|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣迅速達到了新的歷史最高點,激起了市場興奮。會繼續攀登嗎?本文分析了推動比特幣激增和未來預測的因素。

Bitcoin's Wild Ride: New All-Time Highs and Future Forecasts

比特幣的野外騎行:新的歷史最高點和未來的預測

Bitcoin's been making headlines, hitting new all-time highs. Spot Bitcoin ETFs now boast nearly $150 billion in assets under management, while companies like Strategy, Metaplanet, and GameStop are loading up on BTC. But is this just a fleeting moment, or are we looking at a sustained climb? Let's dive into what's driving this surge and what the future might hold.

比特幣一直在成為頭條新聞,達到了新的歷史最高點。現貨比特幣ETF現在擁有近1500億美元的管理資產,而戰略,Metaplanet和GameStop等公司正在加載BTC。但是,這只是一個短暫的時刻,還是我們正在尋找持續的攀登?讓我們深入了解驅動這一激增的原因以及未來可能會有什麼。

Bitcoin Breaks Records (On Some Exchanges!)

比特幣中斷記錄(在某些交流!)

So, Bitcoin hit a new all-time high, right? Well, kinda. It depends on where you're looking. On Binance, for example, BTC in Tether dollars (USDT) reached a high of 112,030 USDT. Coinbase also saw peaks above $112,150 in real American dollars. However, aggregators like CoinMarketCap, which average data across multiple exchanges, haven't officially declared a new all-time high, sticking with the May 22nd record just below $112,000.

因此,比特幣達到了新的歷史最高水平,對嗎?好吧,有點。這取決於您在哪裡尋找的地方。例如,BTC以紐帶(USDT)達到112,030 USDT。 Coinbase還看到了高於$ 112,150的真正美元的高峰。但是,像CoinMarketCap這樣的聚合器(在多個交易所之間的平均數據)尚未正式宣布新的歷史最高水平,並堅持5月22日的記錄低於112,000美元。

Institutional Demand: The Real Game Changer

機構需求:真正的遊戲改變者

The real story here is the growing institutional demand. BlackRock's iShares Bitcoin Trust (IBIT) now holds a staggering 700,000 Bitcoin, surpassing even the iShares Core S&P 500 ETF (IVV) in assets under management. KULR Technology Group, Inc. has even secured a $20 million credit facility with Coinbase Credit, Inc. to further its Bitcoin accumulation goals. Corporate treasuries are surpassing ETFs in Bitcoin buying, signaling a serious shift in how companies view crypto.

這裡的真實故事是製度需求不斷增長。貝萊德(Blackrock)的iShares比特幣信託(IBIT)現在擁有驚人的700,000個比特幣,甚至超過了管理資產中的iShares Core S&P 500 ETF(IVV)。 Kulr Technology Group,Inc。甚至與Coinbase Credit,Inc。獲得了2000萬美元的信用額度,以實現其比特幣積累目標。公司國庫在比特幣購買方面超越了ETF,這表明公司如何看待加密貨幣。

Forecast: $115k - $120k?

預測:$ 115K- $ 120K?

Analysts are buzzing with predictions. Some forecast Bitcoin to hit between $115k and $120k in the coming weeks or months. A clean break of the all-time high, continued institutional accumulation, and a lack of major resistance until the $115k psychological level are all supporting factors. However, a failed breakout could lead to a correction, potentially dropping BTC to the $108k level.

分析師對預測有所嗡嗡作響。一些預測比特幣將在未來幾週或幾個月內達到115,000美元至12萬美元之間。始終高級,持續的機構積累以及缺乏重大抵抗力直到115,000美元的心理水平都是輔助因素,這是一個乾淨的突破。但是,失敗的突破可能會導致更正,可能會將BTC降至108K $。

What About Other Cryptos?

那其他加密貨幣呢?

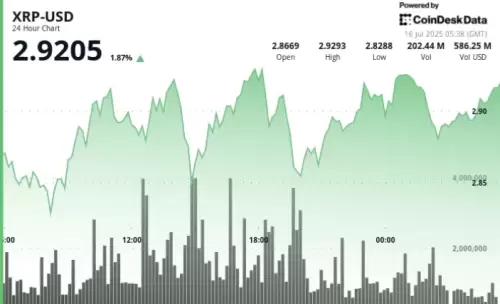

While Bitcoin grabs the spotlight, other cryptos are also showing promise. XRP is forecasted to potentially climb to $3.50 soon, fueled by Ripple's push into traditional finance. Hyperliquid (HYPE) is also looking promising, with activity near $40 hinting at a possible breakout. BlockDAG (BDAG) is worth a look too. Its presale has pulled in a whopping $333.5 million in its presale, with some analysts predicting the coin could reach $1 post-listing and $20 in the long run.

當比特幣引起人們的關注時,其他加密貨幣也表現出希望。預計XRP將很快攀升至3.50美元,這是由於Ripple推向傳統金融而推動的。超流動性(HYPE)也看起來很有希望,活動接近40美元,可能突破了。 BlockDag(BDAG)也值得一看。它的預售已經獲得了高達3.335億美元的預售,一些分析師預測,從長遠來看,硬幣可以達到1美元的上市後售價為1美元。

The Bottom Line

底線

Bitcoin's recent surge is driven by institutional demand, corporate adoption, and overall market enthusiasm. While the all-time high debate rages on, the underlying trend suggests a positive outlook. Of course, crypto is always full of surprises, so buckle up and enjoy the ride! Who knows, maybe we'll all be paying for our lattes with Bitcoin soon. Just kidding... mostly.

比特幣最近的激增是由機構需求,公司採用和整體市場熱情驅動的。儘管有史以來較高的辯論爆發,但潛在的趨勢表明了積極的前景。當然,加密貨幣總是充滿驚喜,所以搭扣並享受旅程!誰知道,也許我們所有人都很快就會用比特幣付款。只是在開玩笑...主要是。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 比特幣,加密貨幣和數字資產:華爾街狂野!

- 2025-07-16 16:30:12

- 從特朗普的“加密週”到花旗集團的Stablecoin,數字資產革命正在咆哮。 Buttercup扣緊,因為這次旅程才剛剛開始!

-

-

- XRP價格:較高的低點暗示了潛在的趨勢變化?

- 2025-07-16 15:10:12

- XRP價格分析顯示合併,潛在的突破和雄心勃勃的價格目標。較高的低點會導致趨勢重大變化嗎?

-

- 比特幣,加密賭場和獎金:紐約人的大獎指南

- 2025-07-16 15:15:12

- 這份綜合指南深入研究比特幣賭場的世界。了解最好的加密賭場,多汁的獎金以及2025年的最新趨勢。

-

- 比特幣,加密貨幣和投資:導航2025年景觀

- 2025-07-16 15:30:12

- 探索比特幣,加密貨幣和投資的最新趨勢。從Altcoin突破到機構採用,請發現2025年的關鍵見解。

-

- 比特幣,德意志銀行和主流採用:新時代?

- 2025-07-16 14:30:13

- 德意志銀行的分析表明,由機構採用,法規清晰度和技術進步驅動,比特幣正在成熟,這表明潛在轉移到主流。

-

- 比特幣的ETF需求和機構動力:紐約市的觀點

- 2025-07-16 14:50:12

- ETF需求和機構勢頭助長了比特幣的激增。了解有關市場趨勢,潛在風險以及BTC下一步的見解。

-

- 比特幣的看漲奔跑:需求激增,更正不太可能嗎?

- 2025-07-16 12:30:12

- 比特幣要進行更正嗎?專家們衡量需求的飆升,消失的供應以及持續上升勢頭的潛力。

-

- 摩根大通,區塊鍊和Stablecoins:華爾街革命?

- 2025-07-16 14:50:12

- 摩根大通(JPMorgan)涉足穩定幣,這表明傳統財務發生了重大轉變。這是金錢的未來還是短暫的實驗?