XRP saw its first weekly outflow in 80 weeks as the global crypto investment products extended their inflow streak to six weeks.

The global cryptocurrency market witnessed a remarkable turn of events last week as stellar Bitcoin and crypto price performance attracted massive inflows into digital asset investment products, extending their positive streak to six weeks.

According to a Monday report by CoinShares, crypto products globally recorded a net inflow of $3.3 billion in the previous week. This ensured a six-week consecutive inflow, bringing the total inflow to $10.8 billion year-to-date and a record $187.5 billion in assets under management (AUM).

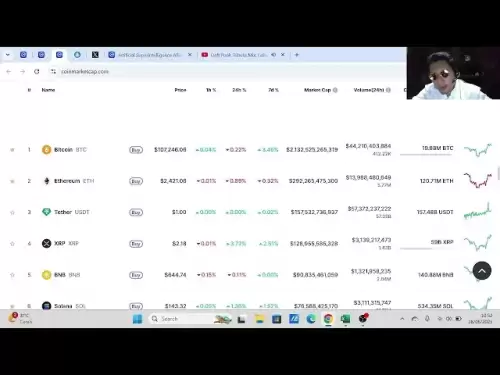

Meanwhile, the global cryptocurrency market cap grew 6% in the previous week to $3.5 trillion, driven by an altcoin resurgence and Bitcoin’s rally to price discovery. The pioneering cryptocurrency reached a new all-time high of $112,000 on May 22, extending recent bullish momentum.

Crypto Inflow Details

Bitcoin led inflows into crypto investment vehicles as the US spot exchange-traded funds amassed staggering amounts last week. Bitcoin funds saw a net weekly inflow of $2.98 billion, pushing month-to-date and year-to-date to $5.49 billion and $10.2 billion, respectively.

Crypto Inflows This Week

As stellar Bitcoin and crypto price performance brought in record-breaking volumes, the digital asset investment products extended their inflow streak to six weeks with a net inflow of $3.3 billion, according to the latest CoinShares report on Monday.This ensures a sixth week of consecutive inflows, bringing the total inflow to $10.8 billion year-to-date and a record $187.5 billion in assets under management (AUM).The global cryptocurrency market cap also grew by 6% last week to $3.5 trillion as investors returned to the market following the recent market downturn and stellar Bitcoin price performance. The bulk of the price increase was driven by an altcoin price surge and Bitcoin’s rally to price discovery. Notably, Bitcoin reached a new all-time high of $112,000 on May 22, further extending the recent bullish momentum.The report further revealed that Bitcoin-based funds attracted the majority of the inflows, with the US-based spot exchange-traded funds (ETFs) amassing staggering amounts. Bitcoin funds saw a net weekly inflow of $2.98 billion, pushing month-to-date and year-to-date to $5.49 billion and $10.2 billion, respectively.The outflows from XRP-based investment vehicles marked the first instance of outflows from the fourth-largest cryptocurrency since November 2023, with the cryptocurrency remaining in a consolidation pattern for several months. The report stated: “This week, we saw the first outflow from XRP products in 80 weeks, with investors pulling funds from the cryptocurrency as it continues to consolidate at lower levels following a sharp decline from December 2024 highs.”The report highlighted that BlackRock’s iShares Bitcoin Trust (IBIT) dominated proceedings for issuers, with the fund reporting a net inflow of $2.56 billion. One of its daily performances last week exceeded the Vanguard S&P 500 ETF (VOO) for the first time.The report also noted that the inflows were concentrated in the United States, with the country reporting an inflow of $3.3 billion. In contrast, Germany, Hong Kong, and Australia had smaller inflows of $41.5 million, $33.3 million, and $10.9 million, respectively. These inflows offset outflows from Switzerland, Sweden, and Brazil.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.