|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

韓國當局詳細介紹了在融合派(ACE)代幣的價格操縱中使用的兩種欺詐性交易策略,這導致投資者損失總計71億韓元(485萬美元)。

South Korean authorities have highlighted two fraudulent trading tactics used in the price manipulation of the Fusionist (ACE) token, which resulted in investor losses of 7.1 billion (385 million) in new learnings from a trial in Seoul.

韓國當局強調了在融合派(ACE)代幣的價格操縱中使用的兩種欺詐性交易策略,這導致投資者在首爾的一項審判中獲得了71億(3.85億)的損失。

How traders used an artificial strategies to deceive the market.

交易者如何使用人工策略欺騙市場。

Fake Volume Scheme Created Illusion of Demand

假批量方案產生了需求的幻想

The first method involved the artificial inflation of trading volume. Manipulators strategically placed buy limit orders above the market price while simultaneously setting sell limit orders below it.

第一種方法涉及交易量的人工通貨膨脹。操縱者在戰略上放置了購買限額訂單以上的購買限額,同時將賣出限額訂單在其下方。

This created a false impression of high demand, leading traders to believe the token was experiencing organic growth. Reports indicate smart contracts automatically executed these orders, maintaining constant activity and masking the lack of genuine market interest.

這給高需求帶來了錯誤的印象,使交易者相信代幣正在經歷有機增長。報告表明,智能合約會自動執行這些訂單,保持持續的活動並掩蓋缺乏真正的市場興趣。

High-Speed Spoofing Faked Buy Pressure

高速欺騙偽造的購買壓力

The second method involved creating fake buy pressure via spoofing. Manipulators placed buy orders at five price levels above the last traded price, designed to mimic real investor demand, only to automatically cancel them within three seconds.

第二種方法涉及通過欺騙產生假購買壓力。操縱者將購買訂單以高於最後交易價格的五個價格水平下達,旨在模仿真正的投資者需求,僅在三秒鐘內自動取消它們。

Repeating this process continuously misled traders about sustained interest, artifactscially driving up the price.

重複這一過程不斷誤導交易者持續的興趣,偽影提高了價格。

Prosecutors Detail Manipulation Impact

檢察官細節操縱影響

On April 3, prosecutors reportedly exposed how defendants manipulated ACE token prices using “hit” orders (loss-making trades to inflate volume) and spoofing (e.g., repeatedly placing and canceling fake buy orders). These tactics caused a 15-fold surge in daily ACE volume on Bithumb, with “hit” orders accounting for nearly 89% of the activity.

據報導,4月3日,檢察官揭露了被告如何使用“命中”訂單(以增加數量的損失交易)和欺騙(例如,反復下達和取消假買入訂單)如何操縱ACE令牌價格。這些策略在Bithumb上每天的ACE量增加了15倍,“命中”訂單佔活動的近89%。

Prosecutors noted that the defendants also placed legitimate sell orders to liquidate coins entrusted to them, although these were not part of the manipulation charges.

檢察官指出,被告還下達了合法的賣出命令,以清算託付給他們的硬幣,儘管這些命令不是操縱指控的一部分。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 比特幣的售價超過$ 90K,以太坊和山寨幣現很出色的收益

- 2025-04-25 17:55:13

- 全球加密貨幣市場繼續反映出看漲的情緒,比特幣保持穩定的立場高於93,000美元。

-

- 分析師說

- 2025-04-25 17:55:13

- 一位廣泛關注的加密分析師說,比特幣(BTC)可能在看跌逆轉之前向上行進程。

-

-

- SUI區塊鏈的本地令牌SUI本週飆升了62%以上

- 2025-04-25 17:50:13

- SUI區塊鏈的原住民令牌SUI本週飆升了62%以上,這是由於猜測與Pokémon的潛在合作所推動。

-

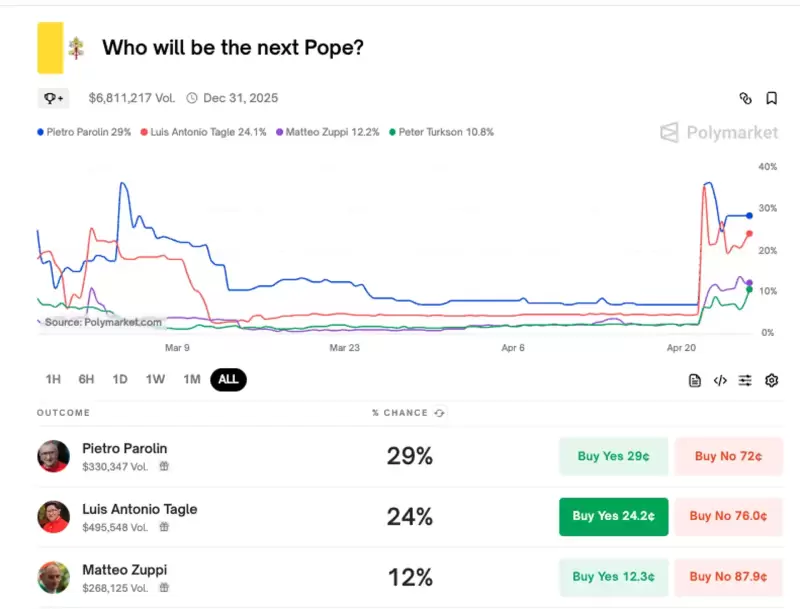

- 多聚市場捕獲

- 2025-04-25 17:45:13

- 由於預計將在下個月舉行的“結論”(教皇選舉秘密會議)選舉下一屆教皇時,圍繞教皇候選人主題的Meme Coins引起了人們的關注。

-

-

-

- DraftKings支付1000萬美元以解決NFT證券集體訴訟

- 2025-04-25 17:40:13

- 流行的體育博彩和幻想體育公司Draftkings已同意達成1000萬美元的和解,以解決集體訴訟

-