|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

作者使用網格機器人在比特幣、USTD 和以太坊上投資了 1 億美元,目標是到 2025 年中期將其變成 10 億美元。 75 天后,投資報酬率為 75%,總資本為 1.75 億美元(包括 78.20 BTC 和 7 ETH,總市值為 6,506 美元)。儘管最近市場波動,作者仍然對該策略充滿信心,並引用了先前的成功經驗和複合回報的潛力。目前正在對策略進行調整,包括設定停損、考慮轉向 HiCOIN-Mining,以及在必要時提前終止機器人。

Turning $100 Million into $1 Billion Using Grid-Bots: A Detailed Analysis of a 75-Day Experiment

使用 Grid-Bot 將 1 億美元變成 10 億美元:75 天實驗的詳細分析

Introduction

介紹

In today's volatile cryptocurrency market, investors are constantly seeking innovative strategies to mitigate risk and maximize returns. Grid-bot trading, an automated trading technique that utilizes a series of predefined buy and sell orders within a specified price range, has emerged as a prominent choice. This article delves into a compelling case study that meticulously tracks the performance of grid-bots in transforming an initial capital of $100 million into an astonishing $1 billion within a period of 75 days.

在當今動盪的加密貨幣市場中,投資者不斷尋求創新策略來降低風險並最大化回報。網格機器人交易是一種自動交易技術,在指定的價格範圍內利用一系列預先定義的買賣訂單,已成為突出的選擇。本文深入研究了一個引人注目的案例研究,該案例仔細追蹤了網格機器人在 75 天內將 1 億美元的初始資本轉變為驚人的 10 億美元的表現。

Methodology

方法

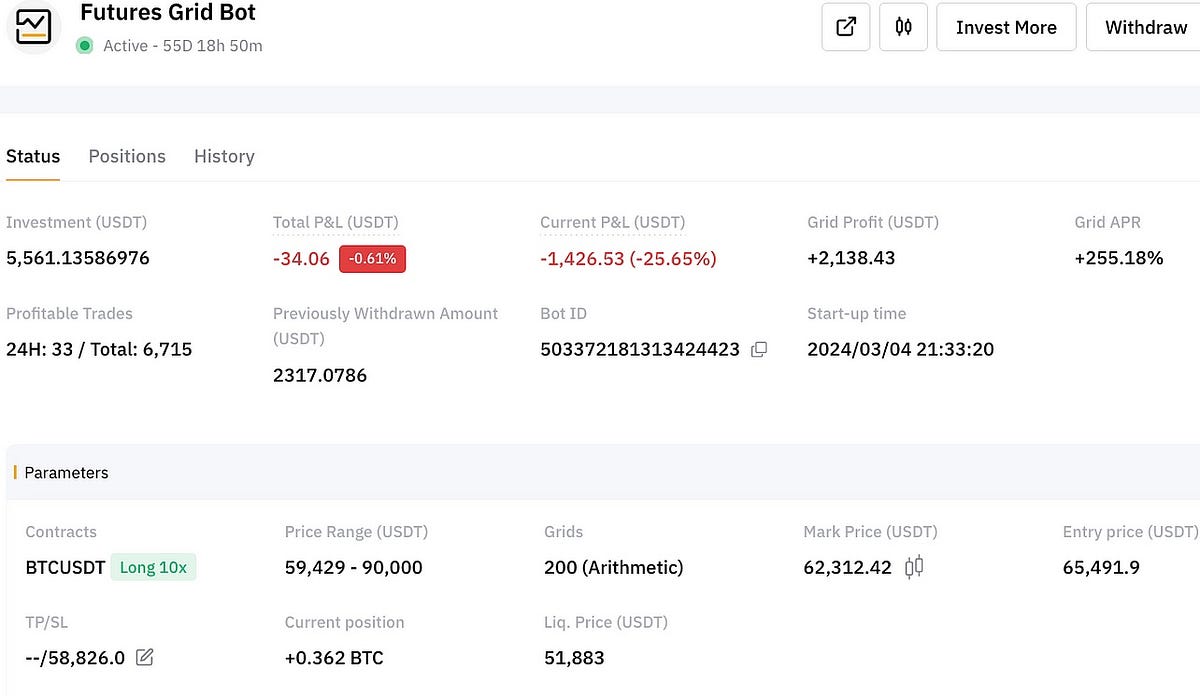

On February 14, 2024, the experiment commenced with an initial investment of $70 million allocated to a Bitcoin grid-bot. Subsequently, an additional $30 million was invested in an Ethereum grid-bot, bringing the total initial capital to $100 million. The grid-bots were configured to execute buy and sell orders within predefined price ranges, capturing profits from market fluctuations within that range.

2024 年 2 月 14 日,實驗開始,初始投資 7,000 萬美元分配給比特幣網格機器人。隨後,又向以太坊網格機器人投資了 3,000 萬美元,使初始資本總額達到 1 億美元。網格機器人被配置為在預先定義的價格範圍內執行買賣訂單,從該範圍內的市場波動中獲取利潤。

Results

結果

Despite the market's recent downturn, the experiment yielded remarkable results. After 75 days, the total capital had grown to an impressive $1,005,350,100, an incredible 905.35% increase from the initial investment. This substantial gain was attributed to the grid-bots' ability to capitalize on market volatility, consistently accumulating profits through a series of small trades.

儘管近期市場低迷,但該實驗取得了顯著的成果。 75 天后,總資本已增長到令人印象深刻的 1,005,350,100 美元,比初始投資增加了 905.35%,令人難以置信。這種巨大的收益歸功於網格機器人利用市場波動的能力,透過一系列小額交易持續累積利潤。

Breakdown of Portfolio

投資組合明細

The current portfolio breakdown illustrates the remarkable performance of the grid-bots:

目前的投資組合細分說明了網格機器人的卓越性能:

- USDT: $5 million

- Bitcoin (BTC): 78.20 ($62,312 per BTC)

- Ethereum (ETH): 7 ($3,171 per ETH)

Impact of Market Volatility

USDT:500 萬美元比特幣 (BTC):78.20(每 BTC 62,312 美元)以太幣 (ETH):7(每 ETH 3,171 美元)市場波動的影響

The market's recent decline has impacted the experiment but not to the extent of jeopardizing the strategy's overall viability. While the ROI has been negative in recent weeks, the accumulated BTC and ETH holdings have significantly increased in value, offsetting the temporary drawdown in USDT.

市場近期的下跌對實驗產生了影響,但並未達到危及該策略整體可行性的程度。雖然最近幾週的投資回報率一直為負,但累計持有的 BTC 和 ETH 價值顯著增加,抵消了 USDT 的暫時回撤。

Risk Mitigation

風險緩解

To manage risk, the grid-bots were equipped with stop-loss mechanisms. In the event of a market crash, the bots would automatically sell the cryptocurrencies at predetermined prices, limiting potential losses. This proactive approach to risk management ensures that the strategy remains sustainable even in adverse market conditions.

為了管理風險,網格機器人配備了停損機制。如果市場崩潰,機器人會自動以預定價格出售加密貨幣,限制潛在損失。這種積極主動的風險管理方法確保即使在不利的市場條件下策略也能維持永續性。

Strategy Refinement

策略細化

As the market environment evolves, the strategy is continuously refined to adapt to changing conditions. The grid-bots' price ranges are optimized in response to market trends, ensuring that they continue to capture profits in a dynamic market.

隨著市場環境的變化,策略不斷改進以適應不斷變化的條件。網格機器人的價格範圍根據市場趨勢進行了優化,確保它們繼續在動態市場中獲取利潤。

Hypothetical Returns

假設回報

Based on the current ROI of 75% in 75 days, a hypothetical scenario projects that the initial investment could potentially grow to over $1 billion by mid-2025. This hypothetical projection underscores the exponential power of compounding, which can generate substantial returns over time.

根據目前 75 天內 75% 的投資報酬率,假設情境預計到 2025 年中期初始投資可能會成長到超過 10 億美元。這一假設的預測強調了複利的指數力量,隨著時間的推移,它可以產生可觀的回報。

Conclusion

結論

This experiment provides compelling evidence of the potential of grid-bots as a powerful investment tool. By leveraging the power of automation and capitalizing on market volatility, investors can significantly enhance their returns while mitigating risk. The strategy's adaptability and continuous refinement ensure its relevance in evolving market conditions.

該實驗提供了令人信服的證據,證明網格機器人作為強大的投資工具的潛力。透過利用自動化的力量和利用市場波動,投資者可以顯著提高回報,同時降低風險。該策略的適應性和不斷改進確保了其在不斷變化的市場條件中的相關性。

Disclaimer

免責聲明

It is important to note that this experiment represents a hypothetical scenario and actual results may vary. Cryptocurrency trading involves inherent risks, and investors should carefully consider their own circumstances before making any investment decisions.

值得注意的是,該實驗代表的是假設場景,實際結果可能會有所不同。加密貨幣交易涉及固有風險,投資者在做出任何投資決定之前應仔細考慮自身情況。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- BlockDag,SEI,Ethena:顯微鏡下的頂級加密表演者

- 2025-08-03 10:00:06

- 深入研究阻滯劑,SEI和Ethena,研究了它們的獨特優勢和市場勢頭。哪個領導背包?

-

- 比特幣爆炸超過$ 119K:機構採用和宏觀如何驅動火災

- 2025-08-03 09:40:57

- 比特幣達到了新的高位!潛入推動其激增的力量:機構擁抱和宏觀經濟的變化。

-

-

- 加密貨幣,網絡釣魚和您的錢包:紐約人安全指南

- 2025-08-03 09:27:32

- 網絡釣魚攻擊正在發展,您的加密錢包是主要目標。了解如何保護您的數字資產免受複雜的騙局和長期威脅。

-

- 拖釣者貓模因硬幣預售飆升:加密叢林中的新國王?

- 2025-08-03 09:25:57

- Troller Cat的預售成功正在轉頭!這個模因硬幣是下一個大事還是鍋中的另一個閃光燈?潛入來找出為什麼要飆升。

-

- 灰度,Altcoin Trust和中型躁狂症:有什麼交易?

- 2025-08-03 08:00:44

- 灰刻層以新的信任潛入中股山頂,而Solana ETF的競賽則升溫。這對Altcoins的未來意味著什麼?

-

- XRP,ADA和Altcoin Evolution:什麼是熱和下一步

- 2025-08-03 08:00:39

- 潛入XRP,ADA和AltCoins的世界。探索重塑加密景觀的最新趨勢,潛在的突破和創新項目。

-

- 山寨幣,比特幣和流入:解碼加密電流

- 2025-08-03 08:00:29

- 比特幣和精選的替代幣正在看到大量流入,信號引起的置信度以及顯著增長的潛力。是什麼推動了這一激增,誰是主要參與者?

-

- HBAR價格檢查:每月收益是否在此阻力水平上持有?

- 2025-08-03 07:58:04

- HBAR的價格大約在0.24美元左右,每月增長55%,但反對抵抗。它可以突破嗎?讓我們深入研究分析。