|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索生成性AI如何影響TED Sarandos下的Netflix,從而影響了流媒體戰爭中的內容創建,用戶體驗和競爭策略。

Netflix, under Ted Sarandos' leadership, is navigating the streaming landscape amid rising competition and technological advancements like Generative AI. This article delves into Netflix's strategic shifts, valuation concerns, and how AI might play a role in its future.

在泰德·薩蘭多斯(Ted Sarandos)的領導下,Netflix正在競爭不斷上升的競爭和技術進步,例如生成AI,正在瀏覽流媒體景觀。本文深入研究了Netflix的戰略轉變,估值問題以及AI如何在其未來中發揮作用。

Netflix's Subscriber Growth and Strategic Shifts

Netflix的訂戶增長和戰略轉變

Netflix's subscriber count reached 301.6 million by late 2024, a 16% annual increase. The company stopped reporting quarterly subscriber numbers in Q1 2025, shifting focus to revenue and engagement metrics. Netflix is leaning on price hikes, a password-sharing crackdown, and its ad-supported tier. Competitors like Disney+ and HBO Max are nipping at Netflix's heels, and global market saturation is real.

到2024年底,Netflix的訂戶數量達到了3.016億,每年增加16%。該公司停止在第1季度2025年第1季度報告季度訂戶編號,將重點轉移到收入和參與度指標上。 Netflix依靠價格上漲,密碼共享的鎮壓及其廣告支持的層。迪士尼+和HBO Max等競爭對手正在戴上Netflix的高跟鞋,而全球市場飽和是真實的。

Netflix's Valuation vs. Reality

Netflix的估值與現實

Netflix's P/E of 60.9 (as of July 2025) is nearly three times the 10-year average of the S&P 500 and twice that of Disney (P/E 26.7). The stock's current P/E of 60.9 leaves little room for error. A minor earnings miss or a competitive misstep could trigger a sharp sell-off.

Netflix的市盈率為60.9(截至2025年7月),幾乎是標準普爾500指數的10年平均值,是迪士尼的兩倍(P/E 26.7)。該股票的當前市盈率為60.9,幾乎沒有錯誤的空間。未成年人的收入失誤或競爭性失誤可能會引發急劇的拋售。

Generative AI and Netflix: A Forward Look

生成AI和Netflix:前瞻性外觀

While not explicitly mentioned in the context, Generative AI could revolutionize content creation, personalization, and recommendation systems at Netflix. Imagine AI-driven scriptwriting tools that assist in developing engaging content or AI algorithms that tailor content recommendations to individual viewer preferences.

儘管沒有在上下文中明確提及,但生成的AI可以在Netflix上徹底改變內容創建,個性化和推薦系統。想像一下AI驅動的劇本工具,可幫助開發引人入勝的內容或AI算法,以將內容建議定制為個人觀看者的偏好。

Ted Sarandos' Vision for Netflix

Ted Sarandos對Netflix的願景

Ted Sarandos' vision for Netflix likely includes leveraging emerging technologies like Generative AI to maintain its competitive edge. This could involve experimenting with AI-generated content, enhancing user experiences through AI-powered personalization, and optimizing content delivery using AI algorithms.

泰德·薩蘭多斯(Ted Sarandos)對Netflix的願景可能包括利用生成AI等新興技術來保持其競爭優勢。這可能涉及實驗AI生成的內容,通過AI驅動的個性化增強用戶體驗,並使用AI算法優化內容交付。

Conclusion

結論

Netflix remains a streaming titan, but its high valuation demands flawless execution. The integration of Generative AI could be a game-changer, but it also presents new challenges. As Netflix continues to evolve under Ted Sarandos' leadership, the streaming wars are far from over, and the future is full of possibilities. So, grab your popcorn and stay tuned!

Netflix仍然是流媒體巨人,但其高估值要求完美執行。生成AI的集成可能會改變遊戲規則,但也提出了新的挑戰。隨著Netflix在Ted Sarandos的領導下繼續發展,流媒體戰爭還遠遠沒有結束,未來充滿了可能性。因此,抓住爆米花並繼續關注!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

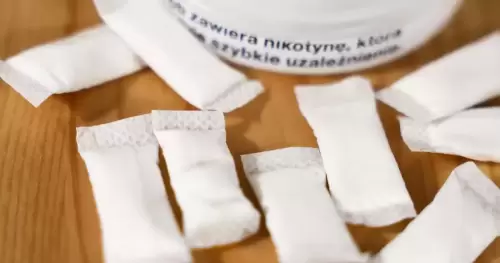

- 尼古丁小袋:對青少年牙齦健康的甜蜜威脅?

- 2025-07-22 21:49:09

- 尼古丁小袋正在越來越受歡迎,尤其是在青少年中。但是,這些甜味的小袋是否會對他們的牙齦健康造成嚴重破壞?讓我們潛入風險。

-

- 與1 XBET得分:足球和大型比賽的指南

- 2025-07-22 21:47:03

- 通過1xbet最大化您的足球投注策略,獲取內部勺子。從2025年婦女歐洲歐元到加密賭注,發現獲勝的趨勢和見解。

-

- XRP,比特幣,ripplecoin:2025年導航加密貨幣景觀

- 2025-07-22 20:07:27

- 深入了解2025年XRP,比特幣和Ripplecoin的發展動態,突出了關鍵趨勢,機構興趣和未來的前景。

-

-

- 茉莉幣價格預測:圖表分析指向潛在的激增

- 2025-07-22 20:00:00

- 深入研究最新的茉莉幣(Jasmy)價格預測和圖表分析,探索潛在的浪潮和關鍵水平。茉莉會突破阻力嗎?

-

- 特朗普,比特幣和替代幣:加密政治戲劇的紐約分鐘

- 2025-07-22 20:00:00

- 特朗普在遊說和經濟激勵措施的驅動下,對加密貨幣的不斷發展的立場正在重塑比特幣和山寨幣的景觀。這是內部勺子。

-

-

-

- 比特幣優勢,Altseason和BTC激增:加密貨幣的下一步是什麼?

- 2025-07-22 19:56:30

- 比特幣的統治結局嗎?深入了解不斷變化的加密景觀,並了解Altseason潛力和BTC的無情激增。