|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索諸如戰略之類的公司如何利用比特幣,戰略資本加薪以及對金融的未來意味著什麼。

Bitcoin, Strategy, and Capital Raise: A New York Minute on Corporate Crypto

比特幣,戰略和資本加薪:紐約公司加密貨幣

Ever wonder what happens when Wall Street meets Bitcoin? Companies like Strategy are making headlines, blending traditional finance with crypto's wild west. Let's break down this Big Apple-sized story.

有沒有想過當華爾街遇到比特幣時會發生什麼?像戰略這樣的公司成為頭條新聞,將傳統的財務與加密貨幣的野生西部融為一體。讓我們分解這個大型蘋果大小的故事。

Strategy's Bitcoin Bonanza

策略的比特幣大富翁

Strategy, led by Bitcoin evangelist Michael Saylor, isn't just dipping its toes into Bitcoin; it's diving headfirst. They've been aggressively increasing their Bitcoin holdings, recently surpassing 597,000 coins valued at over $70 billion. That’s more Bitcoin than most small countries have in reserves! This move positions Strategy as the undisputed heavyweight champion of corporate Bitcoin holders.

由比特幣傳教士邁克爾·賽勒(Michael Saylor)領導的策略不僅將腳趾浸入比特幣中。首先是潛水。他們一直在積極增加自己的比特幣持有量,最近超過了597,000枚硬幣,價值超過700億美元。這比大多數小國儲備金中的比特幣更重要!此舉將戰略定位為無可爭議的企業比特幣持有人的重量級冠軍。

The Capital Raise Hustle

資本提高

How do they do it? By strategically raising capital. A recent $4.2 billion capital raise allowed them to keep buying Bitcoin even after a brief pause. It’s like finding a twenty in your old jeans, except it’s billions and you use it to buy digital gold.

他們怎麼做?通過策略性地籌集資金。最近的42億美元籌集資金使他們能夠繼續購買比特幣,即使在短暫停頓之後。這就像在您的舊牛仔褲上找到二十個,只是數十億美元,您用它來購買數字黃金。

Supply Squeeze: A Bitcoin Reality?

供應擠壓:比特幣現實?

Here's where it gets interesting. Strategy's aggressive buying, acquiring over 2,000 coins daily, is outpacing the rate at which miners produce new Bitcoin (around 450 per day). Adam Livingston calls this “synthetically halving” the Bitcoin supply. Imagine trying to buy hot dogs at a baseball game, but they keep disappearing faster than they're being grilled. That’s a supply squeeze, and it could push Bitcoin prices higher.

這是有趣的地方。策略的積極購買,每天收購2,000多枚硬幣,超過了礦工生產新比特幣的速度(每天約450個)。亞當·利文斯頓(Adam Livingston)稱這是“合成的一半”比特幣供應。想像一下,試圖在棒球比賽中購買熱狗,但它們的消失速度比烤速度更快。那是供應壓力,它可能會將比特幣價格提高。

The Sequans Strategy: A Bold Move

序列策略:大膽的舉動

Other players are entering the game too. Sequans Communications, a 5G/4G IoT chipmaker, recently secured a €384 million (~$384M) combination of equity and debt financing to kickstart their own Bitcoin treasury plan. While it's a risk, their CEO believes Bitcoin's scarcity and decentralization will boost their financial resilience. It's like diversifying your portfolio with a rocket ship – exciting, but buckle up!

其他玩家也正在進入遊戲。 5G/4G物聯網芯片製造商Sequans Communications最近獲得了3.84億歐元(約3.84億美元)的股權和債務融資的組合,以啟動自己的比特幣財政計劃。儘管這是一種風險,但他們的首席執行官認為比特幣的稀缺性和權力下放將提高他們的財務能力。這就像用一艘火箭艦使投資組合多樣化 - 令人興奮,但扣緊!

Potential Pitfalls: Not All Sunshine and Rainbows

潛在的陷阱:並非全部陽光和彩虹

Of course, it’s not all champagne and Lambos. Relying on debt to buy Bitcoin can be risky. A market downturn could spell trouble for leveraged companies. Experts warn about maintaining a balanced approach and keeping shareholders in the loop. It’s like juggling chainsaws – impressive, but one wrong move and things get messy.

當然,這並不是香檳和蘭博斯。依靠債務購買比特幣可能會有風險。市場低迷可能會給槓桿公司帶來麻煩。專家警告說,保持平衡的方法並將股東保持在循環中。就像雜耍電鋸一樣 - 令人印象深刻,但是一個錯誤的舉動和事情變得凌亂。

My Two Satoshis

我的兩個satoshis

While the idea of debt-fueled Bitcoin binges might make some investors nervous, there's no denying that institutional adoption is a major bullish signal for Bitcoin. It's a sign that Bitcoin is maturing and becoming a legitimate asset class. Imagine telling someone in 2010 that corporations would be holding Bitcoin on their balance sheets – they'd probably think you were nuts! However, companies must proceed with caution, manage their leverage responsibly, and be transparent with investors.

儘管債務驅動的比特幣碎屑的想法可能會使一些投資者感到緊張,但不可否認的是,機構採用是比特幣的主要看漲信號。這表明比特幣正在成熟並成為合法的資產類別。想像一下,在2010年告訴某人,公司將在資產負債表上持有比特幣 - 他們可能會認為您很瘋狂!但是,公司必須謹慎行事,負責任地管理其槓桿作用,並與投資者保持透明。

The Bottom Line: Buckle Up, Buttercup!

底線:扣緊,毛cup!

Strategy's moves highlight a significant shift in the crypto landscape. Institutional players are increasingly shaping Bitcoin's supply dynamics. Keep an eye on these developments, but remember – investing in crypto is a wild ride. So, buckle up, do your homework, and maybe grab a slice of New York-style pizza to enjoy the show. After all, in the city that never sleeps, anything is possible, especially when Bitcoin's involved.

策略的移動突出了加密景觀的重大轉變。機構參與者越來越多地塑造比特幣的供應動態。請密切關注這些發展,但請記住 - 投資加密是一次瘋狂的旅程。因此,扣緊,做功課,也許可以抓住一片紐約風格的比薩餅來欣賞表演。畢竟,在不睡覺的城市中,一切皆有可能,尤其是當比特幣參與其中時。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 模因硬幣躁狂症:狗狗,佩佩和加密貨幣預售熱潮

- 2025-07-22 21:59:55

- 探索模因硬幣景觀:Dogecoin,Pepe和Crypto Presals的興起。發現為什麼投資者轉向具有實際實用性的項目。

-

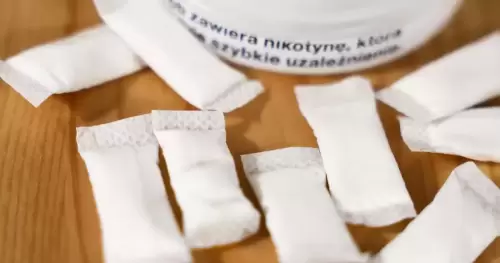

- 尼古丁小袋:對青少年牙齦健康的甜蜜威脅?

- 2025-07-22 21:49:09

- 尼古丁小袋正在越來越受歡迎,尤其是在青少年中。但是,這些甜味的小袋是否會對他們的牙齦健康造成嚴重破壞?讓我們潛入風險。

-

- 與1 XBET得分:足球和大型比賽的指南

- 2025-07-22 21:47:03

- 通過1xbet最大化您的足球投注策略,獲取內部勺子。從2025年婦女歐洲歐元到加密賭注,發現獲勝的趨勢和見解。

-

-

-

- 比特幣的市場份額:空中的另類季節?

- 2025-07-22 21:27:35

- 儘管比特幣的價格飛漲,但隨著山寨幣的增長勢頭,其市場份額仍在下滑。 alt季節終於來了嗎?

-

- XRP,比特幣,ripplecoin:2025年導航加密貨幣景觀

- 2025-07-22 20:07:27

- 深入了解2025年XRP,比特幣和Ripplecoin的發展動態,突出了關鍵趨勢,機構興趣和未來的前景。

-

-

- 茉莉幣價格預測:圖表分析指向潛在的激增

- 2025-07-22 20:00:00

- 深入研究最新的茉莉幣(Jasmy)價格預測和圖表分析,探索潛在的浪潮和關鍵水平。茉莉會突破阻力嗎?