|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣碰到了一個新的ATH,但是在交換中激增會引起人們的注意。這是更正的前奏,還是只是玩遊戲的鯨魚?讓我們潛入紐約風格。

Alright, alright, alright. Bitcoin's been on a tear, hitting a fresh all-time high (ATH) of $123,218, pushing its market cap beyond $2.4 trillion, capiche? But hold on a sec, because the latest data is throwin' us a curveball. Exchange inflows have spiked, and that's got some folks sweatin'. What's the deal?

好吧,好吧,好吧。比特幣一直流淚,達到了新鮮的高峰(ATH)123,218美元,將其市值超過2.4萬億美元,Capiche?但是請等待SEC,因為最新數據是將我們拋出的曲線球。交換流入已經飆升了,有些人汗水。有什麼交易?

The Numbers Don't Lie (But They Can Be Confusing)

這些數字不撒謊(但它們可能會令人困惑)

CryptoQuant data from July 15th shows Bitcoin exchange inflows jumpin' from 54.151K BTC to 63.1K BTC in just 24 hours – a nearly 3% bump. This happened right after Bitcoin peaked at that sweet $123,218 mark on July 14th. So, what does it all mean?

從7月15日開始的加密數據顯示,比特幣交換的流入從54.151k BTC跳躍到24小時內的63.1k BTC,近3%。這是在比特幣在7月14日達到$ 123,218的最高$ 123,218大關之後發生的。那麼,這意味著什麼?

Well, BTC exchange reserves also saw a +0.91% increase, settling at 2.265M. Netflow was positive, up 3.73% to 21.81K BTC. Even the top 10 exchange inflow metric showed a 3.17% increase to 3.656K BTC. Numbers, numbers, everywhere! But the takeaway is clear: more Bitcoin is headin' to exchanges.

好吧,BTC交換儲備還增加了0.91%,定居於226.5m。 NetFlow為正,上升了3.73%至21.81K BTC。即使是前十名的交換流入度量標準也顯示出3.17%的增長到3.656K BTC。數字,數字,到處都是!但是要點很清楚:更多的比特幣正在交流。

Whale Watching: Profit-Taking or Just Playin' the Game?

觀看鯨魚:獲利還是只是玩遊戲?

CryptoQuant analysts are whisperin' about “bullish whale activity,” but also warnin' that this surge in inflows could mean a “local top.” Translation? A healthy price correction might be on the horizon, or at least some near-term consolidation. One analyst even pointed to a wallet dormant for over 14 years that offloaded 20K BTC onto exchanges.

隱性分析師對“看漲鯨魚活動”的竊竊私語,但也警告說,這種流入的激增可能意味著“當地的上衣”。翻譯?健康的價格校正可能即將到來,或者至少是一些近期合併。一位分析師甚至指出了一個已有14年以上的錢包,將20K BTC卸載到交易所上。

Another contributor chimed in, sayin' that this surge in BTC deposits to exchanges is likely the work of those big-money investors. Apparently, whales deposited 1.8K BTC to Binance in a single day, with over 35% of the transactions clocking in at over $1 million. These whales, they're leveraging that sweet, sweet liquidity to speculate – either to cash in on those profits or hedge against market volatility. Classic.

另一個貢獻者說,“ BTC存款在交流中的激增很可能是這些大型投資者的工作。顯然,鯨魚在一天之內將1.8K BTC存入二元,超過35%的交易收入超過100萬美元。這些鯨魚,他們利用這種甜美,甜美的流動性來推測 - 要么兌現這些利潤或對沖市場波動。經典的。

The Bullish Counterpoint (Don't Panic Just Yet)

看漲對立(暫時不要驚慌)

But hold your horses! Not everyone's singin' the blues. Despite the warning signs, the overall market structure is still lookin' pretty bullish. Long-term holders? They're sittin' tight on their BTC, not lookin' to sell at these prices. Plus, spot Bitcoin ETFs are still attractin' strong capital – $2.72 billion in net inflows for the week ending July 11th. That's some serious institutional interest, right there.

但是握住你的馬!並不是每個人都唱歌的藍調。儘管有警告信號,但總體市場結構仍然看起來很看好。長期持有人?他們很緊緊地抓住自己的BTC,而不是以這些價格出售。另外,現貨比特幣ETF仍然吸引著強大的資本 - 截至7月11日的一周的淨流入量為27.2億美元。那是一些嚴重的機構興趣。

And here's a kicker: one analyst observed that daily BTC exchange inflows actually plummeted to their lowest since April 2015 on July 11th, droppin' to 18K BTC. Seems like the big boys are sendin' fewer coins to exchanges, signaling less selling pressure. The market hasn't even entered “overheating mode” yet. So, chill out, maybe?

這是一個踢腳:一位分析師觀察到,每日BTC交換的流入實際上跌至2015年4月11日自7月11日以來的最低點,下降到18k BTC。好像大男孩在交流中少了硬幣,這表明銷售壓力較小。市場甚至還沒有進入“過熱模式”。所以,放鬆一下,也許?

My Two Satoshis

我的兩個satoshis

Look, the Bitcoin market is like a New York City street – always somethin' happenin'. This surge in exchange inflows? It could be a temporary blip, a sign of profit-taking, or whales repositioning. The data is a bit of a mixed bag. Personally, I'm leanin' towards a bit of both. Some profit-taking is natural after such a massive rally, but the underlying fundamentals still look strong. I'm keepin' an eye on those ETF inflows and long-term holder behavior. If they stay strong, this could just be a minor speed bump on the road to even higher highs.

看,比特幣市場就像紐約市的街道一樣 - 總是會發生。這種交換流入的激增?這可能是臨時的碎片,是獲利的標誌或重新定位的鯨魚。數據有點混合袋。就個人而言,我傾向於兩者。經過如此巨大的集會,一些盈利是很自然的,但是基本的基本面看起來仍然很強。我一直關注那些ETF流入和長期持有人的行為。如果它們保持強大,這可能只是通往更高高點的道路上的較小速度。

So, What's Next?

那麼,下一步是什麼?

Bottom line? Stay informed, don't panic, and remember that in the wild world of crypto, anything can happen. Keep an eye on those exchange inflows, whale activity, and ETF numbers. And hey, maybe grab a slice of pizza and enjoy the ride. It's gonna be a wild one, folks!

底線?保持知情,不要驚慌,請記住,在加密貨幣的野生世界中,一切都會發生。密切關注這些交換流入,鯨魚活動和ETF數字。嘿,也許抓住一片披薩,享受旅程。伙計們,這將是一個瘋狂的人!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

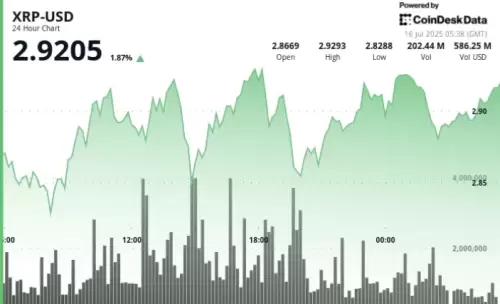

- XRP價格:較高的低點暗示了潛在的趨勢變化?

- 2025-07-16 15:10:12

- XRP價格分析顯示合併,潛在的突破和雄心勃勃的價格目標。較高的低點會導致趨勢重大變化嗎?

-

- 比特幣,加密賭場和獎金:紐約人的大獎指南

- 2025-07-16 15:15:12

- 這份綜合指南深入研究比特幣賭場的世界。了解最好的加密賭場,多汁的獎金以及2025年的最新趨勢。

-

- 比特幣,加密貨幣和投資:導航2025年景觀

- 2025-07-16 15:30:12

- 探索比特幣,加密貨幣和投資的最新趨勢。從Altcoin突破到機構採用,請發現2025年的關鍵見解。

-

- 比特幣,德意志銀行和主流採用:新時代?

- 2025-07-16 14:30:13

- 德意志銀行的分析表明,由機構採用,法規清晰度和技術進步驅動,比特幣正在成熟,這表明潛在轉移到主流。

-

- 比特幣的ETF需求和機構動力:紐約市的觀點

- 2025-07-16 14:50:12

- ETF需求和機構勢頭助長了比特幣的激增。了解有關市場趨勢,潛在風險以及BTC下一步的見解。

-

- 比特幣的看漲奔跑:需求激增,更正不太可能嗎?

- 2025-07-16 12:30:12

- 比特幣要進行更正嗎?專家們衡量需求的飆升,消失的供應以及持續上升勢頭的潛力。

-

- 摩根大通,區塊鍊和Stablecoins:華爾街革命?

- 2025-07-16 14:50:12

- 摩根大通(JPMorgan)涉足穩定幣,這表明傳統財務發生了重大轉變。這是金錢的未來還是短暫的實驗?

-

-

- 狗狗幣到月球上?分析Doge飆升和飆升的潛力!

- 2025-07-16 14:55:12

- 隨著分析師的辯論是否可以飆升,Dogecoin的價格變動正在受到審查。鯨魚積累,模因硬幣競爭和市場趨勢等因素是關鍵。