|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

據彌賽亞分析師迪倫·貝恩(Dylan Bane)稱,他看到美國總統對約100個催化劑的貿易稅,這些國家可能會使加密貨幣遠離僅僅跟隨股市的潮起潮落和流動。

Donald Trump’s tariffs will push Bitcoin closer to achieving the safe haven asset status maxis like Strategy’s Michael Saylor have envisioned for years.

唐納德·特朗普(Donald Trump)的關稅將使比特幣更加接近實現避風港資產地位,就像策略的邁克爾·塞勒(Michael Saylor)所設想的多年一樣。

That’s according to Messari analyst Dylan Bane, who sees the US President’s trade taxes on some 100 countries working as a catalyst that could move the cryptocurrency away from simply following the ebbs and flows of stock markets.

據彌賽亞分析師迪倫·貝恩(Dylan Bane)稱,他看到美國總統對約100個催化劑的貿易稅,這些國家可能會使加密貨幣遠離僅僅跟隨股市的潮起潮落和流動。

“Tariffs represent a retreat from the global economic system that has existed since the end of the Cold War,” Bane said on Wednesday.

貝恩週三說:“關稅是自冷戰結束以來已經存在的全球經濟體系的撤退。”

He said the tariffs could thus trigger “deeper and more lasting shifts in the global economic order” and establish Bitcoin as a form of digital gold to hedge against market turmoil.

他說,關稅可能會引發“全球經濟秩序的更深入,更持久的轉變”,並將比特幣確立為數字黃金的一種形式,以對沖市場動盪。

Trump has upended global financial markets with an aggressive trade tax regime against some of the US’ closest allies.

特朗普以積極的貿易稅制對美國一些最接近的盟友顛覆了全球金融市場。

The dollar is the cornerstone of that economic system, but market watchers say institutions and governments are increasingly losing confidence in the Greenback.

美元是這種經濟體系的基石,但市場觀察家說,機構和政府越來越失去對綠背的信心。

“The trade war is just the latest example of this administration’s contempt for the rest of the world,” said Mark Sobel, US chair of OMFIF, a financial think-tank, and a former senior Treasury official, in an interview with the Financial Times. “Being a trusted partner and ally is a key pillar of the US dollar’s dominance, and has been tossed to the wind.”

“貿易戰只是本屆政府對世界其他地區的蔑視的最新例子,”金融智囊團Omfif的美國主席Mark Sobel在接受《金融時報》採訪時說。 “成為值得信賴的合作夥伴,盟友是美元統治地位的關鍵支柱,並被拋在風中。”

That could be just the opportunity Bitcoin maximalists have been waiting on.

那可能只是比特幣最大化主義者一直在等待的機會。

“Over time, we believe this could lead to Bitcoin decoupling from US equities,” Bane said. “It may increasingly be viewed not as a tech stock proxy or risk-on trade, but as a credible inflation hedge and long-term store of value.”

貝恩說:“隨著時間的流逝,我們認為這可能導致比特幣與美國股票的脫鉤。” “越來越多地將其視為技術股票代理或風險貿易,而是可靠的通貨膨脹對沖和長期價值存儲。”

The DXY Index, which measures the dollar’s strength against other currencies, has steadily declined since a January high of around 110 to a current 99.37.

DXY指數衡量了美元對其他貨幣的實力,自1月份的高點左右110至目前的99.37以來,DXY指數一直在穩步下降。

To be sure, Bitcoin hasn’t achieved safe haven asset status yet. Gold remains king in that regard, and reached an all-time high of $3,375 an ounce this week amid the ongoing trade chaos

可以肯定的是,比特幣尚未達到避風港資產狀態。在這方面,黃金仍然是國王,並且本週在正在進行的貿易混亂中每盎司達到3,375美元

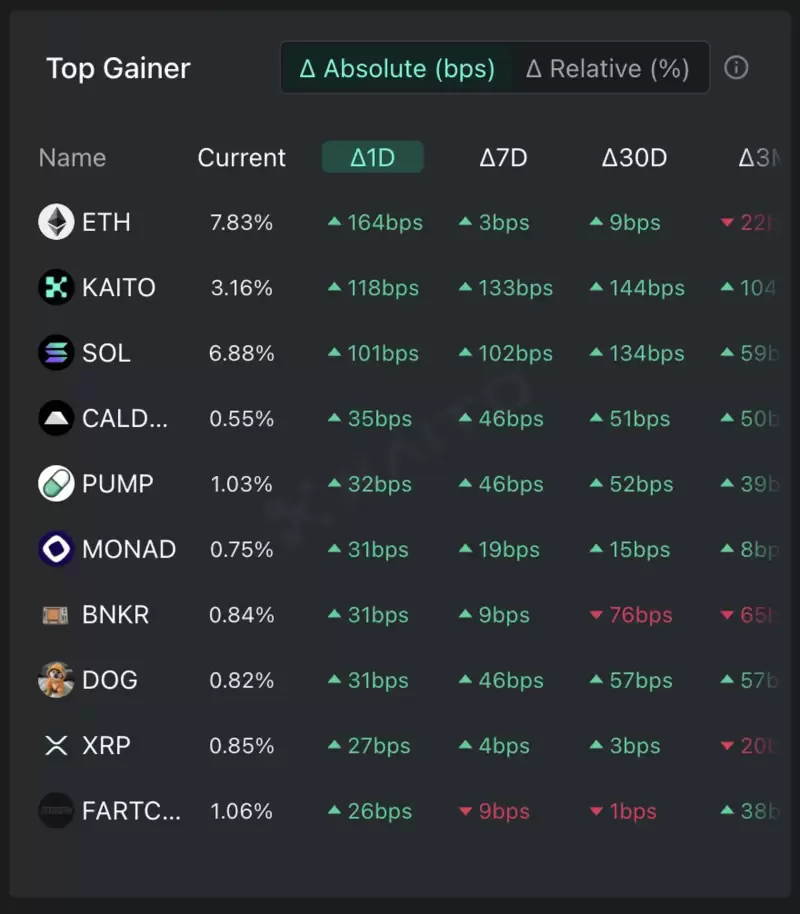

Crypto market movers

加密貨幣市場

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

-

-

- 如果下一個要炸毀的模因硬幣已經在您的雷達上

- 2025-04-27 17:55:13

- 像Bonk和Slerf這樣的模因硬幣一直證明幽默,炒作和時機是實現可觀收益的關鍵要素。

-

- 下週的亮點

- 2025-04-27 17:50:12

- 本文從4月28日至5月4日預覽了業內值得注意的事件,涵蓋了新的比特幣期貨,OKX支付錢包的推出和諸如

-

- 您可能沒有註意到,但是雪崩的C鏈最近再次流行。

- 2025-04-27 17:50:12

- 雖然大多數生態系統的TVL正在緩慢下降,並且市場主題擠滿了AI,Restaking和Meme,但C鏈卻悄悄地反彈了這一趨勢

-

- 穩定幣正在經歷指數級增長,位報告其2024年交易量超過Visa的交易量

- 2025-04-27 17:45:12

- 一些專家斷言,Stablecoins正在經歷指數增長,迅速成為過去二十年中最重要的金融創新之一。