|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HBAR 在交易量巨大的情況下維持關鍵支撐位。看漲指標會持續存在,還是看跌勢頭會佔上風?深入分析。

HBAR's Wild Ride: Support Tests and Heavy Volume in Focus

HBAR 的狂野之旅:支持測試和大量交易成為焦點

HBAR's been a rollercoaster, hasn't it? With all the support tests and heavy volume, it's tough to keep up. Let's break down what's been happening.

HBAR 的經歷就像坐過山車,不是嗎?面對所有的支持測試和大量的支持,很難跟上。讓我們來分析一下發生了什麼。

Support Level Scrutiny

支持級別審查

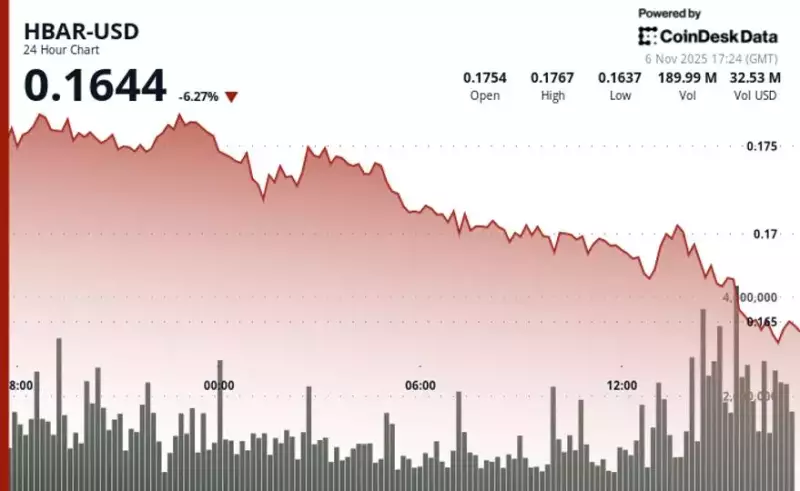

Recently, HBAR's price action has been closely tied to its support levels. We saw HBAR testing its $0.1688 support, which caused a surge in trading volume, spiking 32% above the daily average to 63.6 million tokens. This surge preceded a rebound, hinting at renewed institutional buying interest. But, it's not always that simple, is it?

最近,HBAR 的價格走勢與其支撐位密切相關。我們看到 HBAR 測試了 0.1688 美元的支撐位,這導致交易量激增,比日平均水平飆升 32%,達到 6360 萬個代幣。此次飆升先於反彈,暗示機構購買興趣重新燃起。但是,事情並不總是那麼簡單,不是嗎?

Volume Tells a Story

音量講述故事

Heavy volume often indicates significant activity and potential trend shifts. The increase in trading volume, particularly around support levels, suggests strong market interest and accumulation phases. The Hedera network's transaction volumes have been steadily rising, showcasing growing adoption in DeFi, payments, and enterprise applications. Daily transactions reaching hundreds of thousands, and even peaking over 100 million, highlight the token's utility and investor confidence.

成交量大通常表明存在重大活動和潛在的趨勢轉變。交易量的增加,特別是在支撐位附近的交易量的增加,表明市場興趣濃厚並且處於吸籌階段。 Hedera 網絡的交易量一直在穩步增長,顯示出在 DeFi、支付和企業應用程序中的採用不斷增加。每日交易量達到數十萬,甚至峰值超過1億,凸顯了代幣的實用性和投資者的信心。

Technical Signals: Bullish or Bearish?

技術信號:看漲還是看跌?

Technical analysis paints a mixed picture. Some analysts point to bullish indicators like an ascending triangle and Elliott Wave patterns, suggesting potential breakouts towards $0.21 or even $0.45. Others highlight the importance of holding critical support between $0.185 and $0.195. The hourly chart showed signs of reversal, forming higher lows and testing resistance levels. But the bears aren't giving up without a fight. As seen with LINK, breaking below pivot support can trigger accelerated selling.

技術分析描繪了一幅複雜的圖景。一些分析師指出,上升三角形和艾略特波浪模式等看漲指標表明金價可能突破 0.21 美元甚至 0.45 美元。其他人強調了在 0.185 美元至 0.195 美元之間保持關鍵支撐位的重要性。小時圖顯示出反轉跡象,形成更高的低點並測試阻力位。但熊不會不戰而屈人之兵。正如 LINK 所示,跌破樞軸支撐位可能會引發加速拋售。

DeFi and Liquidity: A Foundation for Growth

DeFi 和流動性:增長的基礎

The stability of DeFi projects on the Hedera network, with values locked between 50 million and 150 million, indicates ongoing investor engagement. These liquidity amounts support the technical and fundamental performance of HBAR prices. This stable ecosystem interaction is crucial for long-term growth.

Hedera 網絡上 DeFi 項目的穩定性(鎖定價值在 5000 萬至 1.5 億之間)表明投資者持續參與。這些流動性金額支持 HBAR 價格的技術和基本面表現。這種穩定的生態系統相互作用對於長期增長至關重要。

My Two Hash(graph)

我的兩個哈希(圖)

Look, HBAR is showing promise, but keep a close watch on those support levels. The heavy volume suggests big players are interested, but the market can be as unpredictable as a New York subway schedule. Keep an eye on overall market sentiment and Bitcoin's movements, as these can significantly influence HBAR's direction.

看,HBAR 表現出了希望,但請密切關注這些支撐位。成交量大表明大型企業有興趣,但市場可能像紐約地鐵時刻表一樣難以預測。密切關注整體市場情緒和比特幣的走勢,因為這些可以顯著影響 HBAR 的方向。

The Takeaway

外賣

So, what's the bottom line? HBAR's in an interesting spot. With heavy volume and support tests, it's a coin worth watching. Whether it's headed to the moon or just taking a detour is anyone's guess, but hey, that's crypto for you! Keep your eyes peeled, and maybe we'll all be sipping Mai Tais on our yachts soon. Or, you know, just paying off our student loans. Either way, good luck!

那麼,底線是什麼? HBAR 處於一個有趣的位置。憑藉大量的成交量和支撐測試,這是一枚值得關注的代幣。任何人都在猜測它是前往月球還是只是繞道而行,但是嘿,這對你來說是加密貨幣!請睜大眼睛,也許我們很快就會在遊艇上品嚐邁泰雞尾酒。或者,你知道,只是還清我們的學生貸款。不管怎樣,祝你好運!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- Layer 2 代幣:到 2026 年是否會出現潛在的爆炸?

- 2025-11-07 16:04:10

- 在可擴展性、創新和機構對加密貨幣的興趣的推動下,探索 Layer 2 代幣到 2026 年爆發的潛力。

-

-

- 比特幣的狂野之旅:飆升、歸零和尋求穩定性

- 2025-11-07 15:58:00

- 比特幣最近的波動讓投資者感到緊張。從 ETF 流出到山寨幣流動性緊縮,我們詳細分析了激增、零的可能性以及這一切意味著什麼。

-

- XRP、比特幣和反彈:紐約有什麼交易?

- 2025-11-07 15:53:38

- 分析有關 XRP、比特幣和潛在市場反彈的最新動態。現在是該跳進去的時候了,還是應該按兵不動?讓我們深入了解一下。

-

- Filecoin、DePIN 和技術突破:最新動態是什麼?

- 2025-11-07 15:53:15

- Filecoin 以技術突破領跑 DePIN!了解驅動力、關鍵水平以及這對去中心化存儲的未來意味著什麼。

-

- 比特幣波動:ETF 流出和 10 萬美元底線

- 2025-11-07 15:51:06

- 由於 ETF 資金外流,比特幣堅守 10 萬美元。在下一次飆升至 10 萬美元之前,是否會出現更大幅度的回調?

-

-

![圖表價格預測 [GRT 今日加密貨幣價格新聞] 圖表價格預測 [GRT 今日加密貨幣價格新聞]](/uploads/2025/11/07/cryptocurrencies-news/videos/690d4df44fe69_image_500_375.webp)