|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

萬事達卡和菲塞爾夫正在加深他們的合作夥伴關係,以整合Fiusd,擴大了穩定的採用,並與數字資產彌合了傳統的財務。

Yo, what's the deal with stablecoins? It looks like they're about to become the next big thing, especially with moves from heavy hitters like Mastercard and Fiserv. Let's dive into how these giants are making stablecoins a part of our everyday financial lives.

喲,stablecoins怎麼辦?看起來他們即將成為下一個大事,尤其是從MasterCard和Fiserv等重擊球手的舉動。讓我們深入了解這些巨頭如何使穩定的人成為我們日常財務生活的一部分。

Mastercard and Fiserv Team Up on FIUSD

萬事達卡和Fiserv聯手加入Fiusd

Mastercard is doubling down on its partnership with Fiserv to bring FIUSD, Fiserv's new stablecoin, into the Mastercard universe. This means more people and businesses can use this blockchain-based token across Mastercard’s massive network of over 150 million merchants. Think of it as bridging the gap between your old-school bank account and the wild world of crypto.

萬事達卡將其與Fiserv的合作夥伴關係加倍,將Fiserv的新Stablecoin Fiusd帶入萬事達卡宇宙。這意味著更多的人和企業可以在萬事達卡的超過1.5億商人網絡中使用基於區塊鏈的令牌。可以將其視為彌合您的老式銀行帳戶與加密世界之間的差距。

Chiro Aikat, co-president at Mastercard, put it best: they're building a "robust ecosystem that bridges traditional financial services with digital assets." The goal? To make stablecoins as common and trustworthy as regular ol' dollars.

MasterCard的聯合總裁Chiro Aikat最好地說:他們建立了一個“強大的生態系統,將傳統金融服務與數字資產融為一體。”目標?使Stablecoins成為普通且值得信賴的人。

Why This Matters

為什麼這很重要

So, why should you care? Well, this collaboration aims to solve real-world problems and create new opportunities for stablecoin use. Here’s the lowdown:

那麼,你為什麼要關心呢?好吧,這種合作旨在解決現實世界中的問題並為使用穩定的使用創造新的機會。這是低點:

- More Choices: Fiserv customers get access to a new digital asset service for banking and payments.

- Greater Utility: Stablecoins are moving beyond just being a store of value; they're becoming a way to actually pay for stuff.

- Wider Reach: By integrating with Mastercard’s network, FIUSD can reach millions of merchants and consumers globally.

Takis Georgakopoulos, COO of Fiserv, believes this move will "advance stablecoin-powered payments and help democratize access to blockchain financial services." In other words, it’s about making crypto more accessible to everyone.

Fiserv的首席運營官Takis Georgakopoulos認為,這一舉動將“提高穩定的付款,並幫助民主化對區塊鏈金融服務的訪問”。換句話說,這是關於使加密貨幣更易於使用。

The Bigger Picture: Stablecoins Going Mainstream

更大的局面:穩定幣成為主流

Fiserv isn't just stopping with Mastercard. They're also launching a stablecoin-issuing platform on the Solana network, which will allow around 3,000 regional and community banks to play around with FIUSD or even create their own stablecoins. Plus, they're teaming up with Circle (the folks behind USDC) and Paxos to make FIUSD interoperable with other major stablecoins.

Fiserv不僅與萬事達卡停止。他們還在Solana網絡上啟動了一個穩定的發行平台,該平台將允許大約3,000個區域和社區銀行與Fiusd一起玩,甚至創建自己的Stablecoins。另外,他們正在與Circle(USDC背後的人)和Paxos合作,使Fiusd與其他主要的StableCoins互操作。

Even PayPal is getting in on the action, planning to build future interoperability between FIUSD and PayPal USD (PYUSD). This could mean seamless movement of funds both domestically and internationally.

甚至PayPal也正在採取行動,計劃在Fiusd和PayPal USD(PYUSD)之間建立未來的互操作性。這可能意味著在國內和國際上無縫的資金移動。

A Few Thoughts

一些想法

While all this sounds promising, there are a few things to keep in mind. For instance, Circle's valuation seems a bit out of whack, considering their revenue model is heavily reliant on interest rates from T-bills. And with more big players entering the stablecoin game, how much room is there for everyone to grow?

雖然這聽起來很有希望,但仍有一些事情要記住。例如,考慮到他們的收入模型在很大程度上依賴於T-Bills的利率,Circle的估值似乎有些不足。隨著更多的大型玩家進入Stablecoin遊戲,每個人都有多少空間?

Also, let's not forget the regulatory side of things. While the Senate has been making moves to create a framework for digital assets, there are still disagreements on how to best regulate stablecoins. It's a bit of a Wild West out there, and we need clear rules to ensure things stay legit.

另外,讓我們不要忘記事物的監管方面。儘管參議院一直在採取行動為數字資產創建框架,但關於如何最好地調節穩定的穩定者仍然存在分歧。那裡有點野外,我們需要明確的規則以確保事情保持合法。

The Bottom Line

底線

All in all, the partnership between Mastercard and Fiserv is a big step towards bringing stablecoins into the mainstream. It's about making digital payments more accessible, efficient, and secure. As stablecoins become more integrated into our financial systems, keep an eye on how these developments shape the future of money. Who knows, maybe one day we'll all be paying for our morning coffee with FIUSD. How cool would that be?

總而言之,萬事達卡和菲塞爾之間的伙伴關係是將Stablecoins帶入主流的重要一步。這是關於使數字付款更容易獲得,高效和安全。隨著Stablecoins越來越融入我們的金融系統,請密切關注這些發展如何影響貨幣的未來。誰知道,也許有一天我們都會和Fiusd一起為早上的咖啡付費。那有多酷?

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 加密貨幣:破壞性的購買超越炒作

- 2025-06-25 04:45:12

- 忘記短暫的模因硬幣。發現像Little Pepe,Unstake和渲染的加密貨幣一樣,它們具有真正的實用性和破壞性的潛力。

-

-

-

- JPMORGAN,區塊鍊和JPMD代幣:鏈融資的量子飛躍?

- 2025-06-25 05:05:13

- 探索Coinbase的基本區塊鍊和BTQ的量子安全穩定解決方案上的JPMorgan的JPMD令牌飛行員。

-

-

- 比特幣,加密,停火:救濟集會還是停頓?

- 2025-06-25 05:12:16

- 特朗普的停火宣布引發了加密集會,但這是可持續的嗎?我們深入研究了最新的趨勢,從比特幣的激增到模因硬幣躁狂症,並帶有紐約的扭曲。

-

- 加密貨幣將於2025年6月進行爆炸性增長:您需要知道什麼

- 2025-06-25 05:12:16

- 獲取在2025年6月能夠爆炸性增長的加密貨幣上的內部勺子。

-

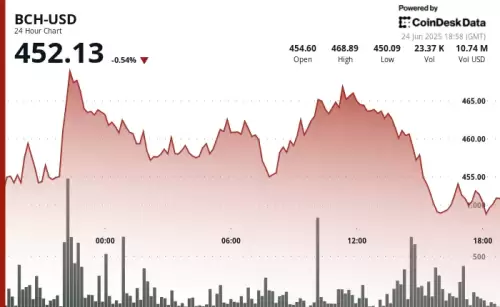

- 比特幣現金(BCH)公牛眼鑰匙阻力水平:它會突破嗎?

- 2025-06-25 05:32:14

- 比特幣現金(BCH)又重新亮相,測試了關鍵阻力水平。它會維持其動力並突破嗎?讓我們深入研究分析。

-

- ETH的看漲前景面臨著薄弱的需求:紐約市的觀點

- 2025-06-25 05:46:12

- 儘管最近激增,但在低收入和競爭不斷上升的情況下,ETH的需求疲軟而掙扎。看漲的未來仍然有可能嗎?