|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密貨幣新聞文章

GENIUS Act hits new resistance as Democrats target Trump family profits and UAE cash. What really happened?

2025/05/05 20:42

Just days before a crucial Senate vote on the GENIUS Act, a bipartisan bill that would set the stage for a U.S. framework for stablecoins, nine Democratic senators announced their opposition to the legislation unless additional anti-money laundering and national security measures were included.

The senators, who include some of the key backers of the bill in the lower chamber, stated their intent to vote against the legislation if these measures were not integrated.

"We urge the Senate to reject the bill in its current form and instead pass legislation that provides comprehensive consumer and financial stability protections, enforces robust anti-money laundering and national security measures, and holds bad actors accountable," the senators wrote in a statement.

The bipartisan legislation, which stands for Guiding and Establishing National Innovation for U.S. Stablecoins Act, passed the Senate Banking Committee in March with bipartisan support. However, it faces a higher threshold to clear the full Senate, requiring 60 votes to overcome a filibuster.

Majority Leader John Thune had scheduled a vote for the bill by Memorial Day. But with five Democrats and 13 Republicans needed for a majority and several key senators signaling their opposition, the bill's passage before the holiday appears increasingly uncertain.

The bill, which would define who can issue dollar-backed stablecoins and under what conditions, is intended to bring legal clarity to a market that now accounts for more than $240 billion in market value. Tokens like Tether (USDT) and USD Coin (USDC) facilitate most crypto transactions and are used by millions of consumers daily for payments and money transfers.

The legislation permits bank-affiliated subsidiaries and federally approved nonbank entities to become "permitted payment stablecoin issuers." These issuers must maintain one-to-one reserves using high-quality liquid assets such as cash or U.S. Treasuries, and all funds must be kept in segregated accounts to protect customer holdings from institutional risk.

To ensure transparency, issuers will be subject to monthly reserve audits conducted by independent registered firms. Senior executives, including the chief executive and chief financial officer, must personally certify the accuracy of these reports.

Smaller issuers can choose to remain under state regulatory systems, provided they meet the federal baseline. Those managing more than $10 billion in stablecoins will be jointly supervised by the Federal Reserve and the Office of the Comptroller of the Currency.

For issuers with more than $50 billion in stablecoins in circulation, the law requires annual financial audits, with specific scrutiny on any transactions involving related parties. Firms that fail to comply with these requirements face a daily penalty of $100,000.

In addition to financial safeguards, the bill applies the anti-money laundering provisions of the Bank Secrecy Act. It also mandates transparent and enforceable redemption policies, ensuring users can reliably exchange stablecoins for U.S. dollars.

Importantly, the legislation excludes algorithmic stablecoins, such as those that attempt to maintain a dollar peg using an autonomous money supply, from its framework. The bill calls for the Treasury Department to conduct a separate study on how to handle such models in the future.

Furthermore, issuers covered under the GENIUS Act will not have access to Federal Reserve master accounts, limiting their ability to integrate directly with the banking system. This restriction could shape how these firms operate within U.S. financial infrastructure.

Proponents of the bill argue that it will reinforce the role of the U.S. dollar in digital finance and increase demand for government debt through mandated reserve holdings.

However, critics have raised structural concerns about the bill, such as the potential for a loophole that might give foreign issuers, like Tether, an edge over domestic firms, and the lack of restrictions on large companies.

For instance, entities like Amazon could theoretically issue their own stablecoins under this framework, an outcome that some lawmakers see as risky.

"The GENIUS Act is a bipartisan bill that provides a common-sense framework for stablecoins in the United States," said Senator Bill Hagerty (R-TN), who introduced the bill. "This legislation will promote innovation and competition in the digital asset ecosystem while safeguarding consumers and the financial system."

Senator Kirsten Gillibrand (D-NY), one of the bill's original co-sponsors, added, "This bill will create a level playing field for American innovators and ensure that consumers are protected from fraud and abuse."

The bill's opponents argued that it failed to adequately address critical issues such as money laundering, national security, and consumer protection. They also expressed concern about the potential for the bill to be used to enrich political insiders.

"This bill is a recipe for disaster," said Senator Elizabeth Warren (D-MA). "It would allow the Trump family to get even richer by laundering money through a stablecoin and it would open the door to widespread fraud and abuse."

The bill's supporters countered that the Democrats' opposition was surprising given the broad bipartisan support the bill had already garnered.

"It's

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- PI網絡,KYC Sync和PI2Day:深入了解最新發展

- 2025-06-20 18:45:13

- 探索PI網絡上的最新KYC同步功能,其對用戶的影響以及圍繞即將舉行的PI2DAY活動的預期。

-

- Dogecoin的三角探戈:看漲的情緒會導致突破嗎?

- 2025-06-20 19:05:12

- Dogecoin形成了對稱的三角形模式,暗示了潛在的60%的價格轉移。看漲的情緒會佔上風並引發突破嗎?

-

- 以太坊,比特幣,價格預測:在動蕩的市場中導航加密潮

- 2025-06-20 19:05:12

- 在地緣政治緊張局勢和市場波動中探索以太坊,比特幣和價格預測的最新趨勢和見解。發現潛在的機會和風險。

-

- 以太坊,比特幣和價格預測遊戲:現在是什麼熱?

- 2025-06-20 18:25:13

- 在以太坊,比特幣和價格預測周圍導航加密蜂鳴聲。在不斷發展的加密景觀中獲得最新的見解和潛在機會。

-

- 比特幣價格突破即將發生?解碼加密市場的下一個大舉動

- 2025-06-20 18:45:13

- 比特幣在重大突破的邊緣嗎?分析最近的市場趨勢,監管發展和鯨魚活動,以預測BTC和Dogecoin的下一個方向。

-

- 加密,人工智能和投資:瀏覽金融的未來

- 2025-06-20 19:25:12

- 探索加密貨幣,AI和投資的融合,從AI驅動的貿易助手到NFT的不斷發展的景觀以及可互操作的區塊鏈的承諾。

-

-

- 甜蜜的懷舊:生日蛋糕的傳統如何在周年紀念日持續

- 2025-06-20 19:45:13

- 探索生日蛋糕,懷舊和周年慶典的持久吸引力。發現傳統在保持情感價值的同時如何發展。

-

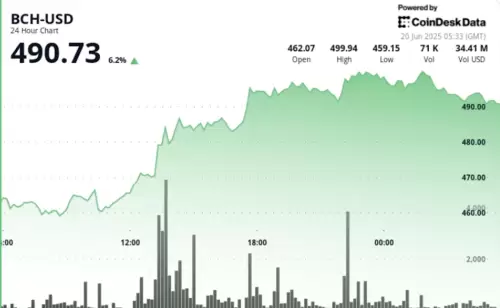

- 比特幣現金價格上漲:公牛以峰值收費!

- 2025-06-20 19:45:13

- 比特幣現金體驗由機構需求和交易量激增的巨大價格上漲,測試了關鍵的500美元電阻水平。