|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

摩根大通(JPMorgan)的JPMD代幣飛行員在Coinbase的基本網絡上標誌著與區塊鏈彌合傳統財務的重要一步。這是機構加密的未來嗎?

Yo, crypto enthusiasts! JPMorgan's been makin' moves with its JPMD token on Coinbase's Base network, and it's kinda a big deal. Let's break down what's goin' on.

喲,加密愛好者!摩根(JPMorgan)在Coinbase的基本網絡上憑藉其JPMD代幣進行了Makin的動作,這很重要。讓我們打破什麼事。

JPMD Token: JPMorgan Enters the Chat

JPMD令牌:jpmorgan進入聊天

JPMorgan is piloting its JPMD token, a deposit token representing dollar deposits, on Coinbase's Base blockchain. This is designed for institutional clients, allowing them to move money on-chain 24/7. Think of it as JPMorgan finally dipping its toes (or maybe diving headfirst) into the crypto pool.

摩根大通(JPMorgan)正在駕駛其JPMD代幣(代表美元存款的礦床代幣)上,在Coinbase的基本區塊鏈上。這是為機構客戶設計的,使他們能夠24/7的鏈上貨幣貨幣。可以將其視為JPMorgan終於將腳趾(或者首先跳水)浸入加密貨幣池中。

Base Network: Why Coinbase's Blockchain?

基本網絡:為什麼Coinbase的區塊鏈?

Base, an Ethereum Layer 2 blockchain, is becoming a hub for innovation. Its total value locked (TVL) has more than doubled in a year, showing growing trust. JPMorgan's choice of Base is strategic, offering a balance between decentralization and regulatory compliance. It's like findin' the perfect spot to set up shop – not too wild, but still where the action is.

基礎是一個以太坊2層區塊鏈,正成為創新的樞紐。它的總價值鎖定(TVL)在一年中增加了一倍以上,表現出越來越多的信任。摩根大通的基礎選擇是戰略性的,在權力下放和法規合規性之間取得了平衡。這就像找到建立商店的理想場所一樣 - 不太瘋狂,而是動作所在的地方。

JPMD vs. Stablecoins: What's the Difference?

JPMD與Stablecoins:有什麼區別?

JPMD aims to be a 'superior alternative to stablecoins.' Unlike stablecoins backed by reserves, JPMD integrates directly with the banking system, representing real dollar deposits at JPMorgan. This could mean greater flexibility, better capital circulation, and lower emission costs. Plus, JPMD might even generate interest, makin' it a more attractive option for big players.

JPMD的目標是成為“穩定劑的優越替代品”。與儲備金支持的Stablecoin不同,JPMD直接與銀行系統集成,代表JPMorgan的真美元存款。這可能意味著更大的靈活性,更好的資本流通和降低的排放成本。另外,JPMD甚至可能引起興趣,對大玩家來說,這是一個更具吸引力的選擇。

The Institutional Angle: Why This Matters

機構角度:為什麼這很重要

Asset managers are movin' on-chain fast, and JPMD could be a game changer for them. Supporting 24/7 token sales and redemptions becomes easier and cheaper with JPMD. It streamlines operations and reduces liquidity fragmentation. It's like havin' a VIP pass to the crypto world for institutions.

資產經理正在快速移動鍊子,JPMD可能對他們來說是改變遊戲規則的人。 jpmd支持24/7代幣的銷售和贖回變得更加容易和便宜。它簡化了操作並減少流動性碎片。這就像Havin'vip通向加密貨幣世界的機構。

Regulatory Hurdles and the Future

監管障礙和未來

The Basel Committee's rules for crypto-assets could pose a challenge, as they treat permissionless blockchains more harshly. However, JPMorgan's relationship with Coinbase might help mitigate these concerns. The bank will likely argue that their partnership ensures risks are managed effectively. It's all about playin' the game right and navigatin' the regulatory landscape.

巴塞爾委員會對加密資產的規定可能會構成挑戰,因為他們更加嚴厲地對待無許可的區塊鏈。但是,摩根大通與Coinbase的關係可能有助於減輕這些問題。該銀行可能會爭辯說,他們的伙伴關係確保有效地管理風險。這一切都是關於遊戲正確的遊戲,而Navigatin”的監管景觀。

My Take: A Watershed Moment

我的觀點:流域時刻

This move by JPMorgan is a watershed moment for institutional adoption of permissionless blockchains. It's a signal that traditional finance is seriously considerin' crypto, and it could pave the way for more banks to follow suit. While there are challenges ahead, the potential benefits are massive. It's like watchin' the old guard embrace the new world, and the possibilities are endless.

摩根大通的這一舉動是機構採用無許可區塊鏈的分水嶺。這表明傳統財務是認真考慮的加密,它可能為更多的銀行效仿鋪平道路。儘管面臨挑戰,但潛在的好處是巨大的。就像看著老後衛擁抱新世界一樣,可能性是無盡的。

So, there you have it. JPMorgan's JPMD token on Base is a big deal, and it's worth keepin' an eye on. Who knows? Maybe one day, we'll all be usin' JPMD to buy our morning coffee. Until then, stay curious and keep hustlin'!

所以,你有。摩根大通(JPMorgan)的jpmd代幣在基礎上很重要,值得關注。誰知道?也許有一天,我們所有人都可以買到早上的咖啡。在此之前,請保持好奇,並保持Hustlin'!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 比特幣,戰爭和穩定:駕駛地緣政治風暴

- 2025-06-19 04:25:12

- 在戰爭和地緣政治緊張局勢中探索比特幣的韌性,從網絡戰到市場反應以及尋求穩定的追求。

-

-

- 比特幣供應緊縮:持有人霍德林,接下來會有100萬美元的BTC嗎?

- 2025-06-19 04:45:13

- 比特幣的供應減少,堅定的持有人定罪和潛在的機構FOMO:這是歷史性比特幣擠壓的完美秘訣嗎?

-

- 鯨魚的佩佩(Pepe)損失:即將發生的事情的跡象?

- 2025-06-19 04:45:13

- 一條主要的佩佩鯨魚以350萬美元的損失退出,但看漲的模式出現了。這是Meme Coin投資者的購買機會還是警告信號?

-

- Thorchain Community Call,6月21日:期待什麼

- 2025-06-19 04:50:12

- 看看即將到來的索氏社區在6月21日的呼籲,重點是TC整合和符文在生態系統中的作用。

-

-

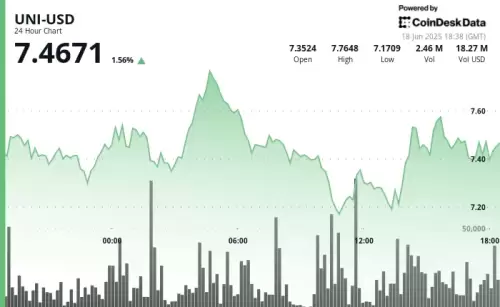

- UNISWAP(UNI)支持級別:導航復出

- 2025-06-19 05:00:13

- Uni從年度低點集會,測試支持水平。這是可持續的上升趨勢,還是更廣泛的採用將決定其命運?

-

- 比特幣價格,競爭和預售:加密貨幣世界中有什麼熱?

- 2025-06-19 05:00:13

- 比特幣的價格面臨著來自Neo Pepe等創新的預售的競爭。發現趨勢和見解塑造加密貨幣景觀。

-

- 導航模因硬幣躁狂症:投資野外西部的投資組合策略

- 2025-06-19 04:35:13

- 模因硬幣正在爆炸,但是它們適合您的投資組合嗎?我們分解了模因硬幣市場中的趨勢,機會和風險。