|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Parataxis Holdings與Bridge Biothapeutics合作,在韓國推出了一個比特幣本地國庫平台,這表明對數字資產的機構興趣不斷增長。

Parataxis Holdings & Bridge Biotherapeutics: A Bitcoin Treasury Play in South Korea

Parataxis Holdings&Bridge Biotherapeutics:韓國的比特幣國庫

The South Korean market is about to get a whole lot more interesting with Parataxis Holdings' strategic move. They're teaming up with Bridge Biotherapeutics to introduce a Bitcoin-native treasury platform. This move could signal a major shift in how South Korea approaches digital asset investment.

韓國市場將通過Parataxis Holdings的戰略舉動變得更加有趣。他們正在與Bridge Biothapeutics合作推出一個比特幣本地的國庫平台。這一舉動可能表明韓國如何進行數字資產投資發生了重大轉變。

What's the Deal?

有什麼交易?

Parataxis Holdings, through Parataxis Korea Fund I LLC, is investing KRW 25 billion into Bridge Biotherapeutics. This investment would give Parataxis Holdings a controlling interest in the company. Following the deal, Bridge Biotherapeutics plans to rebrand as Parataxis Korea and maintain its listing on the KOSDAQ. This isn't just a name change; it's a full-blown pivot towards a Bitcoin-focused treasury strategy.

通過Parataxis韓國基金I LLC,Parataxis Holdings正在將KRW 250億美元投資到橋樑的生物治療學上。這項投資將使可繳納持有率在公司中具有控制權。在交易之後,Bridge Biothapeutics計劃將品牌重塑為韓國的副式,並在Kosdaq上保持清單。這不僅僅是名字更改;這是針對以比特幣為重點的財政策略的全面樞紐。

Why South Korea?

為什麼要韓國?

According to Andrew Kim, Partner at Parataxis Capital, South Korea is seen as "an important market in the evolution of BTC adoption." The aim is to provide institutional investors access to Bitcoin exposure while maintaining sound corporate governance. Think of it as a regulated, institutional-grade on-ramp for Bitcoin in South Korea.

根據Parataxis Capital的合夥人Andrew Kim認為,韓國被視為“ BTC採用發展的重要市場”。目的是為機構投資者提供比特幣敞口的機會,同時維持合理的公司治理。可以將其視為韓國比特幣的受監管的機構級林。

The Big Picture

大局

Edward Chin of Parataxis Holdings emphasizes the strategic nature of Bitcoin on the global stage. With its finite supply, building a company like Parataxis Korea and accumulating a BTC treasury could benefit shareholders and the country in the long run. It's a bold statement, reflecting a belief in the long-term value of Bitcoin.

攜帶持有人的愛德華·欽(Edward Chin)強調了比特幣在全球舞台上的戰略性質。憑藉其有限的供應,從長遠來看,建立了像韓國黨派黨派這樣的公司並積累了BTC財政部。這是一個大膽的聲明,反映了對比特幣長期價值的信念。

Leadership Changes

領導力變化

As part of the transaction, Edward Chin will join the Board of Directors, and Andrew Kim will take on the role of CEO. James Jungkue Lee, Co-founder of Bridge Bio, will continue to lead the biotech business. This blend of expertise – biotech and digital assets – could create a unique synergy.

作為交易的一部分,愛德華·欽(Edward Chin)將加入董事會,安德魯·金(Andrew Kim)將擔任首席執行官。 Bridge Bio的聯合創始人James Jungkue Lee將繼續領導生物技術業務。這種專業知識(生物技術和數字資產)的融合可以創造獨特的協同作用。

South Korea's Crypto Stance

韓國的加密立場

South Korea's regulatory landscape is also evolving. While the central bank is cautious about won-based stablecoins due to concerns about foreign exchange management, there's a push for crypto regulation. The Digital Asset Basic Act, for instance, aims to allow companies to issue stablecoins under certain conditions. This evolving environment sets the stage for Parataxis Korea's entry.

韓國的監管景觀也在不斷發展。儘管中央銀行對基於贏家的穩定股幣謹慎,這是由於對外匯管理的擔憂,但仍在推動加密法規。例如,《數字資產基本法》的目的是允許公司在某些條件下發行穩定幣。這種不斷發展的環境為韓國偏離的進入奠定了基礎。

Final Thoughts

最後的想法

So, will Parataxis Korea become a major player in the South Korean market? Only time will tell. But one thing is clear: the intersection of traditional finance and digital assets is heating up, and South Korea is shaping up to be an interesting testing ground. Who knows, maybe this is the start of a beautiful, Bitcoin-filled friendship.

那麼,韓國會偏愛會成為韓國市場的主要參與者嗎?只有時間會證明。但是有一件事很清楚:傳統金融和數字資產的交集正在加熱,韓國正在塑造是一個有趣的測試場所。誰知道,也許這是一個充滿比特幣的友誼的開始。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 金幣,稀有,馬:錢幣綜述

- 2025-06-20 22:45:13

- 從查爾斯二世幾內亞到凱斯花園50ps,發掘了稀有的金幣,以及他們講的有趣的故事。另外,津巴布韋的黃金硬幣計劃停止。

-

-

-

-

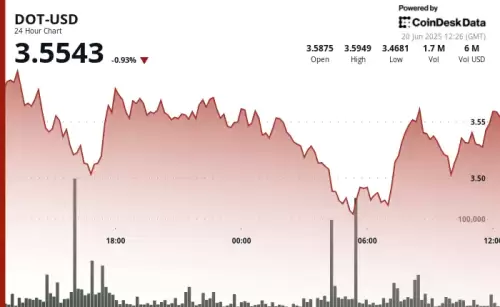

- Polkadot的點:導航三重底部和看漲逆轉

- 2025-06-20 23:25:12

- Polkadot的點顯示了彈性,在擊中潛在的三重底部後形成了看漲的逆轉模式。這是大規模集會的開始嗎?

-

-

-

- XRP價格上漲:雙底和短擠壓在地平線上?

- 2025-06-20 23:30:12

- XRP的價格接近2.16美元,取笑了潛在的突破。雙重底部的模式和迫在眉睫的5500萬美元的短擠壓可能會加劇下一次集會。