|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

分析比特幣,中國和美國的相互作用,重點是製造業轉變,戰略收購以及塑造加密貨幣空間的監管障礙。

The dynamic relationship between Bitcoin, China, and America continues to evolve, marked by manufacturing realignments, strategic financial moves, and ongoing regulatory scrutiny. This article dives into recent developments, highlighting key trends and insights shaping this intricate landscape.

比特幣,中國和美國之間的動態關係不斷發展,以製造重新調整,戰略財務轉移和持續的監管審查為特徵。本文深入研究了最近的發展,強調了關鍵趨勢和見解,塑造了這一複雜的景觀。

Chinese Bitcoin Mining Giants Set Up Shop in the US

中國比特幣採礦巨頭在美國開設了商店

In a significant move, three of China's largest Bitcoin mining hardware manufacturers—Bitmain, Canaan, and MicroBT—have established operations in the United States. This strategic shift aims to circumvent hefty import tariffs imposed during the Trump administration, potentially reshaping the backbone of Bitcoin mining. The move started with Bitmain in December after Trump's election, followed by Canaan and MicroBT, all seeking to avoid a 25% levy on their ASIC machines.

一項重大的舉動,中國最大的比特幣礦業硬件製造商(Bitmain,Canaan和Microbt)已經在美國建立了運營。這一戰略轉變旨在規避特朗普政府期間對進口稅的高額進口關稅,並有可能重塑比特幣採礦的骨幹。此舉始於特朗普當選後12月的比特曼,其次是迦南和邁克特,所有這些都試圖避免對其ASIC機器徵收25%的徵稅。

These companies collectively control over 90% of the world's mining rigs, a level of consolidation rarely seen in the tech industry. While US miners handle almost 40% of global Bitcoin mining, they heavily rely on Chinese-engineered hardware, raising concerns about a “digital dependency trap.” Some critics worry about potential backdoors or compromised firmware in Chinese-built machines, even those assembled in the US.

這些公司共同控制著全球90%以上的採礦鑽機,這在技術行業很少見。儘管美國礦工處理了幾乎40%的全球比特幣開採,但他們在很大程度上依賴中文設計的硬件,這引起了人們對“數字依賴陷阱”的擔憂。一些批評家擔心在中國製造的機器中,即使是在美國組裝的機器,也可能會在中國建造的機器上進行固定。

While some US start-ups are attempting to design ASIC chips domestically, overcoming the established expertise and fabrication capabilities of Chinese firms remains a significant challenge.

儘管一些美國初創公司試圖在國內設計ASIC籌碼,但克服中國公司既定的專業知識和製造能力仍然是一個重大挑戰。

The Smarter Web Company's Bitcoin Bet

智能網絡公司的比特幣下注

On a different note, The Smarter Web Company, a London-listed technology firm, has been steadily increasing its Bitcoin reserves, signaling a deep commitment to its long-term crypto strategy. As of June 19, 2025, the company holds over 346 BTC, valued at over £27.2 million. This is part of their “10 Year Plan,” integrating Bitcoin into their corporate and financial structure. This involved accepting Bitcoin as payment and allocating treasury funds into Bitcoin over the long term.

另一方面,倫敦上市的技術公司Smarter Web公司一直在穩步增加其比特幣儲備,這表明對其長期加密戰略的堅定承諾。截至2025年6月19日,該公司持有346多個BTC,價值超過2720萬英鎊。這是他們“ 10年計劃”的一部分,它將比特幣整合到公司和財務結構中。從長遠來看,這涉及接受比特幣作為付款和將國庫資金分配給比特幣。

This move shows how companies are integrating Bitcoin into their financial operations, treating it as a core part of their financial backbone. The firm views Bitcoin as central to future financial systems and plans to continue integrating it into business operations.

此舉表明,公司如何將比特幣整合到其財務運營中,將其視為其財務骨幹的核心部分。該公司認為比特幣是未來金融系統的核心,併計劃繼續將其納入業務運營。

Regulatory Hurdles and ETF Developments

監管障礙和ETF發展

While Canada has seen the launch of XRP exchange-traded funds (ETFs), the prospect of a U.S.-based XRP ETF remains uncertain. The SEC continues to review applications amid Ripple's ongoing legal battle, with a status update expected in August 2025. Despite the regulatory hurdles, the increasing institutional interest in crypto ETFs highlights the demand for regulated and transparent platforms to access digital assets.

儘管加拿大已經啟動了XRP交易所貿易資金(ETF),但美國XRP ETF的前景仍然不確定。 SEC繼續在Ripple的持續法律鬥爭中審查申請,並預計將於2025年8月更新。儘管有監管障礙,但對Crypto ETF的機構興趣越來越多,凸顯了對訪問數字資產的監管和透明平台的需求。

Final Thoughts

最後的想法

From Chinese mining giants navigating tariffs to companies embracing Bitcoin as a treasury asset and regulatory landscapes evolving, the story of Bitcoin, China, and America is ever-changing. It's a wild ride, but who knows what the future holds? One thing's for sure: it'll be an interesting one!

從中國礦業巨頭涉足關稅到將比特幣作為國庫資產和監管景觀發展的公司,比特幣,中國和美國的故事正在不斷變化。這是一個瘋狂的旅程,但是誰知道未來的情況?可以肯定的是:這將是一個有趣的事情!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- PI網絡,KYC Sync和PI2Day:深入了解最新發展

- 2025-06-20 18:45:13

- 探索PI網絡上的最新KYC同步功能,其對用戶的影響以及圍繞即將舉行的PI2DAY活動的預期。

-

- Dogecoin的三角探戈:看漲的情緒會導致突破嗎?

- 2025-06-20 19:05:12

- Dogecoin形成了對稱的三角形模式,暗示了潛在的60%的價格轉移。看漲的情緒會佔上風並引發突破嗎?

-

- 以太坊,比特幣,價格預測:在動蕩的市場中導航加密潮

- 2025-06-20 19:05:12

- 在地緣政治緊張局勢和市場波動中探索以太坊,比特幣和價格預測的最新趨勢和見解。發現潛在的機會和風險。

-

- 以太坊,比特幣和價格預測遊戲:現在是什麼熱?

- 2025-06-20 18:25:13

- 在以太坊,比特幣和價格預測周圍導航加密蜂鳴聲。在不斷發展的加密景觀中獲得最新的見解和潛在機會。

-

- 比特幣價格突破即將發生?解碼加密市場的下一個大舉動

- 2025-06-20 18:45:13

- 比特幣在重大突破的邊緣嗎?分析最近的市場趨勢,監管發展和鯨魚活動,以預測BTC和Dogecoin的下一個方向。

-

- 加密,人工智能和投資:瀏覽金融的未來

- 2025-06-20 19:25:12

- 探索加密貨幣,AI和投資的融合,從AI驅動的貿易助手到NFT的不斷發展的景觀以及可互操作的區塊鏈的承諾。

-

-

- 甜蜜的懷舊:生日蛋糕的傳統如何在周年紀念日持續

- 2025-06-20 19:45:13

- 探索生日蛋糕,懷舊和周年慶典的持久吸引力。發現傳統在保持情感價值的同時如何發展。

-

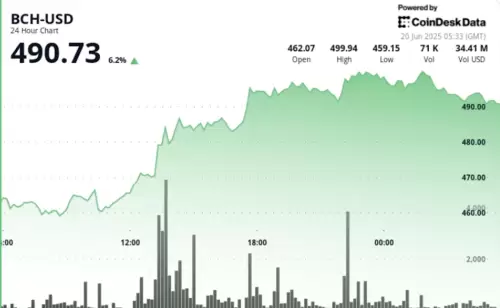

- 比特幣現金價格上漲:公牛以峰值收費!

- 2025-06-20 19:45:13

- 比特幣現金體驗由機構需求和交易量激增的巨大價格上漲,測試了關鍵的500美元電阻水平。