|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5月23日,比特幣(BTC)的價格在5月23日達到了近112,000美元,比4月1日的低點獲得了50%。

Bitcoin (BTC) price hit a new all-time high of nearly $112,000 on May 23, gaining 50% from its April 1 lows. As BTC price now shows “signs of easing momentum” and begins to consolidate, here are three key takeaways from the latest Glassnode report.

5月23日,比特幣(BTC)的價格達到了新的歷史最高近112,000美元,比4月1日的低點獲得了50%。由於BTC價格現在顯示“放鬆勢頭的跡象”並開始合併,這是最新的GlassNode報告中的三個關鍵要點。

Bitcoin RSI drops 15% and is now below overbought threshold

比特幣RSI下降了15%,現在低於超買閾值

BTC’s recent run to $111,000 pushed the daily relative strength index (RSI) into the overbought zone at 79.6. However, “signs of easing momentum” have emerged as the RSI dropped by 15% to 67, market intelligence firm Glassnode said in its latest report.

BTC最近達到111,000美元的價格將每日的相對強度指數(RSI)推向了79.6的過失區。然而,市場情報公司Glass Node在其最新報告中說,隨著RSI的下降15%,“放鬆勢頭的跡象”已經出現。

The decreased buying pressure is also evident in the declining perpetual central bank balances (CVD), which went from -$425.4 million to hit lows of -$608.2 million, marking a 43% decline. This signals “stronger sell-side flows” and a more cautious stance among traders.

購買壓力的下降也很明顯,在永久性央行餘額(CVD)下降,該餘額從4.254億美元的低點達到-6.082億美元,標誌著下降了43%。這標誌著交易者的“更強大的賣方流”和更加謹慎的立場。

According to the chart below, Bitcoin futures open interest (OI) reached record highs and funding rates increased with BTC’s all-time highs, while the perpetual CVD trended lower.

根據下圖,比特幣期貨開放利息(OI)達到了創紀錄的最高點,隨著BTC的歷史高潮,比特幣期貨率提高了,而永恆的CVD則降低了。

Per the report, the decreased buying pressure is also evident in the declining perpetual central bank balances (CVD), which went from -$425.4 million to hit lows of -$608.2 million, marking a 43% decline. This signals “stronger sell-side flows” and a more cautious stance among traders.

根據報告,購買壓力的下降也很明顯,在永久性央行餘額(CVD)下降,該餘額從4.254億美元增長,達到6.082億美元,標誌下降了43%。這標誌著交易者的“更強大的賣方流”和更加謹慎的立場。

Bitcoin traders setting $150K price target

比特幣交易員設定$ 150k的價格目標

Data from Cointelegraph Markets Pro and TradingView showed Bitcoin trading at $109,600 on Friday morning. BTC price has closed above $106,000 the last seven days, reinforcing the importance of this level to buyers.

CoIntelegraph Markets Pro和TradingView的數據顯示,比特幣交易在周五上午為109,600美元。 BTC價格在過去的7天中已收盤超過106,000美元,這加強了此水平對買家的重要性。

“Bitcoin is still holding above the 106K level,” said analyst AlphaBTC in a May 27 X post.

分析師Alphabtc在5月27日的帖子中說:“比特幣仍保持在106K水平上。”

An accompanying chart showed Bitcoin trading in an ascending channel in the 12-hour timeframe, with a BTC price target above $120,000.

隨附的圖表顯示,在12小時的時間範圍內,比特幣在上升渠道中進行了交易,BTC的目標股價高於120,000美元。

In a May 22 X post depicting a similar technical setup, AlphaBTC said:

Alphabtc在5月22日X帖子中描繪了類似的技術設置,說:

"We might see a drop to 102K, but we'll bounce back up to 115K and beyond."

“我們可能會看到102K下降,但我們會反彈到115k及以後。”

Using Fibonacci retracement levels, Titan of Crypto predicted a cycle top of $135,000 if it repeated a 2024 pattern in the weekly timeframe.

加密貨幣的泰坦(Titan)使用斐波那契回撤水平,如果在每週的時間範圍內重複2024年模式,則可以預測循環頂部為135,000美元。

Fellow analyst Rekt Capital shared his Bitcoin price discovery roadmap, showing that BTC was “transitioning into Price Discovery Uptrend 2,” as shown in the chart below.

分析師Rekt Capital分享了他的比特幣價格發現路線圖,這表明BTC“過渡到價格發現上漲2”,如下圖所示。

This is similar to BTC’s price action between January 2024 and March 2024, when BTC/USD rallied more than 91% to its previous all-time highs above $73,000. According to the analyst, if the same scenario were to play out, BTC could reach its next peak of around $150,000.

這類似於BTC在2024年1月至2024年3月之間的價格行動,當時BTC/USD升至其以前的73,000美元以上的歷史最高點數超過91%。根據分析師的說法,如果要出現相同的情況,BTC可能會達到其下一個峰值約15萬美元。

As Cointelegraph reported, Bitcoin is looking for its next catalyst to reach the target of $155,000 after successfully retesting the key level at $106,000.

正如Cointelegraph所報導的那樣,比特幣正在尋找下一個催化劑,以達到155,000美元的目標,此前已成功地重新測試了106,000美元的關鍵水平。

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

本文不包含投資建議或建議。每個投資和交易舉動都涉及風險,讀者在做出決定時應進行自己的研究。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

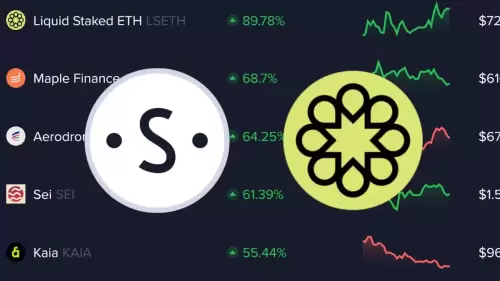

- 情感數據的隱藏寶石:您缺少的最佳性能加密

- 2025-07-01 23:10:15

- 揭開了由情感數據加油的最高表現的加密貨幣,包括隱藏的寶石和市場上意外的潮流。

-

-

- 雪崩,合作夥伴和比特幣:加密貨幣的紐約分鐘

- 2025-07-01 23:10:15

- 探索雪崩,夥伴關係和比特幣的交集,突出了加密貨幣領域的最新發展和未來趨勢。

-

-

- Zachxbt,Ripple和RLUSD採用:深度潛水

- 2025-07-01 22:30:12

- 分析Zachxbt的批評,Ripple的RLUSD採用策略以及對加密生態系統的更廣泛影響。

-

- Jasmycoin(Jasmy):看漲前景和價格預測

- 2025-07-01 23:15:11

- 根據最近的市場趨勢,分析師預測和關鍵支持水平,探索茉莉素幣的潛在看漲激增。日本的比特幣準備好突破了嗎?

-

- Open XP贖回樂觀:7月15日為OP代幣做好準備!

- 2025-07-01 22:35:12

- Superstacks於6月30日結束!從7月15日開始,通過官方應用程序兌換XP。

-

- 斧頭積分和排放減少:Axie Infinity中發生了什麼?

- 2025-07-01 22:55:12

- Axie Infinity一半軸軸承排放,影響通貨膨脹和APY。另外,新的基於收藏品還可以提高市場效率。