|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

According to on-chain data analysis by Glassnode, Bitcoin is at a critical juncture. When BTC soared to $73,800 in March 2024, printing new all-time highs, the Bitcoin market reached a statistically significant level regarding on-chain unrealized profits, according to the Market Value to Realized Value (MVRV) ratio.

根據Glassnode的鏈上數據分析,比特幣正處於關鍵時刻。當 BTC 在 2024 年 3 月飆升至 73,800 美元,創下歷史新高時,根據市場價值與已實現價值 (MVRV) 比率,比特幣市場的鏈上未實現利潤達到了統計顯著水平。

Bitcoin MVRV Ratio At Historically Significant Level: Time To Hold Or Take Profit?

The analytics platform notes that, historically, such levels have coincided with periods of market resistance. Therein, some holders often choose to take profits by exiting their positions.

比特幣 MVRV 比率處於歷史顯著水平:持有或獲利的時間?分析平台指出,從歷史上看,這種水平與市場阻力時期一致。其中,有些持有者往往會選擇透過平倉的方式獲利了結。

It remains to be seen whether the same will be replicated, and prices fall as holders make a profit. However, according to MVRV, this will likely happen if past performance guides.

相關閱讀:FTX 的 Sam Bankman-Fried 今天被判刑:接下來會發生什麼同樣的事情是否會被複製還有待觀察,隨著持有者獲利,價格會下跌。然而,根據 MVRV 的說法,如果以過去的表現為指導,這種情況很可能會發生。

Simply put, the MVRV ratio shows how expensive the coin is relative to historical prices. It is a tool for gauging whether Bitcoin, as it is at spot rates, is under or overvalued. When the ratio is above 1, it suggests that it is overvalued.

BTC MVRV 頻段 |來源:X 上的 Glassnode 簡而言之,MVRV 比率顯示了代幣相對於歷史價格的昂貴程度。它是一種衡量比特幣(以即期匯率計算)是否被低估或高估的工具。當該比率高於1時,表示其被高估。

When BTC rose to approximately $74,000, the MVRV ratio rose above 3. However, it should be noted that it was way lower than historical levels when Bitcoin registered new all-time highs. When BTC rose to $69,000 in 2021, the MVRV ratio was over 5. At the 2017 peak, this value was over 4.8, which is the highest it has been.

當BTC升至約74,000美元時,MVRV比率升至3以上。但值得注意的是,該比率遠低於比特幣創下歷史新高時的歷史水準。當BTC在2021年升至69,000美元時,MVRV比率超過5。在2017年的峰值時,該值超過4.8,這是有史以來的最高值。

BTC Has Been Under Pressure, Will Prices Recover?

Recently, Bitcoin has struggled to edge higher, looking at price action in the daily chart. The coin remains below all-time highs of $73,800. Even though bulls shook off selling pressure over the weekend, pushing strongly above resistance levels, the follow-through has not been impressive.

比特幣一直面臨壓力,價格會復甦嗎?最近,從日線圖上的價格走勢來看,比特幣一直在努力走高。該代幣仍低於 73,800 美元的歷史高點。儘管多頭在周末擺脫了拋售壓力,強勢突破阻力位,但後續走勢並不令人印象深刻。

Any breakout above $74,000 from the candlestick arrangement will thrust the coin into new territory. Some analysts speculate the coin might float to as high as $100,000 in 2024, especially after the network halves its miner rewards in April 2024.

比特幣價格在日線圖上呈上升趨勢|資料來源:Binance 上的 BTCUSDT、TradingView 燭台排列中任何突破 74,000 美元的突破都將推動該代幣進入新的領域。一些分析師推測,該代幣的價格可能會在 2024 年上漲至 10 萬美元,尤其是在 2024 年 4 月網路將礦工獎勵減半之後。

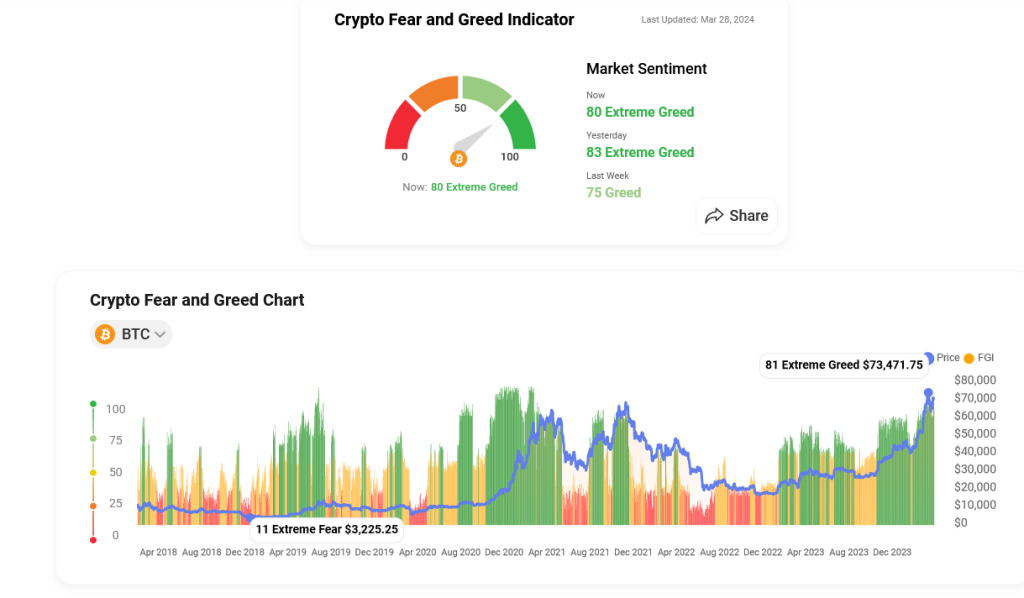

Despite the recent sell-off pushing prices to around $62,000, the overall market sentiment remains bullish. The CoinStats Fear and Greed Index, a gauge of investor sentiment, still reads “Extreme Greed” at 80.

相關閱讀:漣波與波動SEC 傳奇:法律專家揭開「更大的爭論」 儘管最近的拋售將價格推至 62,000 美元左右,但整體市場情緒仍然看漲。衡量投資者情緒的 CoinStats 恐懼和貪婪指數仍然為“極度貪婪”,為 80。

Additionally, interest is back after days of outflows from spot Bitcoin exchange-traded funds (ETFs). By March 27, Lookonchain data shows that Fidelity added added 4,001 BTC. In total, and factoring in GBTC’s outflow, all spot Bitcoin ETF issuers added 3,469 BTC.

比特幣情緒數據|資料來源:CoinStats 此外,在現貨比特幣交易所交易基金(ETF)連續幾天流出之後,利息又回來了。截至 3 月 27 日,Lookonchain 數據顯示 Fidelity 新增了 4,001 BTC。考慮到 GBTC 的流出,所有現貨比特幣 ETF 發行人總共增持了 3,469 BTC。

特徵圖片來自 Canva,圖表來自 TradingView

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 以太坊,比特幣主導地位和Altcoin Rally:Crypto上的紐約分鐘

- 2025-09-28 11:50:00

- 以太坊的激增,比特幣的滑倒和Altcoin季節的嗡嗡聲:對最新的加密動力學的速度降低。

-

- RLUSD,XRP和開放興趣:解碼動力學

- 2025-09-28 11:40:55

- 探索RLUSD,XRP和開放興趣之間的相互作用。發現對製度採用和市場趨勢塑造加密貨幣景觀的關鍵見解。

-

- 加密模因硬幣:揭示2025年潛力

- 2025-09-28 11:15:25

- 潛入模因硬幣躁狂症!發現像Moonbull,Dogwifhat和官方特朗普這樣的頂級競爭者,並在2025年的加密景觀中揭示了他們的潛力。

-

-

- Stablecoins,金融交易和未來世界:紐約的心態

- 2025-09-28 11:12:21

- 探索穩定幣在金融交易中的變革性作用及其對未來世界的潛在影響。

-

- XRP,競爭對手,PDP攀登:在2025年解碼加密貨幣景觀

- 2025-09-28 10:30:43

- 分析XRP與新興競爭對手(例如PayDax協議(PDP))之間的動態,探索了不斷發展的加密市場的顯著增長潛力。

-

- 雪崩,Hedera和Bullzilla:解碼加密宣傳

- 2025-09-28 10:30:10

- 探索雪崩,Hedera和Bullzilla Presale的動力。發現加密市場中的主要見解和趨勢。

-

- 比特幣價格:選項數據揭示了儘管ETF流動的持懷疑態度

- 2025-09-28 10:16:44

- 選項數據顯示,比特幣市場中的懷疑日益增長,儘管ETF穩定流入,交易者仍針對潛在的下跌。這對Q4意味著什麼?

-

- Sui,Tron和Crypto Presale Frenzy:什麼是哈普斯?

- 2025-09-28 10:15:26

- Sui和Tron正在建造,但Bullzilla的預售正在抓住眼球。我們分解了關鍵趨勢和見解。