|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

探索Binance如何領導指控,以彌合Tradfi和Crypto之間的差距,適應法規並推動Web3創新。

The convergence of traditional finance (TradFi) and cryptocurrency is rapidly reshaping the financial landscape. Binance, under the leadership of CEO Richard Teng, is at the forefront of this transformation, strategically positioning itself as a key player in this evolving ecosystem.

傳統金融(TradFI)和加密貨幣的融合正在迅速重塑金融領域。 Binance在首席執行官Richard Teng的領導下處於這種轉變的最前沿,從戰略上將自己定位為這個不斷發展的生態系統的關鍵參與者。

Binance: A Bridge Between TradFi and Crypto

Binance:Tradfi和Crypto之間的橋樑

Binance is making significant strides in attracting TradFi users by offering deep liquidity, corporate-friendly tools, and secure, low-fee trading options. Richard Teng emphasizes that Binance's platform is designed to be accessible and efficient for newcomers to the crypto world. With over 270 million users globally, Binance has established itself as a trusted platform, providing robust security measures and round-the-clock system monitoring. Fast settlements, often completed on the same day or even instantly, align with the expectations of traditional finance systems, making the transition smoother for TradFi users.

Binance通過提供深厚的流動性,對公司友好的工具以及安全,低收費的交易選項,在吸引Tradfi用戶方面取得了長足的進步。理查德·滕(Richard Teng)強調,Binance的平台旨在對加密貨幣世界的新移民訪問和高效。全球擁有超過2.7億用戶,Binance已將自己確立為一個值得信賴的平台,提供了強大的安全措施和全天候的系統監控。快速定居點通常在同一天甚至立即完成,與傳統金融系統的期望保持一致,從而使TradFi用戶的過渡更加順暢。

Adapting to Regulations and Embracing Web3

適應法規並接受Web3

Binance's commitment to regulatory compliance is a crucial factor in gaining the confidence of TradFi institutions. The platform actively works with global regulators to establish clear and fair standards. Beyond trading, Binance is heavily investing in Web3 development, supporting innovation across the decentralized ecosystem. By providing enterprises with the tools and liquidity they need, Binance is fostering growth in the blockchain space.

Binance對監管合規性的承諾是獲得Tradfi機構信心的關鍵因素。該平台與全球監管機構積極合作,建立清晰明顯的標準。除了交易之外,Binance還大量投資於Web3開發,支持分散的生態系統的創新。通過為企業提供所需的工具和流動性,binance正在促進區塊鏈領域的增長。

Bitcoin's Evolving Role

比特幣不斷發展的角色

Recent analysis indicates that Bitcoin is increasingly correlated with the U.S. Dollar Index (DXY). This suggests that Bitcoin is no longer solely a hedge against the dollar but is becoming a macro asset influenced by the same forces that affect traditional currencies. The rise of stablecoins and institutional inflows into Bitcoin ETFs further solidify Bitcoin's integration into the broader financial system.

最近的分析表明,比特幣與美元指數(DXY)越來越相關。這表明比特幣不再僅僅是對美元的樹籬,而是正受到影響傳統貨幣相同力量的宏觀資產。穩定幣和機構流入比特幣ETF的興起進一步鞏固了比特幣的整合到更廣泛的金融體系中。

Bybit's TradFi Integration

Bybit的Tradfi集成

Bybit, another major cryptocurrency exchange, has launched Bybit TradFi, offering trading in metals, oil, indices, stocks, and forex alongside crypto. This move allows traders to diversify their portfolios across traditional and digital assets within a single platform. The TradFi Fusion Cup, a trading competition with a 1,000,000 USDT prize pool, highlights Bybit's commitment to bridging the gap between TradFi and crypto.

另一個主要的加密貨幣交易所Bybit啟動了Bybit Tradfi,並與Crypto一起提供金屬,石油,指數,股票和外匯交易。此舉使交易者能夠在單個平台內通過傳統和數字資產進行多樣化的投資組合。 Tradfi Fusion Cup是一項具有1,000,000 USDT獎金的交易競賽,重點介紹Bybit致力於彌合Tradfi和Crypto之間的差距。

Strategy's Bitcoin Accumulation

策略的比特幣積累

Strategy, a significant corporate holder of Bitcoin, continues to expand its Bitcoin holdings. Recent acquisitions have increased the company's total Bitcoin to 592,345 BTC, reflecting a strong belief in Bitcoin's long-term value. Other companies, such as Semler Scientific and Metaplanet, are also pursuing aggressive Bitcoin acquisition strategies, indicating a growing trend of institutional adoption.

戰略是比特幣的重要公司持有人,繼續擴大其比特幣持有量。最近的收購將公司的總比特幣提高到592,345 BTC,這反映了對比特幣長期價值的強烈信念。其他公司,例如Semler Scientific和Metaplanet,也正在追求積極的比特幣採集策略,這表明機構採用的趨勢不斷增長。

Final Thoughts

最後的想法

The integration of Binance, TradFi, and strategic Bitcoin investments signals a transformative shift in the financial landscape. As crypto becomes more intertwined with traditional finance, the opportunities for innovation and growth are boundless. So, buckle up and get ready for an exciting ride as the lines between TradFi and DeFi continue to blur!

Binance,Tradfi和戰略比特幣投資的整合標誌著金融格局的變革性轉變。隨著加密貨幣與傳統金融的交織在一起,創新和增長的機會是無限的。因此,隨著Tradfi和Defi之間的界限繼續變得模糊,扣緊並準備好進行激動人心的旅程!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 加密貨幣:破壞性的購買超越炒作

- 2025-06-25 04:45:12

- 忘記短暫的模因硬幣。發現像Little Pepe,Unstake和渲染的加密貨幣一樣,它們具有真正的實用性和破壞性的潛力。

-

-

-

- JPMORGAN,區塊鍊和JPMD代幣:鏈融資的量子飛躍?

- 2025-06-25 05:05:13

- 探索Coinbase的基本區塊鍊和BTQ的量子安全穩定解決方案上的JPMorgan的JPMD令牌飛行員。

-

-

- Hedera Price:趨勢逆轉還是下降趨勢延續?

- 2025-06-25 06:05:12

- Hedera(HBAR)是否準備好看好逆轉,還是下降趨勢會持續存在?分析最新的價格動作和關鍵阻力水平。

-

- 比特幣,加密,停火:救濟集會還是停頓?

- 2025-06-25 05:12:16

- 特朗普的停火宣布引發了加密集會,但這是可持續的嗎?我們深入研究了最新的趨勢,從比特幣的激增到模因硬幣躁狂症,並帶有紐約的扭曲。

-

- 加密貨幣將於2025年6月進行爆炸性增長:您需要知道什麼

- 2025-06-25 05:12:16

- 獲取在2025年6月能夠爆炸性增長的加密貨幣上的內部勺子。

-

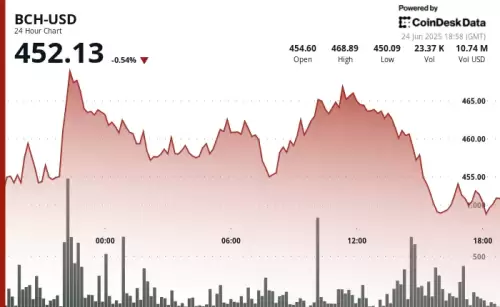

- 比特幣現金(BCH)公牛眼鑰匙阻力水平:它會突破嗎?

- 2025-06-25 05:32:14

- 比特幣現金(BCH)又重新亮相,測試了關鍵阻力水平。它會維持其動力並突破嗎?讓我們深入研究分析。