|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

K33的份額為累積比特幣的份額表明了將加密貨幣納入公司戰略的大膽舉措。本文深入了解財務未來的影響。

K33, a Norwegian digital asset firm, is making waves with its strategic share offering focused on Bitcoin accumulation. This move reflects a growing trend of companies embracing Bitcoin as a key component of their financial strategies. Let's break down what this means for K33 and the broader crypto landscape.

K33是一家挪威數字資產公司,它以其戰略性份額提供的專注於比特幣積累而引起浪潮。此舉反映了公司將比特幣作為其財務戰略的關鍵組成部分的增長趨勢。讓我們分解這對K33和更廣泛的加密景觀意味著什麼。

K33's Bold Move: Share Offering to Buy Bitcoin

K33的大膽舉動:分享要購買比特幣

K33 recently announced a directed share issuance aiming to raise at least SEK 85 million. The primary goal? To acquire up to 1,000 Bitcoins for the company's balance sheet. This isn't just a whim; it's a calculated step in K33's long-term plan to strengthen its financial position and expand its operations.

K33最近宣布了一項指導的股份發行,目的是至少籌集8500萬SEK。主要目標?為公司資產負債表最多可獲得1,000個比特幣。這不僅僅是一時興起。這是K33長期計劃的一步,旨在加強其財務狀況並擴大其運營。

According to K33's CEO, Torbjørn Bull Jenssen, this raise is a "significant milestone" towards their target of holding 1,000 BTC. He believes Bitcoin is the future of global finance, and K33 is positioning itself to capitalize on its potential. This move allows K33 to enhance its operations, attract institutional partners, and explore new product avenues.

根據K33的首席執行官TorbjørnBull Jenssen的說法,這是針對擁有1,000 BTC的目標的“重要里程碑”。他認為比特幣是全球金融的未來,K33正在定位自己的潛力。此舉允許K33增強其運營,吸引機構合作夥伴並探索新產品途徑。

Why Bitcoin? The Bigger Picture

為什麼要比特幣?更大的圖片

K33 isn't alone in this venture. Companies like Davies Commodity, H100 Group, Metaplanet, Strategy, and Know Labs are also incorporating Bitcoin into their treasuries. This trend suggests a growing belief in Bitcoin as a hedge against economic uncertainties and a key element in a decentralized financial future.

K33並不孤單。戴維斯商品,H100集團,Metaplanet,Strategy和New Labs等公司也將比特幣納入其國庫中。這種趨勢表明,人們對比特幣的信念日益增加,作為對經濟不確定性的對沖,也是分散財務未來的關鍵因素。

The accumulation of Bitcoin is becoming increasingly common among forward-thinking companies. Over 225 companies have already added Bitcoin to their holdings, and this number is expected to grow as the crypto landscape matures.

比特幣的積累變得越來越普遍。超過225家公司已經增加了比特幣的股份,隨著加密貨幣景觀的成熟,該數字有望增長。

What's Next for K33 and Bitcoin?

K33和比特幣的下一步是什麼?

With the share offering fully subscribed, K33 is poised to execute its Bitcoin acquisition strategy. This move is expected to boost the company's margins, facilitate new products, and attract larger institutional partners. By holding Bitcoin on its balance sheet, K33 aims to benefit from Bitcoin's upside while mitigating risks for its clients.

隨著份額提供完全訂閱的份額,K33有望執行其比特幣採集策略。這一舉動有望提高公司的利潤率,促進新產品並吸引更大的機構合作夥伴。通過在資產負債表上持有比特幣,K33的目標是從比特幣的上升空間中受益,同時減輕客戶的風險。

Final Thoughts: Riding the Bitcoin Wave

最終想法:騎比特幣浪潮

K33's share offering is more than just a financial maneuver; it's a statement about the growing acceptance of Bitcoin as a legitimate asset. As more companies follow suit, we can expect to see even greater integration of Bitcoin into the traditional financial system. So, buckle up and enjoy the ride—the future of finance is here, and it's powered by Bitcoin!

K33的份額不僅僅是金融機動。這是關於比特幣越來越接受合法資產的聲明。隨著越來越多的公司效仿,我們可以期望將比特幣更大的整合到傳統金融體系中。因此,搭扣並享受旅程 - 財務的未來就在這裡,它由比特幣提供動力!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 金幣,稀有,馬:錢幣綜述

- 2025-06-20 22:45:13

- 從查爾斯二世幾內亞到凱斯花園50ps,發掘了稀有的金幣,以及他們講的有趣的故事。另外,津巴布韋的黃金硬幣計劃停止。

-

-

-

-

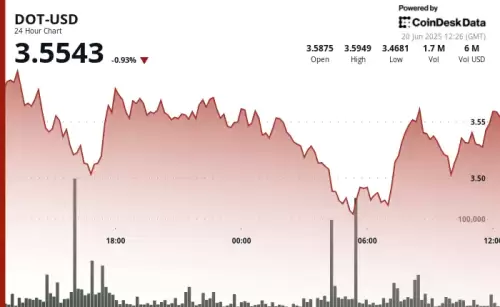

- Polkadot的點:導航三重底部和看漲逆轉

- 2025-06-20 23:25:12

- Polkadot的點顯示了彈性,在擊中潛在的三重底部後形成了看漲的逆轉模式。這是大規模集會的開始嗎?

-

-

-