的影響力的最新發展。立即獲取內部勺子!

Trump, Crypto, and WLF Ownership: A New York Minute on the Latest Moves

特朗普,加密和WLF所有權:最新舉動的紐約分鐘

The intersection of Donald Trump, cryptocurrency, and World Liberty Financial (WLF) ownership is heating up faster than a hot dog cart on a summer day. Let's break down the key developments.

唐納德·特朗普(Donald Trump),加密貨幣和世界自由金融(WLF)所有權的交匯處比夏日的熱狗購物車更快。讓我們分解關鍵的發展。

WLF Ownership: The Shrinking Stake

WLF所有權:收縮股份

The Trump family has been quietly reducing its stake in World Liberty Financial (WLF). Initially holding 60%, their ownership has dipped to around 40% in recent weeks. This follows earlier shifts, dropping from 75% in late 2024. What's the big deal? It signals a strategic restructuring, possibly timed around key political and market events.

特朗普家族一直在悄悄地減少其在世界自由金融(WLF)中的股份。最初持有60%的人,最近幾週的所有權已降至40%左右。這是較早的轉變,從2024年底的75%下降。有什麼大不了的?它標誌著戰略重組,可能圍繞關鍵的政治和市場事件計時。

The Players: DT Marks DEFI LLC and the Trump Kids

球員:DT標記Defi LLC和Trump Kids

Donald Trump's DT Marks DEFI LLC (formerly DT Tower II LLC) is central to this. His sons, Donald Jr., Eric, and Barron, jointly hold a 30% stake in the entity. Plus, there are Delaware-registered companies named after the sons, solidifying the family’s direct links to the crypto project.

唐納德·特朗普(Donald Trump)的DT Marks Defi LLC(以前是DT Tower II LLC)至關重要。他的兒子小唐納德(Donald Jr.),埃里克(Eric)和巴倫(Barron)共同擁有該實體30%的股份。另外,還有特拉華州註冊的公司以兒子的名字命名,鞏固了家庭與加密項目的直接聯繫。

Crypto Surge and Regulatory Scrutiny

加密電湧和監管審查

WLF's token sales have been booming, reportedly hitting $550 million by March. But with great power comes great responsibility (and scrutiny). Concerns about Trump's financial involvement while in public office have escalated, leading to proposed legislation targeting crypto engagements by public officials. The CLARITY Act aimed to set stricter rules, but faced White House objections, particularly concerning language directly targeting Trump.

WLF的代幣銷售一直在蓬勃發展,據報導3月份達到了5.5億美元。但是強大的力量帶來了巨大的責任(和審查)。對特朗普在公職期間的財務參與的擔憂升級,導致擬議的立法針對公職人員的訂婚。 《 Clarity Act》的目的是製定更嚴格的規則,但面臨白宮的反對意見,尤其是關於直接針對特朗普的語言。

Stablecoins and the GENIUS Act

Stablecoins and the Genius Act

Trump has been pushing Congress to fast-track the GENIUS Act, supporting U.S. dollar–backed crypto assets. This came as WLF launched its own stablecoin project linked to the U.S. dollar, backed by a $2 billion deal. Circle, a non-affiliated stablecoin issuer, saw its stock jump after the Senate approved the GENIUS Act, marking a major policy win.

特朗普一直在促使國會快速追踪《天才法》,並支持美元返還的加密貨幣資產。這是因為WLF啟動了自己的Stablecoin項目,該項目與美元有關,並獲得了20億美元的交易。非附屬的Stablecoin發行人Circle在參議院批准了《天才法》之後,股票躍升,標誌著重大政策勝利。

Circle's Rise and WLF's Potential Valuation

Circle的崛起和WLF的潛在估值

Circle's success provides a benchmark for WLF's potential valuation. If WLF receives a similar valuation, it could exceed $1.7 billion. This makes the Trumps’ stake reduction even more significant. Analysts estimate that selling 20% of the company could have earned Donald Trump around $135 million.

Circle的成功為WLF的潛在估值提供了基準。如果WLF獲得類似的估值,則可能超過17億美元。這使得特朗普的減少股份更加重要。分析師估計,出售該公司20%的公司本來可以贏得唐納德·特朗普(Donald Trump)的1.35億美元。

My Two Cents

我的兩分錢

The timing of these ownership shifts and the push for the GENIUS Act raise eyebrows. Trump's endorsement clearly accelerated the bill's path. Whether it’s a shrewd business move or a potential conflict of interest, it's a story worth watching. Coinbase adding USDC as collateral in US futures markets further validates the stablecoin sector.

這些所有權的時機發生了變化和《天才法》的推動,引起了人們的注意。特朗普的認可顯然加速了該法案的道路。無論是精明的業務舉動還是潛在的利益衝突,這都是值得一看的故事。 Coinbase將USDC作為美國期貨市場的抵押品添加進一步驗證了Stablecoin行業。

The Bottom Line

底線

From strategic ownership tweaks to regulatory battles, the Trump-crypto-WLF saga is a wild ride. What's next? Only time will tell. But one thing's for sure: it's gonna be YUGE! Stay tuned, folks, because in the world of Trump and crypto, there's never a dull moment!

從戰略所有權調整到監管鬥爭,特朗普 - 克里普托 - 瓦爾夫傳奇是一次瘋狂的旅程。接下來是什麼?只有時間會證明。但是可以肯定的是:這將是Yuge!伙計們,請繼續關注,因為在特朗普和加密貨幣的世界中,從來沒有一個沉悶的時刻!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- PI網絡,KYC Sync和PI2Day:深入了解最新發展

- 2025-06-20 18:45:13

- 探索PI網絡上的最新KYC同步功能,其對用戶的影響以及圍繞即將舉行的PI2DAY活動的預期。

-

- Dogecoin的三角探戈:看漲的情緒會導致突破嗎?

- 2025-06-20 19:05:12

- Dogecoin形成了對稱的三角形模式,暗示了潛在的60%的價格轉移。看漲的情緒會佔上風並引發突破嗎?

-

- 以太坊,比特幣,價格預測:在動蕩的市場中導航加密潮

- 2025-06-20 19:05:12

- 在地緣政治緊張局勢和市場波動中探索以太坊,比特幣和價格預測的最新趨勢和見解。發現潛在的機會和風險。

-

- 以太坊,比特幣和價格預測遊戲:現在是什麼熱?

- 2025-06-20 18:25:13

- 在以太坊,比特幣和價格預測周圍導航加密蜂鳴聲。在不斷發展的加密景觀中獲得最新的見解和潛在機會。

-

- 比特幣價格突破即將發生?解碼加密市場的下一個大舉動

- 2025-06-20 18:45:13

- 比特幣在重大突破的邊緣嗎?分析最近的市場趨勢,監管發展和鯨魚活動,以預測BTC和Dogecoin的下一個方向。

-

- 加密,人工智能和投資:瀏覽金融的未來

- 2025-06-20 19:25:12

- 探索加密貨幣,AI和投資的融合,從AI驅動的貿易助手到NFT的不斷發展的景觀以及可互操作的區塊鏈的承諾。

-

-

- 甜蜜的懷舊:生日蛋糕的傳統如何在周年紀念日持續

- 2025-06-20 19:45:13

- 探索生日蛋糕,懷舊和周年慶典的持久吸引力。發現傳統在保持情感價值的同時如何發展。

-

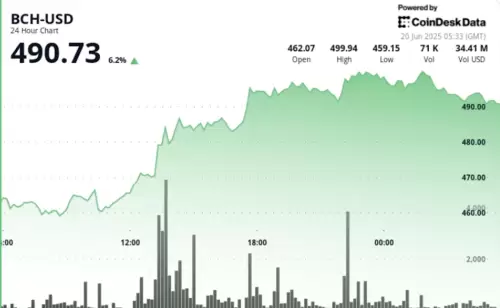

- 比特幣現金價格上漲:公牛以峰值收費!

- 2025-06-20 19:45:13

- 比特幣現金體驗由機構需求和交易量激增的巨大價格上漲,測試了關鍵的500美元電阻水平。