|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索由美國需求和Coinbase Premium Gap驅動的比特幣激增。了解市場趨勢,機構利益和加密的未來。

Bitcoin, Coinbase, and the Premium Gap: What's Driving the Crypto Market?

比特幣,Coinbase和Premium Gap:是什麼推動了加密貨幣市場?

Bitcoin's recent surge to unprecedented highs, fueled by robust U.S. demand and a significant Coinbase Premium Gap, signals a major shift in the crypto landscape. This article delves into the key factors driving this phenomenon, offering insights into market trends and future prospects.

比特幣最近向前所未有的高點激增,這是由於強勁的美國需求和巨大的Coinbase Premium Gap所推動的,這標誌著加密貨幣景觀發生了重大變化。本文深入研究了推動這一現象的關鍵因素,從而洞悉了市場趨勢和未來前景。

Understanding the Coinbase Premium Gap

了解Coinbase Premium GAP

The Coinbase Premium Gap measures the price difference of Bitcoin on Coinbase, a U.S.-based exchange, compared to international platforms like Binance. A high premium indicates strong buying activity on Coinbase, primarily from U.S. investors. Recently, this gap has widened significantly, reaching 42 points, suggesting aggressive accumulation by both retail and institutional players in the U.S.

與Binance這樣的國際平台相比,Coinbase Prem Gap衡量了總部位於美國的交易所比特幣的價格差異。高溢價表明Coinbase的強大購買活動主要來自美國投資者。最近,這一差距大大擴大,達到42分,這表明零售和機構參與者的積極積累

Factors Fueling the Bitcoin Surge

助長比特幣激增的因素

Several factors contribute to Bitcoin's impressive rally:

有幾個因素導致比特幣令人印象深刻的集會:

- Record-Breaking U.S. Demand: The primary driver is the intense buying pressure from U.S.-based investors.

- Institutional Interest: Corporations and institutional investors are increasingly allocating capital to Bitcoin and other digital assets.

- Spot ETF Inflows: The introduction of Bitcoin ETFs has made it easier for traditional investors to gain exposure to the cryptocurrency.

- Broader Market Rally: Bitcoin's surge aligns with a broader rally in risk assets, suggesting increased investor confidence in alternative investments.

The Role of Coinbase and AI

Coinbase和AI的作用

Coinbase is at the forefront of integrating crypto with cutting-edge technologies. Their partnership with Perplexity, an AI answer engine, exemplifies this. By providing real-time crypto data and insights, Coinbase is empowering traders to make informed decisions. The integration of the Coinbase 50 Index into Perplexity's AI-driven web browser, Comet, marks a significant step toward accessible and actionable crypto market analysis. Brian Armstrong, Coinbase CEO, envisions further integration, particularly with crypto wallets integrated into LLMs, for a permissionless digital economy.

Coinbase位於將加密技術與尖端技術集成在一起的最前沿。他們與AI答案引擎的困惑的合作夥伴關係為此體現了這一點。通過提供實時加密數據和見解,Coinbase正在授權交易者做出明智的決定。 Coinbase 50指數集成到困惑的AI驅動的Web瀏覽器Comet中,標誌著朝著可訪問且可行的加密市場分析邁出的重要一步。 Coinbase首席執行官Brian Armstrong設想了進一步的整合,尤其是與集成到LLM的加密錢包,以實現無許可的數字經濟。

The Bigger Picture: Crypto's Transformation

大局:加密的轉型

The crypto industry has come a long way from the

加密行業距離

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

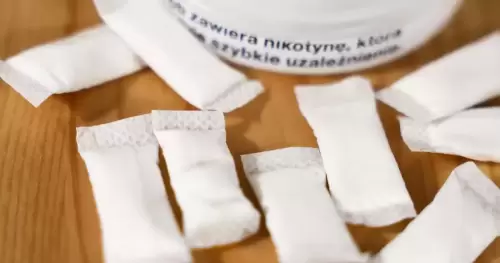

- 尼古丁小袋:對青少年牙齦健康的甜蜜威脅?

- 2025-07-22 21:49:09

- 尼古丁小袋正在越來越受歡迎,尤其是在青少年中。但是,這些甜味的小袋是否會對他們的牙齦健康造成嚴重破壞?讓我們潛入風險。

-

- 與1 XBET得分:足球和大型比賽的指南

- 2025-07-22 21:47:03

- 通過1xbet最大化您的足球投注策略,獲取內部勺子。從2025年婦女歐洲歐元到加密賭注,發現獲勝的趨勢和見解。

-

- XRP,比特幣,ripplecoin:2025年導航加密貨幣景觀

- 2025-07-22 20:07:27

- 深入了解2025年XRP,比特幣和Ripplecoin的發展動態,突出了關鍵趨勢,機構興趣和未來的前景。

-

-

- 茉莉幣價格預測:圖表分析指向潛在的激增

- 2025-07-22 20:00:00

- 深入研究最新的茉莉幣(Jasmy)價格預測和圖表分析,探索潛在的浪潮和關鍵水平。茉莉會突破阻力嗎?

-

- 特朗普,比特幣和替代幣:加密政治戲劇的紐約分鐘

- 2025-07-22 20:00:00

- 特朗普在遊說和經濟激勵措施的驅動下,對加密貨幣的不斷發展的立場正在重塑比特幣和山寨幣的景觀。這是內部勺子。

-

-

-

- 比特幣優勢,Altseason和BTC激增:加密貨幣的下一步是什麼?

- 2025-07-22 19:56:30

- 比特幣的統治結局嗎?深入了解不斷變化的加密景觀,並了解Altseason潛力和BTC的無情激增。