|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A16Z將COMP代幣轉移到Coinbase Prime Sparks Plastulation。這是戰略重新定位還是其他東西?讓我們潛水。

AI16Z, COMP Tokens, and Coinbase Prime: Decoding the Latest Moves

AI16Z,COMP令牌和Coinbase Prime:解碼最新動作

The movement of COMP tokens by AI16Z to Coinbase Prime has the crypto world buzzing. Valued at millions, this transfer raises critical questions about AI16Z's strategy and the future of Compound's governance token.

AI16Z對Coinbase Prime的COMP代幣的運動引起了加密世界的嗡嗡聲。這種轉會價值數百萬,對AI16Z的戰略和化合物治理令牌的未來提出了關鍵問題。

The AI16Z Shuffle: What's the Deal?

AI16Z隨機散裝:有什麼交易?

Recently, AI16Z, a venture capital heavyweight, moved 300,000 COMP tokens (roughly $13.75 million) to Coinbase Prime. This isn't just pocket change; it's a statement. AI16Z, an early backer of Compound, still holds a hefty chunk of COMP, signaling continued faith in the protocol. But why the transfer to Coinbase Prime?

最近,風險投資重量級的AI16Z將300,000個COMP令牌(約1,375萬美元)移至Coinbase Prime。這不僅僅是零錢;這是一個陳述。 AI16Z是複合的早期支持者,仍然擁有一大筆錢的補充,表明了對協議的持續信心。但是為什麼轉移到Coinbase Prime?

Coinbase Prime: The Institutional Playground

Coinbase Prime:機構操場

Coinbase Prime isn't your average crypto exchange. It's tailored for institutional investors, offering advanced trading tools, secure storage, and regulatory compliance. By parking COMP tokens there, AI16Z gains access to sophisticated asset management tools. This could mean a potential sale without disrupting the market, strategic allocations, or even using the tokens as collateral.

Coinbase Prime不是您的平均加密交易所。它針對機構投資者量身定制,提供高級交易工具,安全存儲和法規合規性。通過在此處停車代幣,AI16Z可獲得對複雜資產管理工具的訪問權限。這可能意味著潛在的銷售,而不會破壞市場,戰略分配,甚至使用代幣作為抵押品。

COMP Tokens: More Than Just a Pretty Asset

補償令牌:不僅僅是一個漂亮的資產

COMP isn't just another token; it's the key to governing the Compound protocol. As a governance token, it allows holders to propose and vote on changes. AI16Z's involvement underscores COMP's importance in DeFi. This move could influence market sentiment and shape the future of DeFi lending. The transfer highlights the critical role of institutional platforms like Coinbase Prime in facilitating large-scale digital asset management. It also underscores the continued relevance of governance tokens like COMP within decentralized ecosystems.

不僅僅是另一個令牌;這是管理複合協議的關鍵。作為治理令牌,它允許持有人提出和投票對變更。 AI16Z的參與強調了Comp在DEFI中的重要性。這一舉動可能會影響市場情緒並塑造Defi Lending的未來。轉會突出了Coinbase Prime等機構平台在促進大規模數字資產管理中的關鍵作用。它還強調了治理令牌在分散生態系統中的持續相關性。

Reading the Tea Leaves: What Does it All Mean?

閱讀茶葉:這意味著什麼?

Is AI16Z preparing to cash out? Probably not entirely. Their remaining stake suggests a long-term vision. However, this transfer could indicate a strategic repositioning, perhaps hedging against market volatility or preparing for new DeFi initiatives. On-chain data shows heightened retail speculation coupled with declining whale activity. The bearish sentiment on Binance, with shorts outweighing longs, adds another layer of complexity. Therefore, unless COMP breaks above key resistance levels with strong volume, this could be more of a redistribution event than a breakout setup.

AI16Z是否準備兌現?可能不是完全。他們剩下的股份表明了長期的願景。但是,這種轉移可能表明戰略性重新定位,也許是針對市場波動或為新的Defi計劃做準備。鏈上數據顯示,零售的猜測增強,加上鯨魚活動的下降。造成的看跌情緒超過短褲的渴望,增加了另一層複雜性。因此,除非COMP突破較高的電阻水平,否則這可能是重新分配事件,而不是突破設置。

My Two Sats

我的兩個坐著

Here's my take: While AI16Z's move shows continued involvement, the mixed signals suggest caution. The current market climate feels like a high-stakes poker game. The increased retail speculation and technical indicators hinting at resistance around $49.07 and further Fibonacci levels at $52.51 and $55.30, make me think smart money is playing it cool, waiting for the right moment to act. I wouldn't be surprised if we see some volatility in the short term.

這是我的看法:雖然AI16Z的舉動顯示出繼續參與,但混合信號表明謹慎。當前的市場氣候感覺就像是一款高風險撲克遊戲。零售猜測和技術指標的增加暗示,阻力約為49.07美元,進一步的斐波那契水平為$ 52.51和55.30美元,讓我認為聰明的錢在玩它很酷,等待正確的時機。如果我們在短期內看到一些波動性,我不會感到驚訝。

The Road Ahead

前面的道路

The crypto world is always full of surprises. Whether this move signifies profit-taking, portfolio rebalancing, or a strategic repositioning, it reaffirms the critical role of institutional platforms like Coinbase Prime in facilitating large-scale digital asset management. As the crypto market matures, such calculated moves by major players will continue to shape liquidity, sentiment, and the very fabric of decentralized finance. But one thing's for sure: it's never a dull day in crypto!

加密世界總是充滿驚喜。無論這一舉動都表示獲利,投資組合重新平衡還是戰略重新定位,它都重申了Coinbase Prime等機構平台在促進大規模數字資產管理方面的關鍵作用。隨著加密貨幣市場的成熟,主要參與者所計算的動作將繼續塑造流動性,情感和分散財務的結構。但是可以肯定的是:在加密貨幣中,這絕不是沉悶的一天!

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- Pi Coin的艱難之旅:支持水平,恢復時間表以及專家所說的話

- 2025-07-02 01:10:12

- PI硬幣是籃板的嗎?專家們權衡了關鍵支持水平,潛在的恢復時間表以及USD1的驚人影響。

-

- shiba inu,ozak ai和加密貨幣:導航模因硬幣迷宮

- 2025-07-02 01:15:12

- 探索志願志,Ozak AI和加密貨幣的野生世界,深入研究潛在的催化劑,未來的預測和獨立精神。

-

-

-

-

-

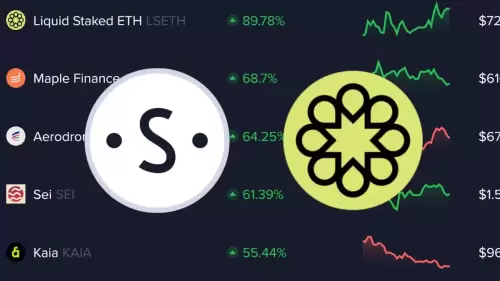

- 情感數據的隱藏寶石:您缺少的最佳性能加密

- 2025-07-01 23:10:15

- 揭開了由情感數據加油的最高表現的加密貨幣,包括隱藏的寶石和市場上意外的潮流。

-