|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025年4月24日,比特幣價格下跌0.3%,貿易額為93,433美元。恢復勢頭的短暫放緩可能與中國官員的最新評論有關,否認與美國進行進步貿易會談的主張。

On April 24, the Bitcoin price slipped by 0.3% to trade at $93,433 as the cryptocurrency encountered a setback in its swift recovery momentum.

4月24日,由於加密貨幣在其迅速恢復的勢頭中遇到挫折,比特幣價格下跌了0.3%,至93,433美元的交易。

The recent comments from Chinese officials denying the claims of progressive trade talks with the United States could have contributed to the short slowdown in buying interest.

中國官員的最新評論否認與美國進行進步貿易會談的主張可能導致購買利息的短暫放緩。

As the broader market faces the risk of renewed correction, the BTC price teeters at bullish support, signaling the risk of a potential breakdown.

隨著更廣泛的市場面臨重新糾正的風險,BTC價格搖搖欲墜,以支持支持,這表明了潛在崩潰的風險。

Trump’s Diplomatic Optimism Meets Chinese Rebuttal

特朗普的外交樂觀遇到了中國反駁

In the third week of April, the crypto market witnessed a surge in buying pressure as Bitcoin soared past the $90,000 mark. The bullish momentum was primarily triggered by the easing panic surrounding the ongoing tariff war.

在4月的第三週,加密貨幣市場的購買壓力激增,因為比特幣超過了90,000美元。看漲的勢頭主要是由圍繞正在進行的關稅戰爭的恐慌引發的。

As the panic in the crypto market subsided, Donald Trump’s assured diplomatic progress of forming trade deals with several countries influenced China.

隨著加密貨幣市場的恐慌平息,唐納德·特朗普(Donald Trump)確保與幾個國家的貿易協定產生影響的外交進展。

However, Guo Jaikun, the spokesperson for China’s Ministry of Foreign Affairs, publicly denied any ongoing trade negotiations with the United States. His statement contradicts Trump’s assertion earlier this week that “productive discussions” were underway between Washington and Beijing.

然而,中國外交部發言人郭·賈肯(Guo Jaikun)公開否認與美國進行的任何持續的貿易談判。他的聲明與特朗普本週早些時候的主張相矛盾,即華盛頓和北京之間正在進行“富有成效的討論”。

If the trade tensions between the U.S. and China continue, the broader market would struggle to drive a sustained recovery and face another pullback risk.

如果美國與中國之間的貿易緊張局勢繼續下去,那麼更廣泛的市場將難以推動持續的恢復,並面臨另一種回調風險。

However, Jaikun assured that China is open to talks with the United States and will negotiate a trade deal based on equality, respect, and mutual benefit.

但是,Jaikun保證,中國開放與美國的對話,並將根據平等,尊重和互利就貿易協議進行談判。

Bitcoin Price Waivers at Key Pivot Level

比特幣價格豁免在關鍵樞軸級別

The Bitcoin price in the last two weeks showcased a high-momentum rally from $74,588 to $93,571. The bullish upswing reclaimed the fast-moving average of the 20-and-50-day exponential moving averages, indicating the initial change in market sentiment.

過去兩週的比特幣價格從74,588美元到93,571美元,展示了高摩托馬式集會。看漲的上升恢復了20天和50天的指數移動平均值的快速移動平均值,表明市場情緒的最初變化。

The coin price now seeks suitability above $90,000 before challenging the $100,000 psychological level. With the current momentum, the buyers should drive a 6% surge to hit $100k, followed by a leap to $109,500.

現在,硬幣價格尋求超過90,000美元的適用性,然後才挑戰100,000美元的心理水平。憑藉目前的勢頭,買家應提高6%的速度,達到10.0萬美元,然後飛往109,500美元。

However, if the global tariff war escalates, the BTC price will break below the $90,000 support and form another lower high. The reversal will signal sell-the-bounce sentiment in the market and drive a prolonged pullback to the $75,000 floor.

但是,如果全球關稅戰爭升級,BTC的價格將低於90,000美元的支持,並形成另一個低位。逆轉將表示市場上出售彈跳情緒,並將長時間的回調推向75,000美元的樓層。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 比特幣的售價超過$ 90K,以太坊和山寨幣現很出色的收益

- 2025-04-25 17:55:13

- 全球加密貨幣市場繼續反映出看漲的情緒,比特幣保持穩定的立場高於93,000美元。

-

- 分析師說

- 2025-04-25 17:55:13

- 一位廣泛關注的加密分析師說,比特幣(BTC)可能在看跌逆轉之前向上行進程。

-

-

- SUI區塊鏈的本地令牌SUI本週飆升了62%以上

- 2025-04-25 17:50:13

- SUI區塊鏈的原住民令牌SUI本週飆升了62%以上,這是由於猜測與Pokémon的潛在合作所推動。

-

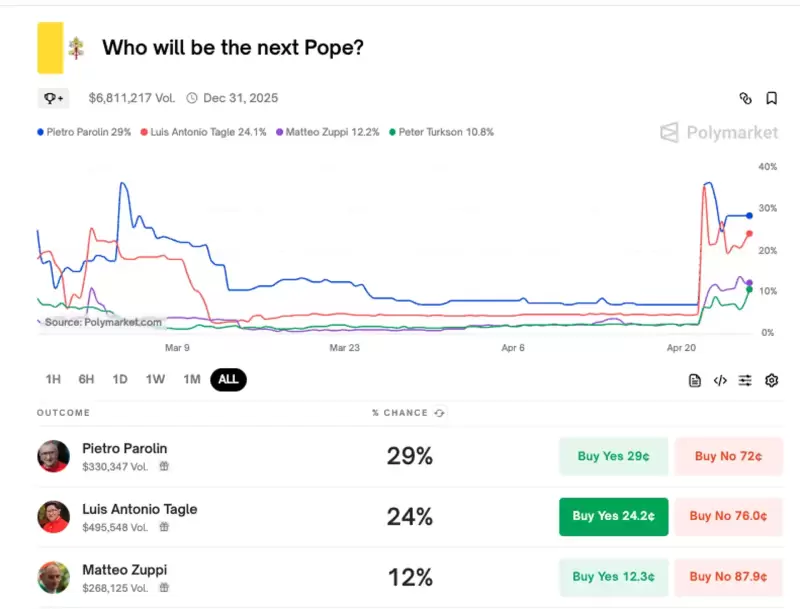

- 多聚市場捕獲

- 2025-04-25 17:45:13

- 由於預計將在下個月舉行的“結論”(教皇選舉秘密會議)選舉下一屆教皇時,圍繞教皇候選人主題的Meme Coins引起了人們的關注。

-

-

-

- DraftKings支付1000萬美元以解決NFT證券集體訴訟

- 2025-04-25 17:40:13

- 流行的體育博彩和幻想體育公司Draftkings已同意達成1000萬美元的和解,以解決集體訴訟

-