|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣BTC/USD在周一上漲3.52%,至87348.17美元,隨著機構購買和宏觀經濟的尾風的增強情緒,其籃板越過了關鍵阻力

Bitcoin BTC/USD rose 3.52% on Monday to $87,348.17, extending its rebound above a key resistance level as institutional buying and macroeconomic tailwinds boosted sentiment across crypto markets.

比特幣BTC/USD週一上漲了3.52%,至87,348.17美元,隨著機構購買和宏觀經濟的尾風增強了加密貨幣市場的促進的情緒,其籃板將其籃板擴大到關鍵阻力水平上。

Bitcoin price is now up 3.9% over the last seven days and has gained 3.91% over the past month.

現在,比特幣價格在過去7天中上漲了3.9%,在過去一個月中上漲了3.91%。

MicroStrategy’s $556M Bitcoin purchase cements dominance

MicroStrategy的5.56億美元比特幣採購水泥優勢

The latest leg higher in Bitcoin coincides with fresh accumulation by MicroStrategy Inc. MSTR, which disclosed in a regulatory filing on Monday that it had purchased 6,556 BTC between April 14 and April 20 for a total of $555.8 million—paying an average of $84,785 per coin.

比特幣中最新的腿與MicroStrategy Inc. MSTR的新鮮積累相吻合,該公司在周一的監管文件中披露,它在4月14日至4月20日之間購買了6,556 BTC,總計5.558億美元,總計為5.558億美元,平均每幣每股幣為84,785美元。

The purchase lifts MicroStrategy’s total holdings to 538,200 BTC, valued at roughly $46.8 billion at current prices, and gives the company an average cost basis of $67,766 per coin. It now controls roughly 77% of the 700,000 BTC held by publicly traded firms, solidifying its role as the largest corporate holder of Bitcoin.

此次購買將MicroStrategy的總持股量提高到538,200 BTC,其價值約為468億美元,並以目前的價格為每枚硬幣67,766美元的平均成本基礎。現在,它控制了公開交易公司持有的700,000 BTC中的77%,鞏固了其作為比特幣最大的公司持有人的作用。

The buy was funded through two stock sale programs, with the company issuing 1.755 million shares of Class A stock and 91,000 shares of preferred stock. Net proceeds totaled $555.5 million.

買入是通過兩項股票銷售計劃資助的,該公司發行了17.5萬股A類股票和91,000股優先股。淨收益總計55550萬美元。

Bitcoin breaks out as dollar weakens, inflation fears resurface

比特幣爆發隨著美元削弱,通貨膨脹恐懼浮出水面

BTC’s move above the $87,000 mark comes as the U.S. Dollar Index (DXY) dropped to a three-year low of 98.00 following reports that President Donald Trump is weighing the removal of Federal Reserve Chair Jerome Powell. The political pressure on the Fed has driven speculation around interest rate cuts and helped fuel demand for safe-haven assets like Bitcoin and gold.

BTC的舉動超過了87,000美元的大關,因為美元指數(DXY)在報導稱唐納德·特朗普總統正在權衡撤職杰羅姆·鮑威爾(Jerome Powell)的報導後,跌至98.00的三年低點。美聯儲的政治壓力引起了人們對降低利率的猜測,並有助於促進對比特幣和黃金等安全資產的需求。

Gold futures rose to fresh all-time highs above $3,400 per ounce on Monday, and traders pointed to Bitcoin’s renewed correlation with gold as a signal of its reemerging hedge narrative.

黃金期貨在周一的每盎司3,400美元以上,新鮮的高點上升,商人指出,比特幣與黃金的新相關性是其重新出現的對沖敘事的信號。

“A weaker dollar could draw renewed attention from American investors, highlighting bitcoin’s potential as a hedge against declining dollar value,” said crypto financial services firm Matrixport in a recent note.

Crypto Financial Services公司Matrixport在最近的一份票據中說:“較弱的美元可能會引起美國投資者的重新關注,從而強調了比特幣的潛力,這是對美元價值下降的對沖。”

Cost-basis clusters suggest $90K may be in play

成本基礎群集建議$ 90K可能正在玩

Bitcoin could face limited overhead resistance below $90,000 due to thin supply clusters in that range, suggesting that if momentum continues, BTC could push toward new highs relatively quickly before major profit-taking sets in.

由於該範圍內的供應簇薄,比特幣可能面臨90,000美元以下的高間接阻力性,這表明如果動量繼續下去,BTC可能會在大量的利潤籌集大量利潤之前迅速朝著新的高點朝著新的高點駛入。

Market data also reflects increased risk appetite across crypto markets, with small-cap tokens like Chainlink ENJ, Magic and Solana SOL outperforming. Bitcoin’s dominance currently sits near 54%, underscoring its role in leading broader market trends.

市場數據還反映了加密貨幣市場的風險胃口增加,而小型代幣(如Chainlink Eng,Magic and Solana Sol)的表現勝過。比特幣的統治地位目前位於54%的範圍內,強調了其在領先更廣泛的市場趨勢中的作用。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 該圖(GRT)集成了Chainlink的互操作性標準,以實現跨鏈傳輸

- 2025-05-22 04:40:12

- 該圖(GRT)具有集成鍊鍊接的互操作性標準,以實現其天然令牌的跨鏈傳輸。

-

-

-

- Coinbase的生物特徵數據收集重新點燃用戶隱私問題

- 2025-05-22 04:35:15

- 隨著對集中式平台的信心減弱,諸如最佳錢包之類的分散工具正在成為2025年最佳加密投資的主要競爭者。

-

- Sand將舉辦NFC官方的里斯本封閉海灘派對

- 2025-05-22 04:30:13

- 該活動標誌著6月4日至6日舉行的NFC峰會的結論,被描述為數字藝術,音樂和元文化的面對面慶祝活動。

-

- 比特幣短暫高高109K $ 109K,因為貿易戰緊迫

- 2025-05-22 04:30:13

- 隨著貿易戰緊張局勢緩解,比特幣最初在交易期間上漲至109,857美元

-

- 香港將穩定法案納入法律,管理菲亞特參考的stablecoins

- 2025-05-22 04:25:13

- 香港立法委員會已頒布了《穩定法案》,該法案將統治菲亞特引用的穩定者(FRS)。根據這項立法

-

- Solana Mobile宣布8月4日為其尋求者Web3智能手機啟動日期

- 2025-05-22 04:25:13

- Solana Mobile已於8月4日宣布,作為其Seeker Web3手機的發布日期。

-

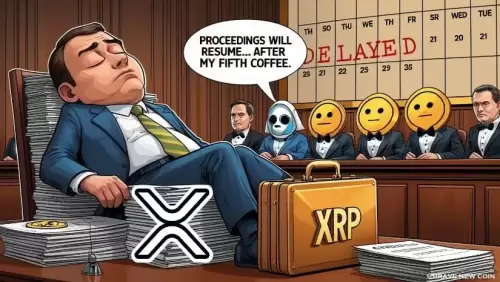

- 儘管SEC延遲,XRP價格分析指向看漲的突破

- 2025-05-22 04:20:13

- 美國SEC已推遲對21shares和Franklin Templeton Spot XRP的決定