|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣交換餘額達到了6年的低點,助長了供應衝擊的預期。交易所儲備和機構利益的下降會觸發下一個價格集會嗎?

Bitcoin's Supply Shock: Exchange Balances Plunge Amidst Bullish Expectations

比特幣的供應衝擊:在看漲期望的情況下,交換餘額暴跌

Bitcoin is flashing some serious bullish signals. Exchange balances have plummeted to levels not seen in six years, igniting speculation about a potential supply shock. Is this the calm before the crypto storm?

比特幣正在閃爍一些嚴重的看漲信號。交換餘額局限於六年來未見的水平,這引發了人們對潛在供應衝擊的猜測。這是加密風暴之前的平靜嗎?

The Great Bitcoin Exodus: Where Did All the Coins Go?

偉大的比特幣出埃及記:所有硬幣都在哪裡?

According to on-chain data, Bitcoin exchange balances have dipped below 2.9 million BTC, marking a significant shift. This exodus from exchanges suggests that investors are stashing their coins away in cold wallets, signaling strong conviction in Bitcoin's long-term prospects.

根據鏈上數據,比特幣交換餘額降至290萬BTC以下,這是一個重大轉變。交流中的這種出埃及記表明,投資者將硬幣藏在冷錢包中,這表明比特幣的長期前景中有著強烈的信念。

Think of it this way: fewer coins available on exchanges mean buyers have to compete harder to get their hands on some BTC. This increased competition can trigger a supply shock, potentially driving prices sky-high.

這樣想:交易所上可用的硬幣更少,這意味著買家必須更加努力地競爭以獲取一些BTC。這種增加的競爭會引發供應衝擊,潛在地推動價格高。

Institutional Appetite and ETF Mania

機構食慾和ETF躁狂症

What's fueling this dramatic decline in exchange balances? Two words: institutions and ETFs. Treasury companies have been on a Bitcoin buying spree, snatching up coins and moving them into long-term custody. Last week alone, they acquired 5,898 BTC.

在交換餘額中,這種急劇下降的幅度是什麼?兩個詞:機構和ETF。財政公司一直在比特幣購買狂歡,搶購硬幣並將其搬進長期監護權。僅上週,他們就獲得了5,898 BTC。

Bitcoin ETFs are also playing a major role. These investment vehicles now hold over 800,000 BTC, further reducing the available supply on exchanges. S&P Global reports an "overwhelming response" to Bitcoin ETFs, indicating strong demand from both retail and institutional investors.

比特幣ETF也發揮了重要作用。這些投資工具現在持有超過80萬BTC,進一步減少了交易所的可用供應。標普全球報告對比特幣ETF的“壓倒性反應”,表明零售和機構投資者的需求強勁。

Altcoin Season on the Horizon?

Altcoin季節即將到來?

While Bitcoin is grabbing all the headlines, keep an eye on altcoins. Ethereum and Solana are showing patterns that suggest a potential altcoin season is brewing. Declining exchange reserves for these tokens have historically preceded significant price rallies.

當比特幣抓住所有頭條新聞時,請密切關注Altcoins。以太坊和索拉納(Ethereum)和索拉納(Solana)正在顯示出潛在的Altcoin季節的模式。這些代幣的交換儲量下降歷史上已經進行了大量的價格集會。

Of course, Bitcoin dominance remains a force to be reckoned with. As of late June 2025, Bitcoin dominance is hovering around 65.80%, which may delay, but not prevent, Altcoin Season.

當然,比特幣優勢仍然是不可忽視的力量。截至2025年6月下旬,比特幣優勢徘徊在65.80%左右,這可能會延遲但不會預防替代幣季節。

The Trump Card: Bitcoin and the Dollar

王牌:比特幣和美元

Even the White House is taking notice of Bitcoin's growing influence. Donald Trump has expressed favorable views on Bitcoin potentially becoming an international reserve currency, easing pressure on the dollar. Advisor Bo Hines even hinted at building a strategic Bitcoin reserve for the United States.

甚至白宮也注意到比特幣的影響力日益增長。唐納德·特朗普(Donald Trump)對比特幣有可能成為國際儲備貨幣表達了有利的看法,減輕了美元的壓力。顧問Bo Hines甚至暗示為美國建立戰略性比特幣保護區。

Conviction vs. Exhaustion: The Million-Dollar Question

定罪與精疲力盡:百萬美元的問題

Bitcoin's market is currently caught between strong accumulation by long-term holders and waning interest from the broader crowd. This divergence raises concerns about the sustainability of the current market structure. Will institutional confidence be enough to fuel the next big rally, or will market fatigue set in?

目前,比特幣的市場在長期持有人的強勁積累與更廣泛的人群的興趣減弱之間。這種差異引起了人們對當前市場結構的可持續性的擔憂。機構的信心足以助長下一個大集會,還是市場疲勞會引發?

Final Thoughts: Buckle Up, Buttercup!

最終想法:扣緊,毛cup!

Bitcoin's supply dynamics are shifting, and the implications could be huge. Whether you're a seasoned crypto veteran or a curious newcomer, now's the time to pay attention. With exchange balances dwindling, institutional interest soaring, and even whispers of government adoption, the stage is set for an interesting ride. So, HODL on tight, folks, because the future of Bitcoin is looking brighter than ever!

比特幣的供應動態正在轉移,含義可能很大。無論您是經驗豐富的加密貨幣退伍軍人還是好奇的新人,現在是時候關注了。隨著交流餘額的減少,機構興趣飆升,甚至是政府採用的耳語,舞台將成為一個有趣的旅程。因此,霍德(Hodl)緊緊抓住,因為比特幣的未來看起來比以往任何時候都更加光明!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- BNB,Maxwell Fork和BSC Mainnet:導航速度,穩定性和地緣政治潮汐

- 2025-06-30 06:50:12

- 在市場波動中探索麥克斯韋硬叉對BNB智能連鎖店的影響,使技術升級與經濟現實平衡。

-

- 比特幣價格,年輕一代和人工智能工作流離失所:一場完美的風暴?

- 2025-06-30 07:30:12

- 探索年輕一代對AI驅動的工作流離失所和傳統金融體系的擔憂如何推動比特幣採用和價格。

-

- 韓國和山寨幣:交易量加熱!

- 2025-06-30 07:30:12

- 韓國加密用戶正在多元化山頂!發現對韓國不斷發展的山寨幣交易量的趨勢和見解。

-

-

-

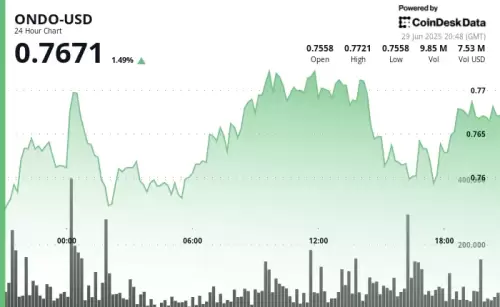

- Ondo Climbs:代幣化的股票已準備好2025年收購?

- 2025-06-30 07:12:02

- Ondo Finance在2025年將股票押注大量,而雙子座跳入歐盟市場。這是金融的未來嗎?

-

- 比特幣礦工:收入下降,但不出售?在加密貨幣場景上的紐約分鐘

- 2025-06-30 07:12:03

- 比特幣礦工在收入下降時面臨艱難的時期,但令人驚訝的是沒有出售他們的比特幣。有什麼交易?讓我們分解,紐約風格。