|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣在過去一周中以111,000美元的價格交易,以錄製新的歷史最高(ATH),因為Crypto Bull Run Revival繼續進行

Bitcoin (BTC) price action continues to heat up as the crypto market experiences a slight downturn. The recent buildup to new all-time highs (ATHs) has largely been driven by anticipation of the U.S. Government's announcement of potential new trade tariffs.

比特幣(BTC)的價格行動繼續升溫,因為加密貨幣市場略有低迷。最近,新的歷史最高水平(ATH)的建立很大程度上是由於預期美國政府宣布潛在的新貿易關稅而驅動的。

While the apex cryptocurrency has since experienced some retracement, investors remain bullish, especially if the previous ATH is successfully reclaimed, which would strongly signal a continuation of the current uptrend.

儘管Apex加密貨幣此後經歷了一些回答,但投資者仍然看漲,尤其是如果以前的ATH成功收回,這將強烈表明當前上升趨勢的延續。

Interestingly, crypto analyst BilalHuseynov has observed an uncommon development with the Market Value To Realized Value ratio (MVRV) that indicates a positive difference with the current bull cycle from others.

有趣的是,加密分析師Bilalhuseynov觀察到了一個罕見的發展,其市場價值與已實現的價值比(MVRV),這表明與其他人的牛週期有積極的差異。

Bitcoin MVRV Stays At 2.4 Amid New ATH – What Could This Mean?

在新的ATH中,比特幣MVRV保持在2.4 - 這意味著什麼?

In a QuickTake post on May 23, BilalHuseynov shares an interesting insight on the Bitcoin market following recent on-chain development. Notably, the premier cryptocurrency hit a new all-time high at $111,970 on May 22 to ultimately confirm the validity of the current bull cycle.

在5月23日的Quicktake帖子中,Bilalhuseynov在最近的鏈開發後分享了對比特幣市場的有趣見解。值得注意的是,這位總理的加密貨幣在5月22日達到了新的歷史最高高點,最終確認了當前牛週期的有效性。

Amidst this bullish development, BilalHuseynov notes an unusual event in that the MVRV ratio failed to reach the peak numbers associated with when Bitcoin set a new ATH in previous bull cycles. For context, the MVRV measures the market cap of Bitcoin to the realized cap, i.e, the value of all Bitcoin at the last point of purchase. It is used to indicate trend reversals, as an MVRV ratio over 1 suggests overvaluation while a figure below 1 signals undervaluation.

在這個看漲的發展中,比拉爾霍西諾夫指出了一個不尋常的事件,因為MVRV比率未能達到與比特幣在以前的牛市中設置新ATH時相關的峰值數字。在上下文中,MVRV測量了比特幣的市值到已實現的上限,即,在最後一點點購買點所有比特幣的價值。它用於指示趨勢逆轉,因為MVRV比率超過1表示高估,而低於1個信號低估的數字低估。

According to BilalHuseynov, when Bitcoin achieved a new ATH in 2013, 2017, and 2021 bull cycles, the MVRV ratio reached top values between 3.5-4.0. However, following the eclipse of the $109,000, the MVRV ratio has hit a peak value of 2.4. The crypto analyst explains that the reduced MVRV number can be linked to a disproportionate rise in Realized Cap compared to the Market Cap. This development can be attributed to the fact that a high volume of circulating Bitcoin exchanged hands at higher prices, thereby resulting in a higher cost basis.

根據Bilalhuseynov的說法,當比特幣在2013年,2017年獲得了新的ATH和2021年的Bull Cycles時,MVRV比率達到了3.5-4.0之間的最高值。但是,在$ 109,000的日食之後,MVRV比率達到了2.4的峰值。加密分析師解釋說,與市值相比,MVRV數量的減少可能與已實現的上限的不成比例上升有關。這一發展可以歸因於以下事實:大量循環比特幣以更高的價格交換,從而導致成本更高。

Interestingly, BilalHuseynov explains that this unusual development is a positive signal for Bitcoin’s long-term development, indicating a stable market even at ATH prices, that possesses less froth and no hype-driven overvaluation. Furthermore, there is the possibility that stronger market hands, i.e, long-term holders and institutional holders, are part of this new investors, suggesting long-term market confidence with no urgency for profit-taking.

有趣的是,Bilalhuseynov解釋說,這種異常的發展是比特幣長期發展的積極信號,即使以ATH價格達到穩定的市場,它的泡沫較少,沒有炒作驅動的高估。此外,有可能更強大的市場手(即長期持有人和機構持有人)是這位新投資者的一部分,這表明長期市場信心,而沒有盈利的緊迫性。

BTC Price Overview

BTC價格概述

At the time of writing, Bitcoin is trading at $108,397 following the retracement in the past days. The premier cryptocurrency is down by 2.50% in the past day but up by 17.65% in the past month.

在撰寫本文時,比特幣在過去幾天的回溯之後的交易價格為108,397美元。在過去的一天中,總理加密貨幣下降了2.50%,但在過去一個月中增長了17.65%。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 加密貨幣:破壞性的購買超越炒作

- 2025-06-25 04:45:12

- 忘記短暫的模因硬幣。發現像Little Pepe,Unstake和渲染的加密貨幣一樣,它們具有真正的實用性和破壞性的潛力。

-

-

-

- JPMORGAN,區塊鍊和JPMD代幣:鏈融資的量子飛躍?

- 2025-06-25 05:05:13

- 探索Coinbase的基本區塊鍊和BTQ的量子安全穩定解決方案上的JPMorgan的JPMD令牌飛行員。

-

-

- 比特幣,加密,停火:救濟集會還是停頓?

- 2025-06-25 05:12:16

- 特朗普的停火宣布引發了加密集會,但這是可持續的嗎?我們深入研究了最新的趨勢,從比特幣的激增到模因硬幣躁狂症,並帶有紐約的扭曲。

-

- 加密貨幣將於2025年6月進行爆炸性增長:您需要知道什麼

- 2025-06-25 05:12:16

- 獲取在2025年6月能夠爆炸性增長的加密貨幣上的內部勺子。

-

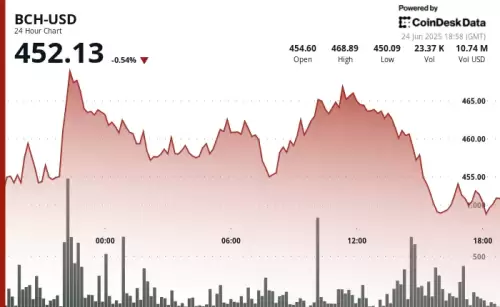

- 比特幣現金(BCH)公牛眼鑰匙阻力水平:它會突破嗎?

- 2025-06-25 05:32:14

- 比特幣現金(BCH)又重新亮相,測試了關鍵阻力水平。它會維持其動力並突破嗎?讓我們深入研究分析。

-

- ETH的看漲前景面臨著薄弱的需求:紐約市的觀點

- 2025-06-25 05:46:12

- 儘管最近激增,但在低收入和競爭不斷上升的情況下,ETH的需求疲軟而掙扎。看漲的未來仍然有可能嗎?