|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密貨幣新聞文章

Eric Trump Announces World Liberty Financial's USD1 Stablecoin Will Be Used for MGX's $2 Billion Investment in Binance

2025/05/02 01:51

During the Token2049 in Dubai, Eric Trump announced that World Liberty Financial’s dollar-backed stablecoin (USD1) will officially be the official stablecoin used to close MGX’s $2 billion investment in Binance. He also said USD1 will integrate with the Tron network backed by billionaire Justin Sun.

Trump disclosed that Abu Dhabi’s MGX will use the USD1 stablecoin to settle a $2 billion investment into Binance in one of crypto’s largest funding deals, marking the investment firm’s first venture into the crypto space.

The President’s son pointed out that the world was at the dialogue phase of the ‘crypto revolution,’ the people who were going to make it big were those who saw it today, ‘not in five years when half the explosive growth has happened’. He also criticized the inefficiencies and limited operating hours of the traditional financial system, calling it all a joke.

Trump mentioned that sending funds internationally through SWIFT was slow, costly, and complex, emphasizing that crypto [almost] made banks redundant.

An analysis report published by Statrys said the average transaction time on the SWIFT payment network was 20 hours and seven minutes. Additionally, 75% of SWIFT transactions involve one or two intermediary banks, meaning that these average 1 day and 11 hours to settle. However, a USDT or USDC stablecoin transaction on Ethereum settles within two to five minutes.

“USD1 will become one of the most transparent and regulated stablecoins in the world…not only do we want to create a product in our stable point USD, one that can be sent across borders in a very seamless way, but transparency and frankly, consumer safety is paramount…”

-Eric Trump, Son of President Donald Trump

According to Binance, the MGX deal was the first institutional investment in Binance so far, the single largest investment into a crypto company, and the largest investment ever fully paid in crypto.

Binance CEO Richard Teng also said the exchange’s ongoing investments in security and compliance reinforced the company’s mission to support a secure and trusted digital financial ecosystem. He added that the investment by MGX was a notable milestone for the crypto industry and Binance was working with regulators worldwide to establish transparent, responsible, and forward-thinking policies for the crypto industry.

The investment will further solidify Binance’s presence in the Middle East, where it currently has over 1K employees, and strengthen its regulatory compliance and global expansion strategy. Teng said Binance was working with MGX to shape the future of digital finance, and the goal was to build a more inclusive and sustainable ecosystem with a strong focus on compliance, security, and user protection.

Binance also launched ‘fund accounts’ recently, becoming the first crypto exchange to offer this feature. According to the exchange’s team, the initiative aimed to bridge the gap between crypto and traditional finance (TradFi) for institutional users, enhancing the platform’s appeal to professional investors like MGX.

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 金幣,稀有,馬:錢幣綜述

- 2025-06-20 22:45:13

- 從查爾斯二世幾內亞到凱斯花園50ps,發掘了稀有的金幣,以及他們講的有趣的故事。另外,津巴布韋的黃金硬幣計劃停止。

-

-

-

-

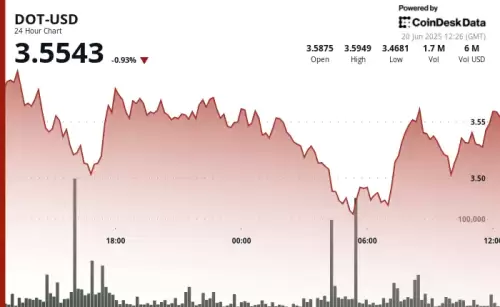

- Polkadot的點:導航三重底部和看漲逆轉

- 2025-06-20 23:25:12

- Polkadot的點顯示了彈性,在擊中潛在的三重底部後形成了看漲的逆轉模式。這是大規模集會的開始嗎?

-

-

-