|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

散戶多頭/空頭比率熱圖揭示了山寨幣定位的明顯趨勢。多頭部位中領先的是 SUI 和 SOL 等資產

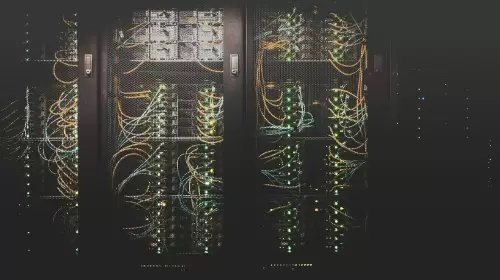

![比特幣 [BTC] 多空比率發出謹慎訊號,山寨幣反彈 比特幣 [BTC] 多空比率發出謹慎訊號,山寨幣反彈](/uploads/2025/01/13/cryptocurrencies-news/articles/altcoins-rally-bitcoin-btc-short-ratio-signals-caution/image-1.jpg)

CryptoQuant’s retail long/short ratio heatmap provided valuable insights into the positioning of traders in the altcoin market.

CryptoQuant 的零售多/空比率熱圖為交易者在山寨幣市場中的定位提供了寶貴的見解。

As highlighted in the analysis, assets like SUI and SOL enjoyed sustained green zones, indicating a collective bullish sentiment among retail traders.

正如分析中所強調的,SUI 和 SOL 等資產持續處於綠色區域,顯示散戶交易者的集體看漲情緒。

This bullish outlook was further supported by sustained retail long positioning over the past seven days.

過去 7 天持續的散戶多頭部位進一步支撐了這種看漲前景。

In contrast, coins like TRX and XRP exhibited higher levels of short interest, suggesting traders anticipated downside movements in these assets.

相較之下,TRX 和 XRP 等代幣的空頭興趣程度較高,這表明交易者預計這些資產將出現下行走勢。

Santiment’s social volume data also provided an interesting perspective.

Santiment 的社交量數據也提供了一個有趣的視角。

As evident on the chart, while Ethereum [ETH] maintained high engagement levels, SUI and Solana have been rapidly closing the gap, buoyed by network developments and community-driven hype.

從圖表中可以明顯看出,雖然以太坊 [ETH] 保持了較高的參與度,但在網路發展和社群驅動的炒作的推動下,SUI 和 Solana 正在迅速縮小差距。

Altcoins like DOT and AGLD also saw spikes in social volume, indicating their rising popularity in trading discussions.

DOT 和 AGLD 等山寨幣的社交量也出現激增,顯示它們在交易討論中越來越受歡迎。

Despite the optimism around altcoins, Bitcoin appeared to be in a neutral to slightly bearish zone.

儘管人們對山寨幣持樂觀態度,但比特幣似乎處於中性至略微看跌的區域。

The average retail long/short ratio for BTC was close to parity, reflecting caution among traders amid slower price momentum.

比特幣的平均零售多頭/空頭比率接近平價,反映出交易者在價格勢頭放緩的情況下保持謹慎。

This divergence is evidence of evolving market dynamics – Traders are seeking higher risk-to-reward setups in altcoins while Bitcoin’s dominance wanes in speculative fervor.

這種差異是市場動態不斷變化的證據——交易者正在山寨幣中尋求更高的風險回報設置,而比特幣的主導地位則因投機熱情而減弱。

For now, the altcoin rally seems to be driven by a mix of speculative retail interest and improving social sentiment.

目前,山寨幣的上漲似乎是由散戶投機興趣和社會情緒改善共同推動的。

Bitcoin’s long/short ratio signals caution

比特幣的多頭/空頭比率發出謹慎訊號

Bitcoin’s neutral long/short ratio highlighted its alignment with macroeconomic uncertainty and traders’ preference for stability.

比特幣的中性多空比率凸顯了其與宏觀經濟不確定性和交易者對穩定性的偏好的一致性。

With slower price momentum and a lack of decisive trend signals, participants appeared hesitant to take large directional bets, favoring hedging strategies over speculative plays.

由於價格動能放緩且缺乏決定性的趨勢訊號,參與者似乎不願進行大額定向押注,更傾向於對沖策略而不是投機策略。

Alphractal’s Whale v. Retail Delta heatmap revealed muted whale interest in BTC compared to other altcoins, indicating that large holders were not significantly accumulating or offloading.

Alphractal 的 Whale v. Retail Delta 熱圖顯示,與其他山寨幣相比,鯨魚對 BTC 的興趣較低,這表明大戶並未大量增持或拋售比特幣。

Instead, their behavior seemed to be in line with maintaining stability rather than amplifying volatility.

相反,他們的行為似乎符合維持穩定而不是放大波動性。

This, in sharp contrast with coins like TRX or GALA, where pronounced retail activity – often unbalanced by whale trades – fuels sharper price swings.

這與 TRX 或 GALA 等代幣形成鮮明對比,這些代幣中明顯的零售活動(通常因鯨魚交易而失衡)加劇了價格波動。

Diverging optimism – Altcoins and market stability

樂觀情緒分歧-山寨幣和市場穩定

The uneven sentiment across altcoins suggested the market is at a crossroads.

山寨幣的情緒參差不齊表明市場正處於十字路口。

Coins like SUI and SOL saw concentrated bullish momentum, yet this optimism isn’t universal.

像 SUI 和 SOL 這樣的代幣看到了集中的看漲勢頭,但這種樂觀情緒並不普遍。

Short positioning in assets such as TRX and XRP alluded to growing skepticism in other pockets of the market.

TRX 和 XRP 等資產的空頭部位暗示了市場其他領域日益增長的懷疑情緒。

This bifurcation seems to be hinting at a potential liquidity tug-of-war, where overly optimistic plays in some altcoins might amplify volatility spillovers.

這種分歧似乎暗示著潛在的流動性拉鋸戰,一些山寨幣的過度樂觀可能會放大波動性外溢效應。

For market stability, this fragmented sentiment introduces risks.

對於市場穩定來說,這種分散的情緒會帶來風險。

If speculative euphoria in certain altcoins unwinds abruptly, it could dampen broader confidence and lead to contagion effects.

如果某些山寨幣的投機熱情突然消散,可能會削弱更廣泛的信心並導致蔓延效應。

Conversely, sustained optimism in select assets could attract sidelined capital, fueling a wider rally.

相反,特定資產的持續樂觀情緒可能會吸引觀望資本,從而推動更廣泛的反彈。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 朝鮮的網絡情節:通過虛擬搶劫案為武器開發提供資金

- 2025-07-01 10:30:12

- 朝鮮國民因竊取超過90萬美元的虛擬貨幣以資助武器計劃而被起訴。深入了解平壤的非法網絡計劃。

-

- 被低估的加密代幣:計算令牌竊取節目嗎?

- 2025-07-01 10:50:12

- 計算令牌正在為其在AI和分散計算中的潛力而受到關注,但是與GameFI和傳統財務相比,它們仍然被低估了嗎?

-

-

-

-

- Neo Pepe:這是您一直在等待的加密機會嗎?

- 2025-07-01 11:10:12

- Neo Pepe成為最佳Pepe硬幣的吸引力,深入其預售,令牌交易約為0.07美元。這是您一直在等待的加密機會嗎?

-

-

- Stablecoin攤牌:USD1與USDC和監管隆隆聲

- 2025-07-01 09:10:12

- USD1的崛起挑戰USDC,引發了政治陰謀的監管辯論。這是Stablecoins的未來還是短暫的時刻?

-

- XRP,華爾街和比特幣模型:機構加密的新時代?

- 2025-07-01 09:30:12

- XRP是華爾街的新寵兒嗎?公司正在圍繞XRP構建其國庫,模仿MicroStrategy的比特幣戰略。發現趨勢及其含義。