|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索比特幣,Altcoins和Defi的最新趨勢,包括2024年及以後的監管影響和新興投資策略。

The crypto world never sleeps! From Bitcoin's price peaks to altcoin surges and DeFi regulatory shifts, there's always something brewing. Let's dive into the latest happenings in Bitcoin, altcoins, and DeFi.

加密世界永遠不會睡覺!從比特幣的價格高峰到Altcoin的飆升和Defi監管變化,總會有一些釀造。讓我們研究比特幣,Altcoins和Defi的最新事件。

Bitcoin's Bumpy Ride: $120K and Beyond?

比特幣的顛簸:$ 120K及以後?

Bitcoin recently flirted with $123,000, hitting a new all-time high before experiencing a bit of a pullback. Despite the volatility, institutional interest remains strong, and many analysts are still eyeing a potential move towards $120,000. Key factors include continued institutional support, favorable market positioning, and broader macro-level developments.

比特幣最近以123,000美元的價格調情,在經歷了一些回調之前達到了新的歷史最高水平。儘管有波動性,但機構的興趣仍然很大,許多分析師仍在朝著120,000美元的可能性轉移。關鍵因素包括持續的機構支持,有利的市場定位以及更廣泛的宏觀發展。

However, some analysts suggest caution. CryptoQuant data highlighted a spike in Bitcoin exchange inflows around the $123,000 peak, signaling potential profit-taking by whales and a possible price correction. It's all part of the game – profit realization, weak positions exiting, and finding a new base for future growth.

但是,一些分析師建議謹慎。加密數據強調了比特幣交換的峰值流入量約為123,000美元的峰值,這表明了鯨魚的潛在利潤和可能的價格校正。這是遊戲的全部一部分 - 利潤實現,弱勢地位退出以及為未來增長的新基礎找到新的基礎。

Altcoins Heating Up: From HBAR to SHIB and Beyond

山寨幣加熱:從HBAR到Shib及以後

While Bitcoin grabs headlines, the altcoin market is buzzing with activity. Coins like HBAR, Solana (SOL), and XLM are gaining momentum, along with the ever-popular Shiba Inu (SHIB). This surge is fueled by a mix of factors, including early-stage altcoin rotation, renewed community hype (thanks, SHIB!), and ecosystem partnerships (HBAR, we're looking at you!).

儘管比特幣抓住了頭條新聞,但山寨幣市場卻隨著活動而嗡嗡作響。 HBAR,Solana(Sol)和XLM等硬幣以及廣受歡迎的Shiba Inu(Shib)的動力。這一激增是由於各種因素的混合所推動的,包括早期的山寨幣輪換,新的社區炒作(謝謝,Shib!)和生態系統夥伴關係(HBAR,我們正在看著您!)。

One interesting trend is the rise of utility-driven meme coins. Pepeto, for example, is trying to stand out by offering functionality, audited tech, and staking infrastructure. With over $5.5 million raised in presale and more than 31 trillion tokens staked, Pepeto aims to combine meme branding with real-world utility. Will it be the next x100 meme coin? Only time will tell.

一個有趣的趨勢是公用事業驅動的模因硬幣的興起。例如,Pepeto試圖通過提供功能,審核技術和積分基礎架構來脫穎而出。 Pepeto旨在將Meme品牌與現實世界實用程序相結合,籌集了超過550萬美元的預售和超過31萬億個令牌。這是下一個X100模因硬幣嗎?只有時間會證明。

DeFi's Regulatory Reckoning: The GENIUS Act and Yield-Bearing Stablecoins

Defi的監管估算:天才法案和承受屈服的穩定者

The GENIUS Act could be a game-changer for DeFi. While it aims to provide regulatory clarity for stablecoins, it also draws a hard line against yield-bearing stablecoins. The Act explicitly bans stablecoins from paying interest or yield, pushing DeFi to evolve or risk falling into regulatory shadows. This move is intended to protect traditional banks by preventing capital flight to yield-generating stablecoins.

天才行為可能是Defi的遊戲規則改變者。雖然它旨在為穩定蛋白提供調節性清晰度,但它也為抗屈服的穩定劑提供了一條硬線。該法案明確禁止穩定的穩定者支付利息或收益率,促使Defi進化或冒險落入監管陰影中。此舉旨在通過防止資本飛行產生產生穩定的穩定劑來保護傳統銀行。

This shift might actually be a good thing for DeFi in the long run. Without the ability to directly embed yield into stablecoins, protocols will be forced to build yield externally through delta-neutral strategies, arbitrage, and liquidity pools. This could lead to more transparent and resilient risk engines. Protocols that embrace smart compliance, with AML rails and attestation layers, will be well-positioned to attract institutional liquidity.

從長遠來看,這種轉變實際上對Defi來說可能是一件好事。如果沒有直接將產量嵌入穩定的能力,協議將被迫通過三角中不良的策略,套利和流動性池在外部建立產量。這可能會導致更透明和彈性的風險引擎。符合AML軌道和證明層的符合智能合規性的協議將有充分的位置,以吸引機構流動性。

Looking Ahead: Navigating the Crypto Landscape in 2024 and Beyond

展望未來:2024年及以後的加密貨幣景觀

The crypto market is a dynamic and ever-changing beast. As we move further into 2024 and beyond, it's crucial to stay informed and adapt to the evolving landscape. Key takeaways:

加密市場是一種充滿活力且不斷變化的野獸。隨著我們進一步發展到2024年及以後,保持知情並適應不斷發展的景觀至關重要。關鍵要點:

- Bitcoin: Keep an eye on institutional support and macro-level developments. Be prepared for potential price corrections and consolidation periods.

- Altcoins: Explore altcoins with solid roadmaps and real-world utility. Don't underestimate the power of community hype, but look beyond the memes.

- DeFi: Pay close attention to regulatory developments and the impact on yield-bearing stablecoins. Focus on protocols that prioritize transparency, compliance, and resilient risk management.

So, buckle up, crypto enthusiasts! It's going to be an interesting ride. Keep your eyes peeled, do your research, and remember that in the world of crypto, anything is possible!

因此,搭扣,加密愛好者!這將是一個有趣的旅程。保持眼睛剝落,進行研究,並記住,在加密世界中,一切皆有可能!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

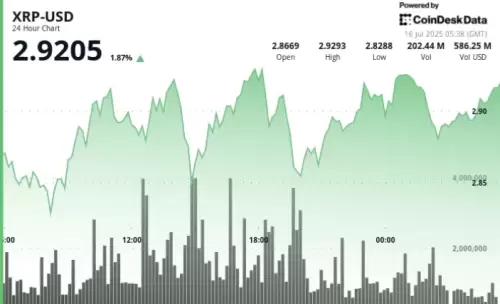

- XRP價格:較高的低點暗示了潛在的趨勢變化?

- 2025-07-16 15:10:12

- XRP價格分析顯示合併,潛在的突破和雄心勃勃的價格目標。較高的低點會導致趨勢重大變化嗎?

-

- 比特幣,加密賭場和獎金:紐約人的大獎指南

- 2025-07-16 15:15:12

- 這份綜合指南深入研究比特幣賭場的世界。了解最好的加密賭場,多汁的獎金以及2025年的最新趨勢。

-

- 比特幣,加密貨幣和投資:導航2025年景觀

- 2025-07-16 15:30:12

- 探索比特幣,加密貨幣和投資的最新趨勢。從Altcoin突破到機構採用,請發現2025年的關鍵見解。

-

- 比特幣,德意志銀行和主流採用:新時代?

- 2025-07-16 14:30:13

- 德意志銀行的分析表明,由機構採用,法規清晰度和技術進步驅動,比特幣正在成熟,這表明潛在轉移到主流。

-

- 比特幣的ETF需求和機構動力:紐約市的觀點

- 2025-07-16 14:50:12

- ETF需求和機構勢頭助長了比特幣的激增。了解有關市場趨勢,潛在風險以及BTC下一步的見解。

-

- 比特幣的看漲奔跑:需求激增,更正不太可能嗎?

- 2025-07-16 12:30:12

- 比特幣要進行更正嗎?專家們衡量需求的飆升,消失的供應以及持續上升勢頭的潛力。

-

- 摩根大通,區塊鍊和Stablecoins:華爾街革命?

- 2025-07-16 14:50:12

- 摩根大通(JPMorgan)涉足穩定幣,這表明傳統財務發生了重大轉變。這是金錢的未來還是短暫的實驗?

-

-

- 狗狗幣到月球上?分析Doge飆升和飆升的潛力!

- 2025-07-16 14:55:12

- 隨著分析師的辯論是否可以飆升,Dogecoin的價格變動正在受到審查。鯨魚積累,模因硬幣競爭和市場趨勢等因素是關鍵。