|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ripple對美國銀行許可證的追求標誌著RLUSD和更廣泛的加密景觀的關鍵時刻。這對信任,法規和數字資產的未來意味著什麼?

Yo, crypto enthusiasts! Ripple's making moves, and it's got everyone talking. The buzz? A national banking license. Here's the lowdown on what it means for Ripple, XRP, and the future of crypto.

喲,加密愛好者! Ripple正在做動作,這讓每個人都在談論。嗡嗡聲?國家銀行許可證。這是對Ripple,XRP和Crypto的未來意味著什麼。

Ripple's Banking Ambitions: What's the Deal?

Ripple的銀行野心:有什麼交易?

Ripple Labs is gunning for a national banking license from the Office of the Comptroller of the Currency (OCC). Why? To boost trust in its RLUSD stablecoin. Think of it as Ripple wanting to play by the big boys' rules, aiming for that gold star in regulatory compliance.

Ripple Labs正在從貨幣審計長辦公室(OCC)的辦公室獲得國家銀行許可證。為什麼?提高對其Rlusd Stablecoin的信任。可以將其視為希望通過大男孩的規則演奏的波紋,以監管合規性為目標。

Ripple CEO Brad Garlinghouse himself confirmed the application, emphasizing that if approved, Ripple would be under both state supervision by the New York Department of Financial Services (NYDFS) and federal oversight. This dual setup could set a new standard for trust in the stablecoin market, signaling to institutions that RLUSD operates with similar regulatory guardrails to traditional fiat currencies.

Ripple首席執行官Brad Garlinghouse本人確認了該申請,強調,如果獲得批准,Ripple將受到紐約金融服務部(NYDFS)和聯邦監督的州監督。這種雙重設置可以為Stablecoin市場的信任設定新的標準,並向RLUSD用與傳統法定貨幣類似的監管護欄運作的機構發出信任。

RLUSD: Ripple's Stablecoin Play

RLUSD:Ripple的Stablecoin Play

RLUSD, launched in December 2024, is Ripple's dollar-backed stablecoin. While it's not the biggest player in the game (market cap around $470 million), it's making waves by prioritizing regulation. This push for compliance is what Garlinghouse believes sets RLUSD apart in the crowded stablecoin market.

RLUSD於2024年12月推出,是Ripple的美元支持的Stablecoin。雖然它不是遊戲中最大的玩家(市值約4.7億美元),但它通過優先考慮法規而引起浪潮。加林豪斯(Garlinghouse)認為,這種努力在擁擠的Stablecoin市場中與眾不同。

Why a Banking License Matters

為什麼銀行許可很重要

Getting a national banking license isn't just about bragging rights. It unlocks some serious perks:

獲得國家銀行許可證不僅僅是吹牛權利。它解鎖了一些嚴肅的特權:

- Streamlined Payments: No more need for a bunch of intermediary banks, making transactions faster and cheaper.

- Expanded Services: Ripple could offer more than just stablecoins, like digital asset custody and other innovative financial products.

The Fed Factor: A Master Account

美聯儲因素:主帳戶

But wait, there's more! Ripple has also applied for a Federal Reserve master account through its subsidiary Standard Custody. This would allow Ripple to hold RLUSD reserves directly at the Fed, adding another layer of security and trust.

但是等等,還有更多! Ripple還通過其子公司標準監護權申請了聯邦儲備主帳戶。這將使Ripple可以直接在美聯儲中持有RLUSD儲備,從而增加了另一層的安全性和信任。

Ripple vs. Circle: The Stablecoin Race

Ripple vs. Circle:Stablecoin種族

Ripple isn't the only one eyeing a banking license. Circle, the company behind USDC, is also in the mix. It's a race to see who can become the most regulated and trusted stablecoin provider. This competition is pushing the entire industry toward greater transparency and accountability.

Ripple並不是唯一一個關注銀行許可證的人。 USDC背後的公司Circle也參與其中。這是一場比賽,看看誰能成為最受監管,最受信任的Stablecoin提供商。這項競爭正在推動整個行業提高透明度和問責制。

The Regulatory Landscape: GENIUS Act and Beyond

監管景觀:天才法和超越

All this is happening as lawmakers are also trying to figure out how to regulate stablecoins. The GENIUS Act, which has already passed the Senate, aims to require stablecoin issuers to hold full dollar reserves and publish monthly reports. It is a sign that the adoption of clear and supervised rules is the key to the full integration of stablecoins into the traditional financial system.

當議員們還試圖弄清楚如何規範穩定幣時,這一切都發生了。已經通過參議院的《天才法》旨在要求Stablecoin發行人持有全美元儲備並發布月度報告。這表明採用明確和監督的規則是將穩定幣完全整合到傳統金融體系中的關鍵。

The Future of Ripple and Regulated Stablecoins

連鎖和規範的穩定的未來

Whether Ripple gets its banking license remains to be seen. However, the move signals a big shift in the crypto world. Stablecoins are no longer just fringe players; they're aiming for a seat at the table with the traditional financial system. It opens up new possibilities for investors, companies and consumers.

Ripple是否獲得其銀行許可證還有待觀察。但是,此舉標誌著加密貨幣世界發生了很大的轉變。 Stablecoins不再只是邊緣球員。他們的目標是與傳統金融系統坐在桌子上。它為投資者,公司和消費者打開了新的可能性。

Final Thoughts

最後的想法

So, what's the takeaway? Ripple's banking license pursuit is a sign that crypto is growing up. Whether you're a die-hard believer or a skeptical observer, it's hard to deny that the regulatory landscape is changing, and Ripple wants to be at the forefront. Keep your eyes peeled, because the next chapter in the Ripple story is sure to be a wild ride.

那麼,收穫是什麼? Ripple的銀行許可證追求是加密貨幣成長的標誌。無論您是頑固的信徒還是持懷疑態度的觀察者,都很難否認監管景觀正在發生變化,而Ripple希望成為最前沿。睜大眼睛,因為《連鎖故事》中的下一章肯定是一個瘋狂的旅程。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 房子,特朗普比爾,比特幣集會:宏觀和加密貨幣的紐約分鐘

- 2025-07-04 10:30:12

- 特朗普的法案激發了比特幣的嗡嗡聲!了解財政政策,清潔能源削減和模因硬幣躁狂症如何在永遠野生的加密世界中交織在一起。

-

- 硬幣大師免費旋轉:您的日常鏈接(2025年7月)

- 2025-07-04 10:50:12

- 每天鏈接中的硬幣大師中無旋轉!本指南涵蓋了2025年7月的主動鏈接,向您展示瞭如何兌換它們以獲取額外的遊戲玩法。

-

-

- 2025年7月的AltCoins:市場動力和首選

- 2025-07-04 11:10:12

- 參與2025年7月的Altcoin市場,探索有準備增長的動力,關鍵趨勢和出色的表演者。

-

-

-

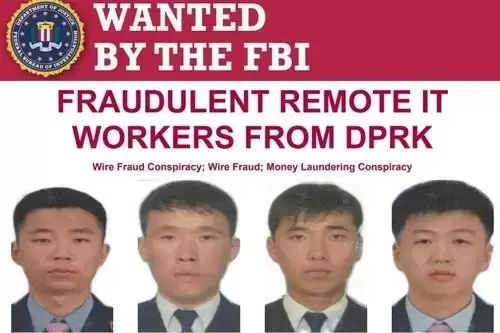

- 平壤在壓力下:看美國起訴書和朝鮮演員

- 2025-07-04 08:30:12

- 解碼美國對朝鮮人的最新起訴以及他們對平壤策略的揭示。

-

-

- Robinhood的風險遊戲:假代幣,真正的麻煩?

- 2025-07-04 09:10:14

- Robinhood進入令牌化資產的企業引發了爭議,因為Openai距離“假”令牌距離,引發了有關風險和透明度的疑問。