|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Metaplanet的侵略性比特幣策略,超越了特斯拉的持股,並震撼了加密貨幣景觀。深入了解他們大膽的舉動和市場影響。

Tokyo-listed Metaplanet is making waves in the Bitcoin world, aggressively accumulating BTC and even surpassing Tesla in corporate holdings. This ain't your average company – they're diving headfirst into crypto, and it's creating ripples across the market.

東京上市的Metaplanet在比特幣界引起了轟動,積極積累了BTC,甚至超過了公司持有的特斯拉。這不是您的普通公司,而是他們首先跳入加密貨幣,並且在市場上產生了漣漪。

Metaplanet's Bitcoin Buying Spree

Metaplanet的比特幣購買狂歡

Metaplanet isn't just dabbling in Bitcoin; they're going all in. They've significantly accelerated their Bitcoin accumulation, exceeding their annual targets. As of late June, they've amassed a whopping 13,350 BTC, rocketing them past Tesla and other major players in the corporate Bitcoin game. This bold move positions them as the fifth-largest corporate Bitcoin holder globally. CEO Simon Gerovich reports a staggering 349% year-to-date BTC yield, showcasing their impressive returns.

Metaplanet不僅涉足比特幣;他們全力以赴。他們已經大大加速了比特幣的積累,超過了年度目標。截至6月下旬,他們積累了13,350 BTC,在企業比特幣遊戲中,他們超越了特斯拉和其他主要玩家。大膽的舉動將它們定位為全球第五大公司比特幣持有人。首席執行官西蒙·杰羅維奇(Simon Gerovich)報告說,年齡至今的349%的BTC收益驚人,展現了他們令人印象深刻的回報。

Strategic Financing: Bonds and Bitcoin

戰略融資:債券和比特幣

So, how are they funding this massive Bitcoin buying spree? Metaplanet's been getting creative with their finances. They issued a $208 million zero-coupon bond, fully subscribed by Evo Fund. This isn't your typical interest-bearing bond; it's a strategic move to refinance previous obligations and enhance liquidity. Evo Fund's backing signals strong institutional confidence in Metaplanet's vision.

那麼,他們如何為這種大規模的比特幣購買狂歡呢? Metaplanet的財務狀況一直在發揮創造力。他們發行了2.08億美元的零息債券,由EVO基金完全訂閱。這不是您典型的帶有利息的債券;這是再融資以前的義務並提高流動性的戰略舉動。 EVO基金的支持信號對Metaplanet的願景有強烈的機構信心。

Market Impact and Investor Confidence

市場影響力和投資者信心

Metaplanet's aggressive Bitcoin accumulation is sending shockwaves through the market. Their stock surged nearly 10% following the announcement of their increased holdings. This upward momentum puts pressure on short sellers and reinforces investor confidence in Metaplanet's bullish outlook on Bitcoin's future. The company's actions also contribute to short-term price movements, with BTC briefly reaching $108,268 following the announcement of one of their purchases.

Metaplanet的積極性比特幣積累正在向市場發送衝擊波。在宣布增加持股量後,他們的股票飆升了近10%。這種向上的動力給賣空者帶來了壓力,並增強了投資者對Metaplanet對比特幣未來的看法的信心。該公司的行動也有助於短期價格變動,在宣布其中一次購買後,BTC短暫達到了108,268美元。

Why Metaplanet's Move Matters

為什麼Metaplanet的舉動很重要

Metaplanet's strategic embrace of Bitcoin signals a maturing asset class. It demonstrates that companies are increasingly viewing cryptocurrency as a viable investment option. Michael Saylor even pointed out Metaplanet's plan was followed by other companies such as Semler Scientific. This could lead to increased demand for Bitcoin, potentially driving up its price. It also aligns Metaplanet with other corporate giants in Bitcoin acquisition, reflecting increased confidence and recognition in Bitcoin's potential.

Metaplanet對比特幣的戰略擁抱信號是成熟的資產類別。它表明,公司越來越多地將加密貨幣視為可行的投資選擇。邁克爾·塞勒(Michael Saylor)甚至指出,梅勒·科學(Semler Scientific)等其他公司之後,梅特帕內特(Metaplanet)的計劃之後。這可能會導致對比特幣的需求增加,並有可能提高其價格。它還將Metaplanet與其他公司巨頭相結合,以收購比特幣,這反映了對比特幣潛力的信心和認可的提高。

The Road Ahead

前面的道路

Metaplanet isn't stopping here. They're aiming for 30,000 BTC by 2025, and with their innovative financing strategies and strong investor backing, they're well on their way. Keep an eye on Metaplanet; they're setting a new standard for corporate crypto investment and reshaping the relationship between institutional capital and the cryptocurrency market.

Metaplanet並沒有停在這裡。他們的目標是到2025年,他們的目標是30,000 BTC,並且憑藉其創新的融資策略和強大的投資者支持,他們正在努力。密切關注Metaplanet;他們為公司加密投資設定了新的標準,並重塑了機構資本與加密貨幣市場之間的關係。

So, what's the takeaway? Metaplanet is playing chess while others are playing checkers. They're not just buying Bitcoin; they're building a financial empire on it. And who knows, maybe Tesla will start feeling the heat and jump back into the Bitcoin game. It's gonna be one heck of a show!

那麼,收穫是什麼? Metaplanet正在下棋,而其他人則在打跳棋。他們不只是購買比特幣;他們正在建立金融帝國。誰知道,也許特斯拉會開始感覺到熱量並跳回比特幣遊戲。這將是一場演出的一個!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

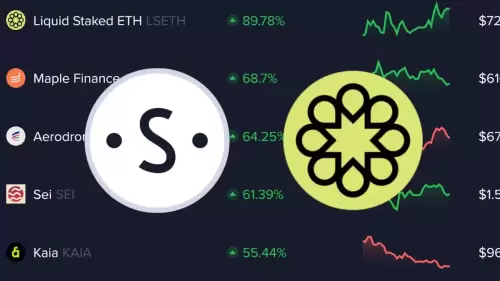

- 情感數據的隱藏寶石:您缺少的最佳性能加密

- 2025-07-01 23:10:15

- 揭開了由情感數據加油的最高表現的加密貨幣,包括隱藏的寶石和市場上意外的潮流。

-

-

- 雪崩,合作夥伴和比特幣:加密貨幣的紐約分鐘

- 2025-07-01 23:10:15

- 探索雪崩,夥伴關係和比特幣的交集,突出了加密貨幣領域的最新發展和未來趨勢。

-

-

- Breez SDK:閃電般的比特幣登機功能下一波應用程序

- 2025-07-01 23:50:12

- Breez SDK正在徹底改變比特幣應用程序的登機,使閃電網絡付款易於訪問且容易。深入了解最新的整合和趨勢。

-

- 比特幣,上市公司和ETF:加密投資的新時代

- 2025-07-01 23:55:12

- 探索比特幣,上市公司和ETF的交匯處,揭示了塑造加密投資格局的最新趨勢和見解。提示:是看好的。

-

- Zachxbt,Ripple和RLUSD採用:深度潛水

- 2025-07-01 22:30:12

- 分析Zachxbt的批評,Ripple的RLUSD採用策略以及對加密生態系統的更廣泛影響。

-

- Jasmycoin(Jasmy):看漲前景和價格預測

- 2025-07-01 23:15:11

- 根據最近的市場趨勢,分析師預測和關鍵支持水平,探索茉莉素幣的潛在看漲激增。日本的比特幣準備好突破了嗎?