|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025年4月15日,Galaxy Digital在加密貨幣領域的重要名稱,通過存放12,500 ETH採取了重大舉動

Galaxy Digital, a major player in the cryptocurrency space, has deposited 12,500 ETH, valued at approximately $20.36 million, to Binance. This marks the second such deposit from the institutional giant, following a similar transfer of 12,500 ETH on April 12, 2025, which brought the total amount transferred to 25,000 ETH—valued at over $40 million—within just three days.

Galaxy Digital是加密貨幣領域的主要參與者,已存入12,500 ETH,價值約為2036萬美元,以供二錢。這標誌著2025年4月12日的12,500 ETH的類似轉移,這是從機構巨頭那裡獲得的第二個押金,這將總金額轉移至25,000 ETH(以超過4000萬美元的價格),僅在三天之內。

The deposits come as part of Galaxy Digital’s broader strategy to manage liquidity and navigate the volatile crypto market. According to a report by Benzinga, the firm’s actions have had a noticeable impact on ETH’s price and trading activity.

這些存款是Galaxy Digital管理流動性並導航揮發性加密市場的更廣泛戰略的一部分。根據Benzinga的一份報告,該公司的行動對ETH的價格和交易活動產生了明顯影響。

Trading Implications and Price Movements

交易含義和價格變動

The movements of such a substantial amount of ETH to Binance have significant implications for traders and investors. In the wake of the April 12 deposit, ETH price saw a 1.2% increase, moving from $1,628 to $1,648 within 24 hours. However, following the April 15 deposit, ETH witnessed a 0.8% price drop, moving from $1,648 to $1,635 over the span of just five hours.

如此大量的ETH向二手企業的運動對貿易商和投資者產生了重大影響。在4月12日的押金之後,ETH Price上漲了1.2%,在24小時內從1,628美元轉移到1,648美元。但是,在4月15日的押金之後,ETH的價格下跌了0.8%,在短短五個小時內從1,648美元轉移到1,635美元。

These shifts in price are directly linked to the large-scale deposits by Galaxy Digital, highlighting how institutional activity can have an immediate bearing on short-term price fluctuations in the crypto market.

這些價格的轉變直接與Galaxy Digital的大規模存款有關,強調了機構活動如何立即與加密貨幣市場的短期價格波動有關。

Additionally, trading volumes on Binance surged by 15% for the ETH/BTC pair and 10% for the ETH/USDT pair during this period, reflecting increased market activity triggered by these large transactions.

此外,在此期間,ETH/BTC對的交易量飆升了15%,ETH/USDT對的交易量增加了10%,反映了這些大型交易觸發的市場活動的增加。

Technical Indicators and Market Sentiment

技術指標和市場情緒

From a technical analysis standpoint, Ethereum’s Relative Strength Index (RSI) stood at 62 on April 15, 2025, indicating a slightly overbought condition, which often signals potential for a price pullback. The Moving Average Convergence Divergence (MACD) showed a bearish crossover, suggesting that downward momentum could follow in the short term.

從技術分析的角度來看,以太坊的相對強度指數(RSI)在2025年4月15日為62,表明條件略有過多,這通常標誌著價格下降的潛力。移動平均收斂差異(MACD)顯示出看跌的交叉,表明在短期內可以下降動量。

In addition, on-chain metrics revealed a 3% increase in the number of active ETH addresses over the past 24 hours, indicating heightened interest and activity from retail and institutional investors alike. Furthermore, the total value locked (TVL) in Ethereum-based DeFi protocols saw a 2% increase, demonstrating ongoing confidence in the broader Ethereum ecosystem despite short-term volatility.

此外,鍊鍊指標顯示,過去24小時內主動地址的數量增加了3%,這表明零售和機構投資者的興趣和活動增加。此外,基於以太坊的DEFI協議中的總價值鎖定(TVL)增加了2%,儘管短期波動率,但仍表現出對更廣泛的以太坊生態系統的持續信心。

The Impact on AI-Related Tokens

對與AI相關令牌的影響

Interestingly, the ongoing fluctuations in Ethereum’s price and volume are also having ripple effects on the broader AI-crypto market. The rise of AI-driven trading algorithms has been significant, with AI trading volumes showing a 5% increase over the past week, as reported by CryptoQuant. This trend suggests that AI-related tokens like SingularityNET (AGIX) and Fetch.AI (FET) may experience correlated movements with major cryptocurrencies like ETH.

有趣的是,以太坊價格和數量的持續波動也會對更廣泛的AI-Crypto市場產生連鎖反應。正如CryptoQuant報導的那樣,AI驅動的交易算法的興起很大,AI交易量比過去一周增加了5%。這種趨勢表明,諸如SingularityNet(Agix)和Fetch.AI(FET)之類的與AI相關的令牌可能會與ETH這樣的主要加密貨幣經歷相關運動。

Following the deposit of 12,500 ETH on April 15, AGIX saw a 2.5% rise in trading volume, highlighting potential cross-correlation between the movements of major crypto assets and AI-driven tokens.

在4月15日的12,500 ETH押金後,Agix的交易量增長了2.5%,強調了主要的加密資產和AI驅動令牌的運動之間的潛在互相關。

Key Takeaways and Next Steps

關鍵要點和下一步

With Galaxy Digital shifting over $40 million worth of Ethereum, traders and investors are advised to stay alert for potential price volatility and liquidity shifts. Monitoring the Binance order books and observing ETH price movements will be key in understanding the short-term market dynamics.

由於Galaxy數字轉移的價值超過4000萬美元的以太坊,建議商人和投資者對潛在的價格波動和流動性轉移保持警惕。監視義務訂單書籍和觀察ETH價格變動將是理解短期市場動態的關鍵。

Furthermore, the increasing role of AI-driven trading could present new opportunities for investors looking to navigate the evolving crypto landscape. As AI trading volumes continue to rise, tokens like AGIX and FET may experience heightened volatility and present interesting avenues for exploration.

此外,AI驅動交易的越來越多的作用可能會為希望瀏覽不斷發展的加密貨幣景觀的投資者帶來新的機會。隨著AI貿易量的不斷增加,像Agix和FET這樣的代幣可能會經歷增強的波動性,並提出了有趣的探索途徑。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 1層區塊鏈SUI(SUI)有一個突破性的一周,增長了74%

- 2025-04-26 22:25:12

- 第1層區塊鏈SUI($ SUI)已經有一個突破性的一周。

-

-

-

- 黃金,白銀和比特幣是投資者最大的難題

- 2025-04-26 22:15:13

- 這三個資產都有其優勢,缺點和價格軌蹟的份額,因此很難帶來表現最好的人

-

- 賈斯汀·孫(Justin Sun)在特朗普排行榜上奪冠

- 2025-04-26 22:15:13

- 總統模因硬幣項目出版的特朗普排行榜正式實時追踪$特朗普代幣的前20至40名持有人。

-

- FXGUYS(XRP)價格預測:新的加密貨幣預期為50倍回報

- 2025-04-26 22:10:13

- 一些分析師可能指出了可能的波紋(XRP)價格上漲。但是是時候停止盯著那個XRP價格圖表了

-

-

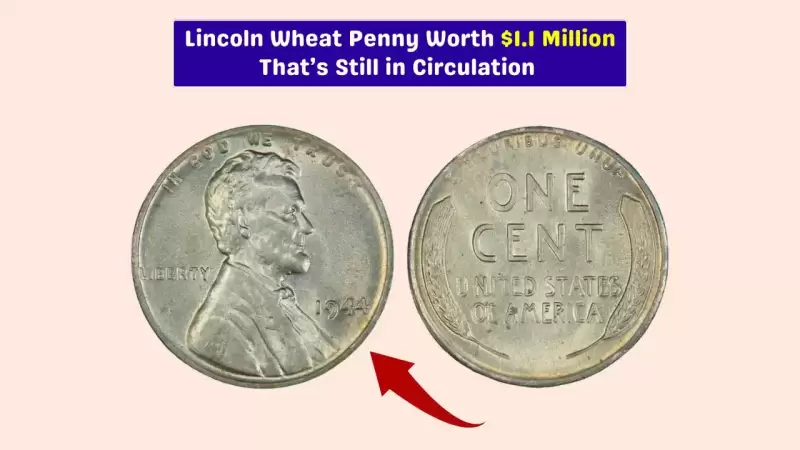

- 1944年鋼鐵一分錢:一個有價值的錯誤

- 2025-04-26 22:05:13

- 這枚硬幣被稱為1944年的鋼鐵,現在被認為是美國歷史上最有價值的硬幣之一。