|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

特朗普媒體深入研究比特幣,以2B美元的價格收購。大膽的舉動引發了財務和政治嗡嗡聲,重塑了數字自主權和金融科技期貨。

Bitcoin, Trump Media, and Acquisition: A New York Perspective

比特幣,特朗普媒體和收購:紐約的觀點

Trump Media's recent $2 billion Bitcoin acquisition is turning heads. This move signals a bold step towards digital autonomy, fintech integration, and a potential reshaping of the financial landscape. Let’s break down what this means from a New York state of mind.

特朗普媒體最近獲得20億美元的比特幣收購正在轉頭。此舉標誌著朝著數字自主權,金融科技集成以及金融景觀重塑的大膽一步。讓我們從紐約的心態中分解這意味著什麼。

Trump Media Goes Big on Bitcoin

特朗普媒體在比特幣上很大

Trump Media & Technology Group (TMTG), the force behind Truth Social, isn't just tweeting about crypto; they're diving headfirst into the Bitcoin pool. CEO Devin Nunes is betting big, allocating a whopping $2 billion to Bitcoin. This isn't just pocket change; it's a major move that positions TMTG as one of the largest corporate Bitcoin holders in the U.S.

Trump Media&Technology Group(TMTG)是真相社會背後的力量,不僅在推特上發布有關加密貨幣的推文;他們首先跳入比特幣池。首席執行官德文·納尼斯(Devin Nunes)押注大型,向比特幣分配了高達20億美元的資金。這不僅僅是零錢;這是將TMTG定位為美國最大的公司比特幣持有人之一的重大舉措

Why Bitcoin? Financial Freedom, Baby!

為什麼要比特幣?財務自由,寶貝!

Nunes isn't shy about the reasoning: financial freedom. He aims to shield the company from potential discrimination by financial institutions and align with future technologies. Think utility tokens within the Truth Social ecosystem. This move echoes MicroStrategy's playbook, potentially setting a precedent for other corporations to hoard crypto. With two-thirds of its liquid assets now in Bitcoin, DJT is all in.

Nunes對推理並不害羞:財務自由。他的目標是保護公司免受金融機構的潛在歧視,並與未來的技術保持一致。在社會生態系統中考慮實用令牌。此舉呼應了Microstrategy的劇本,有可能為其他公司的ho積加密樹立先例。 DJT現在在比特幣中擁有三分之二的流動資產。

The Bigger Picture: Fintech and Beyond

大局:金融科技及以後

This acquisition isn't just about holding Bitcoin; it's about building a fintech empire. TMTG is exploring crypto-based retail products, ETFs, and strategic acquisitions. They're even cooking up a utility token for the Truth Social platform. The aim? To integrate blockchain into their core operations, powering payments, content monetization, and financial services.

這次收購不僅僅是持有比特幣;這是關於建立金融科技帝國。 TMTG正在探索基於加密貨幣的零售產品,ETF和戰略收購。他們甚至為真相社交平台做一個公用事業令牌。目的?將區塊鏈集成到其核心運營中,付款,內容貨幣化和金融服務。

Political Intrigue and Regulatory Scrutiny

政治陰謀和監管審查

Of course, no discussion about Trump and finance is complete without a dash of political spice. Senator Elizabeth Warren is already calling for clearer regulations around crypto activities involving Trump-affiliated companies. This scrutiny extends beyond market dynamics, raising questions about motivations and potential impacts. It’s a political tightrope walk, folks.

當然,沒有一段政治香料,就沒有關於特朗普和財務的討論是完整的。伊麗莎白·沃倫(Elizabeth Warren)參議員已經呼籲圍繞涉及特朗普附屬公司的加密活動制定更明確的法規。這種審查超出了市場動態,引發了有關動機和潛在影響的問題。伙計們,這是一條政治繩索步行。

From Skeptic to Believer: The Trump Crypto Evolution

從懷疑論到信徒:特朗普加密進化

Let's not forget Donald Trump's earlier skepticism toward crypto. Fast forward, and now his company is knee-deep in Bitcoin. This shift underscores the evolving landscape of cryptocurrency acceptance and its integration into mainstream financial strategies. Even the most hardened skeptics are starting to see the light—or at least the potential for profit.

我們不要忘記唐納德·特朗普對加密貨幣的早期懷疑。快進了,現在他的公司在比特幣中屈膝。這一轉變強調了加密貨幣接受的不斷發展的景觀及其融入主流財務戰略。即使是最堅強的懷疑論者也開始看到光線,或者至少有利潤的潛力。

A Strategic Play or a Risky Gamble?

戰略性遊戲還是冒險的賭博?

TMTG sees Bitcoin as a strategic engine for growth, not just a reserve asset. They’ve even allocated $300 million toward Bitcoin-related options, aiming to convert these positions into spot Bitcoin when the market's ripe. This layered approach aims to maximize exposure without compromising liquidity.

TMTG認為比特幣是增長的戰略引擎,而不僅僅是儲備資產。他們甚至將3億美元分配給了與比特幣相關的選擇,旨在在市場成熟時將這些頭寸轉換為現貨比特幣。這種分層方法旨在最大程度地提高暴露量,而不會損害流動性。

What's Next? Buckle Up!

接下來是什麼?扣!

Industry watchers are keenly observing the potential effects of TMTG's move on Bitcoin markets and beyond. Will this trigger a wave of corporate crypto adoption? Will regulators crack down? Only time will tell.

行業觀察者敏銳地觀察了TMTG搬遷對比特幣市場及其他地區的潛在影響。這會引發一波公司加密貨幣嗎?監管機構會破壞嗎?只有時間會證明。

So, there you have it. Trump Media's Bitcoin bet is more than just a financial maneuver; it's a statement. Whether it's a stroke of genius or a wild gamble, one thing's for sure: it's keeping things interesting in the Big Apple and beyond. Stay tuned, because this crypto rollercoaster is just getting started!

所以,你有。特朗普媒體的比特幣押注不僅僅是金融動作。這是一個陳述。無論是天才還是狂野的賭博,都可以肯定的是:它使大蘋果及其他地區的事情變得有趣。請繼續關注,因為這種加密過山車才剛剛開始!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 模因硬幣躁狂症:狗狗,佩佩和加密貨幣預售熱潮

- 2025-07-22 21:59:55

- 探索模因硬幣景觀:Dogecoin,Pepe和Crypto Presals的興起。發現為什麼投資者轉向具有實際實用性的項目。

-

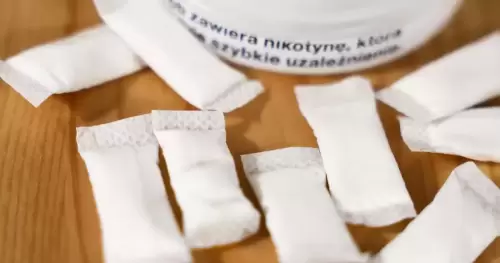

- 尼古丁小袋:對青少年牙齦健康的甜蜜威脅?

- 2025-07-22 21:49:09

- 尼古丁小袋正在越來越受歡迎,尤其是在青少年中。但是,這些甜味的小袋是否會對他們的牙齦健康造成嚴重破壞?讓我們潛入風險。

-

- 與1 XBET得分:足球和大型比賽的指南

- 2025-07-22 21:47:03

- 通過1xbet最大化您的足球投注策略,獲取內部勺子。從2025年婦女歐洲歐元到加密賭注,發現獲勝的趨勢和見解。

-

-

-

- 比特幣的市場份額:空中的另類季節?

- 2025-07-22 21:27:35

- 儘管比特幣的價格飛漲,但隨著山寨幣的增長勢頭,其市場份額仍在下滑。 alt季節終於來了嗎?

-

- 比特幣ETF看到流出,但是投資格局仍然很強

- 2025-07-22 21:06:37

- 比特幣ETF經歷了1313.5萬美元流出的逆轉,而以太坊ETF飆升。戰略利潤和多元化標誌著不斷發展的加密投資格局。

-

- XRP,比特幣,ripplecoin:2025年導航加密貨幣景觀

- 2025-07-22 20:07:27

- 深入了解2025年XRP,比特幣和Ripplecoin的發展動態,突出了關鍵趨勢,機構興趣和未來的前景。

-