|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chainlink面臨看跌壓力,測試關鍵的$ 12.50支持。它會反彈還是屈服於熊?導航波濤洶湧的水。

Chainlink (LINK) is caught in a tug-of-war between bulls and bears, with the $12.50 mark proving to be a crucial battleground. After a rocky ride, is LINK poised for a rebound, or will the bears drag it down further?

Chainlink(Link)被公牛和熊之間的拔河比賽捕獲,事實證明,$ 12.50的大關被證明是一個至關重要的戰場。經過艱難的騎行後,Link是否準備好籃板,還是熊會進一步將其拖下來?

Bears Test Chainlink's Resolve

熊測試連鎖鏈接的決心

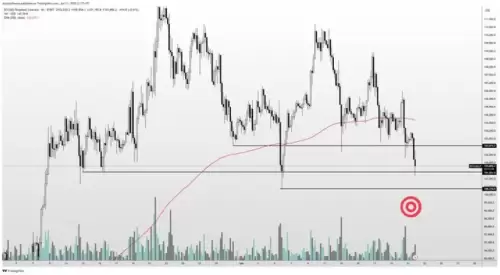

Recent analysis indicates that Chainlink closed a session with a bearish sentiment, now testing the key $12.50 support level. With weekend liquidity expected to dip, brace yourself for choppy price action. A decisive move from this zone could hint at LINK's next direction.

最近的分析表明,ChainLink以看跌的情緒結束了會議,現在測試了關鍵的$ 12.50支持水平。週末流動性預計會下降,請自己為波動的價格動作做好準備。從該區域的決定性舉動可以暗示Link的下一個方向。

CRYPTOWZRD pointed out that both LINK/USDT and LINK/BTC daily candles closed bearish, mirroring Bitcoin's pullback. This shows that LINK is still sensitive to what Bitcoin does. We need to see some strong bullish candles before we can talk about a real recovery.

Cryptowzrd指出,Link/USDT和Link/BTC Daily Candles都關閉看跌,這反映了比特幣的回調。這表明鏈接仍然對比特幣的工作敏感。在談論真正的康復之前,我們需要看到一些強大的看漲蠟燭。

Oversold Territory: A Potential Springboard?

超賣區域:潛在的跳板?

Here's the good news: LINK/BTC is sitting in extremely oversold territory. This suggests a positive reversal is statistically likely. If LINK bounces, expect a sharp upside spike, potentially flipping sentiment from bearish to bullish quickly.

這是個好消息:Link/BTC坐在極其售的領土上。這表明積極的逆轉在統計上可能是可能的。如果鏈接彈跳,預計會有急劇的上升尖峰,可能會從看跌到迅速看漲的情緒。

A bullish reversal from the $12.50 support is crucial. If buyers regain control, the next targets are $16 and then $19.50. Clearing these levels would signal a true shift in momentum.

從$ 12.50的支持中看漲的逆轉至關重要。如果買家重新獲得控制權,那麼下一個目標是16美元,然後是19.50美元。清除這些水平將表明動量的真正轉變。

Keep a close eye on Bitcoin's weekend performance, as it will heavily influence Chainlink. With lower liquidity expected, focus on shorter timeframes for quick scalp opportunities.

密切關注比特幣的周末表現,因為它將嚴重影響鏈條。預計流動性較低,專注於較短的時間範圍,以獲取快速頭皮機會。

Intraday Volatility and Key Levels

盤中波動和關鍵水平

The intraday chart remains bearish and volatile, reflecting market uncertainty. Watch for a decisive breakout and sustained hold above the $12.85 intraday resistance. This could flip sentiment and offer a long opportunity, with an initial target near $14.40.

盤中圖仍然是看跌和波動的,反映了市場的不確定性。觀察果斷的突破,並持續持續超過$ 12.85的盤中阻力。這可能會翻轉情緒並提供漫長的機會,最初的目標接近$ 14.40。

However, a failed attempt to hold $12.85 would favor the bears, potentially leading to short setups. Renewed selling pressure could drag the price lower.

但是,持有$ 12.85的嘗試失敗將有利於熊隊,這可能會導致短暫的設置。更新的銷售壓力可能會使價格降低。

Whale Activity and Market Dips

鯨魚活動和市場下降

On-chain data reveals a massive 3,373% surge in Chainlink whale moves. This coincides with a broader crypto market sell-off, with $458 million in liquidations. Large transaction volume spiked to $762.7 million, or 59.63 million LINK, the highest in nearly three months.

鏈上的數據顯示,鏈條鯨的移動率巨大3,373%。這與更廣泛的加密貨幣市場拋售相吻合,清算票價為4.58億美元。大型交易量飆升至7.627億美元,即5963萬個鏈接,是將近三個月內最高的。

This surge followed Chainlink's token unlock, with 17.875 million LINK (valued at $149 million) deposited into Binance. Despite this, LINK was down 3.13% to $12.66, mirroring the overall market downturn.

這次激增是在Chainlink的代幣解鎖之後的,其中178.75億個鏈接(價值1.49億美元)存放在binance中。儘管如此,Link下跌了3.13%,至12.66美元,反映了整體市場的低迷。

The Bottom Line

底線

Chainlink is at a critical juncture. The $12.50 support is being tested, and the coming days will determine whether it holds or breaks. Keep an eye on Bitcoin's movements, whale activity, and key intraday levels. Whether you're a bull or a bear, buckle up—it's going to be a bumpy ride!

連鎖店處於關鍵時刻。 $ 12.50的支持正在測試,未來幾天將決定它是持有還是斷裂。密切關注比特幣的運動,鯨魚活動和關鍵的盤中水平。無論您是公牛還是熊,都可以搭扣 - 這將是一個顛簸的旅程!

So, will Chainlink defy the bears and bounce back stronger than ever? Or will it succumb to the pressure and sink lower? Only time will tell. But one thing's for sure: the crypto world never has a dull moment!

那麼,Chainlink會反抗熊並反彈比以往任何時候都更強大嗎?還是會屈服於壓力並下沉?只有時間會證明。但是可以肯定的是:加密世界從來沒有一個沉悶的時刻!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- CoinMarketCap安全漏洞:喚醒加密錢包安全的呼籲

- 2025-06-22 14:25:13

- CoinMarketCap面臨最近的安全漏洞,涉及惡意錢包彈出窗口,突出了加密貨幣空間中不斷存在的危險。

-

- 加密貨幣市場跌落:比特幣傾角和清算戰爭

- 2025-06-22 14:25:13

- 地緣政治緊張局勢和大規模清算引發了加密貨幣市場的低迷。這是暫時的傾角還是更大的東西的開始?

-

- 比特幣在印度的經濟戰略中的潛在作用:一個新時代?

- 2025-06-22 14:45:12

- 探索印度比特幣和加密ETF的潛力,與韓國對數字資產和穩定的創新方法相似。

-

- Dogecoin,Meerkat和Telegram:新的模因硬幣生態系統?

- 2025-06-22 14:45:12

- 當Meerkat在電報中創新時,Dogecoin面臨挑戰。這是模因硬幣的未來嗎?

-

- 比特幣價格火箭:新的歷史高昂和預測330,000美元的市場激增

- 2025-06-22 14:50:12

- 比特幣襲擊了機構利益的新高。分析師預測,在這個動蕩的市場中,建議謹慎行事,但謹慎行事。

-

-

-

-