|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

深入研究Circle(CRCL)IPO之後的股票激增,ARK Invest的戰略舉動以及更廣泛的加密投資趨勢。

Cripto, Circle, and Investors: Navigating the Digital Frontier

Cripto,Circle和Investors:導航數字邊界

The world of crypto is always buzzing, and lately, the spotlight's been on Circle (CRCL), the issuer of USDC. With its stock surging after its IPO, and big players like Ark Invest making strategic moves, it's time to break down what's happening and what it means for investors.

加密世界總是在嗡嗡作響,最近,聚光燈已經在USDC的發行人(CRCL)上。隨著其股票飆升,以及像方舟投資這樣的大型參與者的戰略舉動,是時候分解發生的事情以及對投資者的意義了。

Circle's Wild Ride Post-IPO

Circle的野外騎行

Circle (CRCL) hit the New York Stock Exchange (NYSE) on June 5th, and it's been a rollercoaster ever since. Opening at $69, it shot up to $103 before settling at $83 on its first day. But the bullish trend didn't stop there. The stock recently reached an all-time high of $248, showing serious investor enthusiasm.

Circle(CRCL)於6月5日襲擊了紐約證券交易所(NYSE),此後一直是過山車。開盤價為69美元,最高可達103美元,然後在第一天就以83美元的價格定居。但是看漲的趨勢並沒有止步於此。該股票最近達到了248美元的歷史最高點,表現出嚴重的投資者熱情。

Ark Invest's Strategic Sell-Off

方舟投資的戰略拋售

Cathie Wood’s Ark Invest has been trimming its position in Circle, offloading a total of $415,844 shares across three of its ETFs. This comes after previous sales, totaling around $255.9 million worth of CRCL shares sold between June 16th and June 23rd. While the stock was surging, Ark was locking in gains. The largest single-day sale happened on June 20th, with $111.6 million in CRCL stock sold.

Cathie Wood的ARK Invest一直在縮小其在圈子中的地位,在其三個ETF中總計$ 415,844股。這是在先前的銷售之後,總計約2.559億美元的CRCL股票在6月16日至6月23日之間售出。當股票飆升時,方舟正在鎖定收益。最大的單日銷售發生在6月20日,售出了1.116億美元的CRCL股票。

What Does This Mean for Investors?

這對投資者意味著什麼?

Circle's success is fueled by growing regulatory clarity and investor interest in stablecoins. As Circle solidifies its position in the digital finance space, its future growth may attract both institutional and retail interest. Ark Invest's sell-off could be interpreted in various ways, including profit-taking after a successful investment or a strategic shift in portfolio allocation.

越來越多的監管清晰度和投資者對Stablecoins的興趣,Circle的成功助長了。隨著Circle鞏固其在數字融資領域的地位,其未來增長可能會吸引機構和零售利益。 ARK Invest的拋售可以通過各種方式來解釋,包括成功投資後獲利或投資組合分配的戰略轉變。

Broader Crypto Trends: Beyond Circle

更廣泛的加密趨勢:超越圈子

While Circle's stock performance is noteworthy, the crypto landscape is vast. Projects like XYZVerse ($XYZ), which combines sports and crypto, are gaining traction. Hyperliquid is transforming decentralized finance (DeFi) with its Layer 1 blockchain. Ondo Finance bridges traditional finance and blockchain, offering stable, yield-generating assets. Chainlink connects blockchain to real-world data, enhancing smart contract utility. And TRON (TRX) empowers creators in the decentralized internet.

雖然Circle的股票性能值得注意,但加密貨幣景觀卻很廣泛。結合體育和加密貨幣的Xyzverse($ XYZ)等項目正在吸引。超流動性正在轉化其1層區塊鏈的分散融資(DEFI)。 Ondo Finance橋樑傳統金融和區塊鏈,提供穩定的產生產生的資產。 ChainLink將區塊鏈連接到現實世界數據,從而增強智能合約實用程序。 Tron(TRX)在分散的Internet中賦予了創作者。

My Take: The Future is Bright (and Decentralized)

我的看法:未來是光明的(和分散的)

The convergence of traditional finance and blockchain technology is creating exciting opportunities. Stablecoins like USDC play a crucial role in this ecosystem, providing stability in a volatile market. However, innovation extends beyond stablecoins. Projects that empower creators, enhance DeFi, and connect blockchain to the real world are poised for growth. While some, like Ark Invest, may adjust their positions, the overall trend suggests increasing adoption and integration of crypto in various sectors.

傳統金融和區塊鏈技術的融合正在創造令人興奮的機會。像USDC這樣的Stablecoins在該生態系統中起著至關重要的作用,在動蕩的市場中提供了穩定性。但是,創新範圍超出了穩定的。賦予創作者能力,增強Defi並將區塊鏈連接到現實世界的項目已準備好增長。儘管有些人(例如ARK Invest)可能會調整其頭寸,但總體趨勢表明,加密在各個部門的採用和整合。

Wrapping Up

總結

So, what's the takeaway? The world of cripto is dynamic and ever-evolving. Circle's stock surge and Ark Invest's strategic moves are just pieces of a much larger puzzle. Keep an eye on these trends, do your research, and remember, in the world of crypto, anything is possible. Now, go forth and conquer the digital frontier! Cheers!

那麼,收穫是什麼?克利普託的世界充滿活力且不斷發展。 Circle的股票激增和ARK Invest的戰略舉動只是一個更大的難題。請密切關注這些趨勢,進行研究,並記住在加密世界中,一切皆有可能。現在,出去征服數字邊界!乾杯!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- USDC採礦與雲採礦:2025年解鎖每日獎勵

- 2025-07-02 09:15:12

- 探索2025年USDC採礦和雲採礦的興起,重點關注DRML礦工等平台,這些平台可提供每日獎勵和可訪問的加密貨幣收益。

-

- XRP,雲採礦和2025市場:紐約人的拍攝

- 2025-07-02 08:30:12

- 探索XRP在雲採礦和2025市場中的作用。查找Hashj和DRML礦工等平台如何改變遊戲,從而提供穩定性和輕鬆。

-

-

-

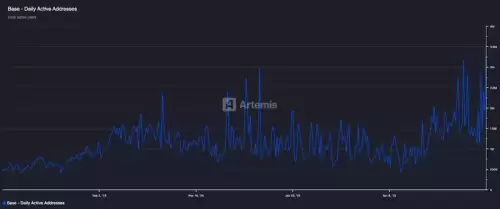

- 基地的鏈敘事:Bitmart研究深度潛水

- 2025-07-02 08:50:12

- BITMART研究分析了Base的爆炸性增長,不斷發展的敘述以及機構一致性,突顯了其在彌合傳統金融和Web3中的作用。

-

- AI遊戲令牌:價格預測和收益的未來

- 2025-07-02 09:20:12

- 探索AI遊戲,價格預測和潛在代幣收益的收斂性。從Block3的AI驅動引擎到Ruvi AI的公用事業驅動的方法,現在是未來的。

-

- 加密貨幣方案,網絡欺詐和BDC連接:深度潛水

- 2025-07-02 09:35:13

- 探索加密貨幣轉換,網絡欺詐以及BDC運營商在促進非法財務活動中的作用的聯繫。揭示最新趨勢和見解。