|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

去年為2個主要加密BTC和ETH推出ETF之後,該市場將其視為加密歷史上的關鍵事件之一。

Here’s Why Bitcoin and Ethereum ETFs Data Looks More Worrying Than EverAfter launching ETFs for 2 main cryptos BTC and ETH last year, the market was looking at this as one of the crucial events in the history of crypto. Even though we had months with many inflows for both, especially Bitcoin, most recent data looks more worrying than ever.Bitcoin ETFs Showing Concerning PatternsRecent data from U.S. spot Bitcoin ETFs showed troubling trends. While April 17 saw $108 million flow into these funds, with BlackRock’s IBIT recording the largest single-day net inflow of $80.96 million, this small win shouldn’t be overstated.

這就是為什麼比特幣和以太坊ETF數據看起來比Everafter啟動2個主要加密BTC和ETH的ETF更令人擔憂的原因,該市場正在將其視為加密歷史上的重要事件之一。即使我們有幾個月的流入,尤其是比特幣,但最近的數據看起來比以往任何時候都更令人擔憂。 BitcoinETF顯示了來自美國現貨比特幣ETF的模式數據顯示出令人困擾的趨勢。 4月17日,這些資金流向了1.08億美元,貝萊德的IBIT記錄了最大的單日淨流入量為8096萬美元,但這一小胜利不應被誇大。

This minimal gain follows a period of substantial outflows, as April has already seen more than $812 million pulled out of Bitcoin ETFs. To put this into perspective, this surpasses the already concerning outflows of $767.91 million recorded in March. The worst day was April 8, when a staggering $326.3 million left these funds amid escalating global tensions and heightened economic fears.

這一最小收益是在一段大量流出之後,因為4月已經從比特幣ETF中撤出了超過8.12億美元。為了介紹這一點,這超過了3月記錄的已經記錄的7.6791億美元的流出。最糟糕的一天是4月8日,當時一筆驚人的3.263億美元在全球緊張局勢加劇並加劇了經濟恐懼的情況下留下了這些資金。

However, what’s interesting is that Bitcoin’s price remained stable around the $84,000 mark throughout these outflows. This suggests institutional investors might be slowly reducing their holdings and exiting their positions despite Bitcoin’s stable price performance, perhaps due to growing macroeconomic concerns or adjustments in their investment strategies.

但是,有趣的是,在這些流出中,比特幣的價格保持穩定。這表明,儘管比特幣的價格穩定,但機構投資者可能正在慢慢降低其持股量並退出其頭寸,這可能是由於宏觀經濟問題的越來越多或投資策略的調整所致。

On April 17, U.S. spot Bitcoin ETFs recorded a total net inflow of $108 million. The largest single-day net inflow came from BlackRock’s Bitcoin ETF (IBIT), which saw an inflow of $80.9588 million. All nine U.S. spot Ethereum ETFs recorded zero net flows for the day, with neither…

4月17日,美國現貨比特幣ETF的總淨流入量為1.08億美元。最大的單日淨流入來自BlackRock的比特幣ETF(IBIT),其流入量為809.588億美元。所有九個美國的Ethereum ETF均記錄了當天的零淨流動,這兩個都沒有…

Continue reading on CoinMarketCap

繼續閱讀CoinMarketCap

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 比特幣的售價超過$ 90K,以太坊和山寨幣現很出色的收益

- 2025-04-25 17:55:13

- 全球加密貨幣市場繼續反映出看漲的情緒,比特幣保持穩定的立場高於93,000美元。

-

- 分析師說

- 2025-04-25 17:55:13

- 一位廣泛關注的加密分析師說,比特幣(BTC)可能在看跌逆轉之前向上行進程。

-

-

- SUI區塊鏈的本地令牌SUI本週飆升了62%以上

- 2025-04-25 17:50:13

- SUI區塊鏈的原住民令牌SUI本週飆升了62%以上,這是由於猜測與Pokémon的潛在合作所推動。

-

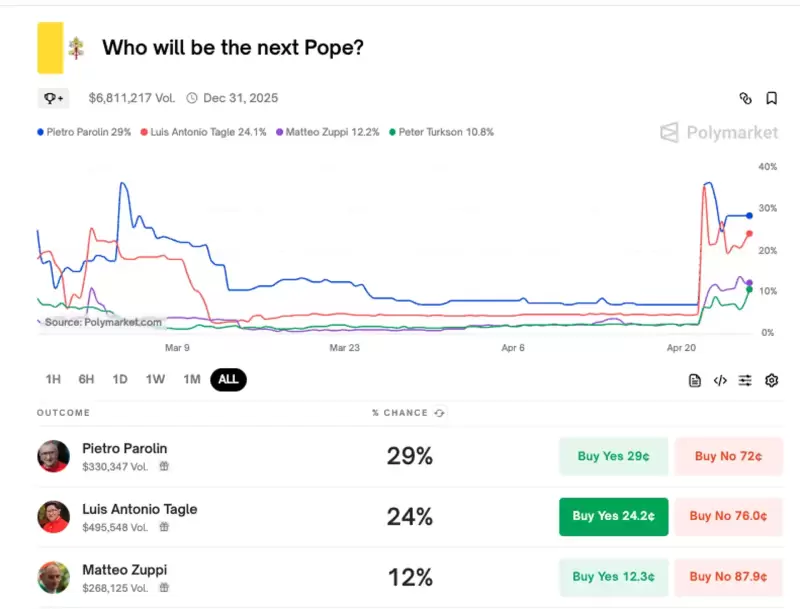

- 多聚市場捕獲

- 2025-04-25 17:45:13

- 由於預計將在下個月舉行的“結論”(教皇選舉秘密會議)選舉下一屆教皇時,圍繞教皇候選人主題的Meme Coins引起了人們的關注。

-

-

-

- DraftKings支付1000萬美元以解決NFT證券集體訴訟

- 2025-04-25 17:40:13

- 流行的體育博彩和幻想體育公司Draftkings已同意達成1000萬美元的和解,以解決集體訴訟

-