|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of T-Mobile (TMUS) dropped on Monday despite the broader rally in the Nasdaq Composite, which was up over 1.8% at the time. The telecom giant, which had a stellar 2024, recently faced a downgrade from two major Wall Street analysts.

Why Did T-Mobile Stock Drop?

Despite T-Mobile's strong performance last year, with impressive growth fueled by its 2020 acquisition of Sprint, analysts from Wells Fargo and RBC Capital downgraded their outlook for the company. Wells Fargo reduced its price target for T-Mobile from $240 to $220, while RBC Capital adjusted its target from $255 to $240.

Both analysts cited that the “low-hanging fruit” from the Sprint merger — such as cost synergies and spectrum advantages — has likely already been realized. With that phase behind them, T-Mobile may face challenges maintaining its robust growth in the coming years. Additionally, the company is expected to experience a slowdown in free cash flow growth as its tax rate reverts to that of a full taxpayer.

T-Mobile's Valuation Compared to Rivals

Currently, T-Mobile's stock is trading at approximately 11 times its forward earnings before interest, taxes, depreciation, and amortization (EBITDA), and 15 times its forward free cash flow estimates. This is higher than its major competitors Verizon (VZ) and AT&T (T), which trade at a much lower multiple — 7 times EBITDA and 9 to 11 times free cash flow, respectively. This difference in valuation has led some analysts to caution against further investment in T-Mobile at its current levels.

Is T-Mobile Still a Solid Investment?

While the downgrade from Wells Fargo and RBC may seem concerning, T-Mobile remains a solid company with long-term potential. The analysts might be right that the stock's explosive gains of the past few years will be hard to replicate, but this does not necessarily make T-Mobile a “sell.”

T-Mobile continues to lead the telecom industry with its strong cash flow, market share gains, and spectrum advantage. The company is also heavily investing in share repurchases, which could potentially support stock price growth. Additionally, T-Mobile raised its dividend by 35% last year, further demonstrating confidence in its financial health. Though its current dividend yield is modest at 1.6%, there's potential for future growth in payouts, making it an attractive option for long-term investors, particularly those who are looking to build income for retirement.

Is T-Mobile Still a Good Long-Term Pick?

Despite the downgrade, T-Mobile remains a leading player in the telecom industry. While it may not achieve the same rapid growth as in recent years, the company's strong position and commitment to shareholder returns still make it a solid pick for investors with a long-term horizon. With a dividend that has room to grow and a resilient business model, T-Mobile could provide steady returns for those investing for the next decade or so.

However, if you're considering investing in T-Mobile, it's important to evaluate whether the stock fits your investment strategy, especially in light of the recent analyst downgrades and the changing market dynamics.

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 1層區塊鏈SUI(SUI)有一個突破性的一周,增長了74%

- 2025-04-26 22:25:12

- 第1層區塊鏈SUI($ SUI)已經有一個突破性的一周。

-

-

-

- 黃金,白銀和比特幣是投資者最大的難題

- 2025-04-26 22:15:13

- 這三個資產都有其優勢,缺點和價格軌蹟的份額,因此很難帶來表現最好的人

-

- 賈斯汀·孫(Justin Sun)在特朗普排行榜上奪冠

- 2025-04-26 22:15:13

- 總統模因硬幣項目出版的特朗普排行榜正式實時追踪$特朗普代幣的前20至40名持有人。

-

- FXGUYS(XRP)價格預測:新的加密貨幣預期為50倍回報

- 2025-04-26 22:10:13

- 一些分析師可能指出了可能的波紋(XRP)價格上漲。但是是時候停止盯著那個XRP價格圖表了

-

-

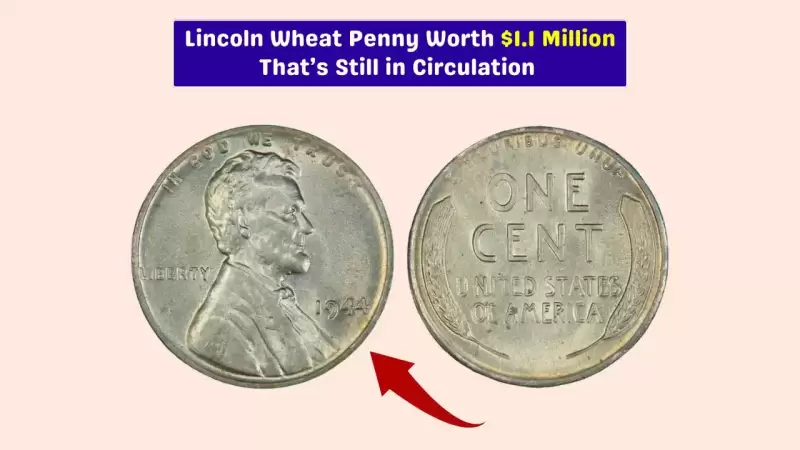

- 1944年鋼鐵一分錢:一個有價值的錯誤

- 2025-04-26 22:05:13

- 這枚硬幣被稱為1944年的鋼鐵,現在被認為是美國歷史上最有價值的硬幣之一。