|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cathie Wood, CEO of ARK Invest, has updated her Bitcoin price forecast for 2030 and remains bullish on the industry’s leading cryptocurrency.

In an interview with CNBC, she stated that BTC still has significant upside potential, driven by an increasingly limited supply and institutional interest that’s just beginning to take shape.

According to Wood, her base-case scenario places Bitcoin between $700,000 and $750,000 by the end of the decade, while her most optimistic scenario sees it approaching $1.5 million. This forecast relies on several factors, including the growing adoption of BTC as a store of value alternative to gold and its expanding use in countries with unstable financial systems.

One of ARK Invest’s key arguments centers around supply dynamics. Fewer than one million BTC remain to be mined, a factor that will reduce future availability and reinforce its position as a scarce asset. At the same time, Wood pointed out that institutional investors remain cautious but have already started adding BTC to their portfolios.

Bitcoin: A Safe Haven for Emerging Markets

Beyond market conditions, Wood discussed the opportunities Bitcoin offers in emerging markets, where currency restrictions and monetary instability are fueling demand for decentralized assets. This factor, combined with growing corporate interest and limited supply, shapes the scenario ARK considers favorable for BTC’s sustained growth.

Since January 2025, ARK Invest has operated its own BTC-based exchange-traded fund, the ARK 21Shares Bitcoin ETF (ARKB), holding 48,363 BTC valued at roughly $5 billion. At the time of writing, Bitcoin is trading around $104,300 after a 10.6% gain over the past week, with little change in the last 24 hours. While Wood believes this price reflects a positive trend, it’s still far from the levels her team expects by the end of the decade.TL;DR: Cathie Wood, CEO of ARK Invest, remains bullish on Bitcoin and sees significant upside potential in the cryptocurrency, driven by limited supply and rising institutional interest.

According to her, her firm's base-case scenario estimates Bitcoin to reach $700,000-$750,000 by 2030, with her most optimistic scenario placing it closer to $1.5 million. This forecast relies on factors such as BTC's adoption as a store of value and its use in countries with unstable financial systems.

One factor highlighting Bitcoin's scarcity is that less than one million BTC remain to be mined.

According to Wood, institutional investors are also beginning to add Bitcoin to their portfolios, albeit cautiously, as they seek assets that offer some 'downside protection.'

According to her, emerging markets are driving demand for Bitcoin due to currency restrictions and monetary instability, shaping the scenario ARK considers favorable for BTC's sustained growth.

ARK Invest operates its own BTC ETF, the ARK 21Shares Bitcoin ETF (ARKB), holding 48,363 Bitcoin valued at roughly $5 billion.

Bitcoin is currently trading at around $104,300 after a 10.6% gain over the past week, showing little change in the last 24 hours. While Wood believes this price reflects a positive trend, it’s still far from the levels her team expects by the end of the decade.

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

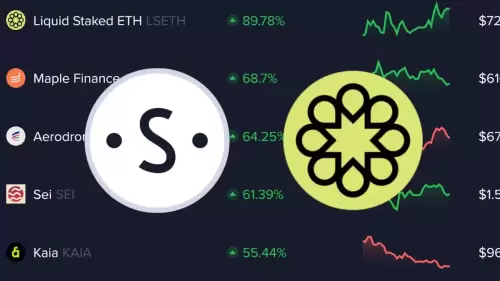

- 情感數據的隱藏寶石:您缺少的最佳性能加密

- 2025-07-01 23:10:15

- 揭開了由情感數據加油的最高表現的加密貨幣,包括隱藏的寶石和市場上意外的潮流。

-

-

- 雪崩,合作夥伴和比特幣:加密貨幣的紐約分鐘

- 2025-07-01 23:10:15

- 探索雪崩,夥伴關係和比特幣的交集,突出了加密貨幣領域的最新發展和未來趨勢。

-

-

- Zachxbt,Ripple和RLUSD採用:深度潛水

- 2025-07-01 22:30:12

- 分析Zachxbt的批評,Ripple的RLUSD採用策略以及對加密生態系統的更廣泛影響。

-

- Jasmycoin(Jasmy):看漲前景和價格預測

- 2025-07-01 23:15:11

- 根據最近的市場趨勢,分析師預測和關鍵支持水平,探索茉莉素幣的潛在看漲激增。日本的比特幣準備好突破了嗎?

-

- Open XP贖回樂觀:7月15日為OP代幣做好準備!

- 2025-07-01 22:35:12

- Superstacks於6月30日結束!從7月15日開始,通過官方應用程序兌換XP。

-

- 斧頭積分和排放減少:Axie Infinity中發生了什麼?

- 2025-07-01 22:55:12

- Axie Infinity一半軸軸承排放,影響通貨膨脹和APY。另外,新的基於收藏品還可以提高市場效率。