|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

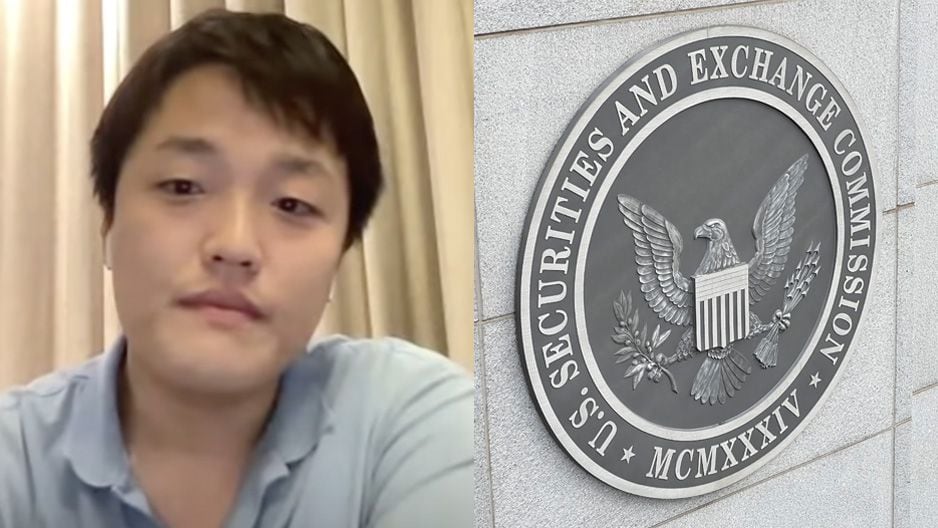

Terraform Labs Accused of Misleading Investors in SEC Fraud Trial

New York, NY – A New York jury has commenced deliberations in the high-profile civil fraud case brought by the U.S. Securities and Exchange Commission (SEC) against Terraform Labs and its co-founder, Do Kwon. The SEC alleges that the defendants made misleading statements to investors about the stability of Terra USD (UST), a so-called "algorithmic stablecoin" that crashed spectacularly in May 2022, leading to billions of dollars in losses.

During the trial, the SEC presented evidence that Terraform Labs, under Kwon's leadership, marketed UST as a stable and reliable investment, downplaying the inherent risks associated with its algorithmic design. The SEC argued that the company falsely claimed that UST's peg to the U.S. dollar was maintained through an automated self-correcting mechanism, when in reality, it was largely supported by continuous trading activity and interventions by institutional investors.

In her closing arguments, SEC attorney Laura Meehan accused the defendants of "lying for years" about the success, stability, and legitimacy of their blockchain. She highlighted a "secret agreement" between Terraform Labs and trading firm Jump, which allegedly purchased millions of dollars of UST off-chain to artificially inflate its value and maintain its peg.

Meehan asserted that Kwon and his company intentionally concealed Jump's involvement to deceive investors into believing that UST's stability was solely due to its proprietary algorithm. "Defendants lied to give the impression of a robust and thriving ecosystem," Meehan said.

The defense, led by attorney Louis Pellegrino, countered that UST was indeed utilized by the mobile payment app Chai and that the "secret agreement" with Jump was not secret at all, but rather a formal arrangement to provide liquidity when needed.

Pellegrino argued that the inherent risks associated with UST were well-known to investors, citing trading memos from Galaxy Digital that outlined the potential for a collapse. He portrayed Terraform Labs as a victim of a coordinated short attack by hedge funds that destabilized the ecosystem and led to the crash.

"Terraform is still here, trying to make things better," Pellegrino said. "Terraform is no house of cards."

However, the SEC maintained that the defendants' misleading statements about UST's stability and the algorithmic mechanism that allegedly maintained it were material omissions that misled investors.

The jury is now tasked with determining whether Terraform Labs and Do Kwon are liable for civil fraud under federal securities laws. The outcome of the trial will have significant implications for the cryptocurrency industry, as it could set a precedent for how regulators approach algorithmic stablecoins and the disclosure of risks associated with crypto assets.

Kwon's Absence and Uncertain Future

Do Kwon, who has been under house arrest in Montenegro since his release from prison in March 2023, was absent from the trial due to extradition proceedings. The country's Supreme Court is currently considering requests from both the United States and South Korea to extradite him on criminal fraud charges.

Kwon's ultimate destination remains unclear. Should he be extradited to either country, he could face significant jail time if convicted. However, if he is able to avoid extradition and remain in Montenegro, he may continue to lead Terraform Labs from afar.

The outcome of the SEC's civil case and the extradition proceedings against Kwon will significantly impact the future of Terraform Labs and the broader cryptocurrency ecosystem.

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

-

-

-

- Bitcoin (BTC) price prediction: Ark Invest says BTC will hit $2.4 million by 2030

- 2025-06-14 20:00:49

- When it comes to Bitcoin (BTC 0.70%) price forecasts, the one investor who has my attention right now is Cathie Wood of Ark Invest. She is now predicting that Bitcoin will hit a price of $2.4 million by the year 2030.

-

-