Analyzing recent whale activity, Bitcoin's resilience, and altcoin rally potential amid economic uncertainty.

Ever feel like you're watching a high-stakes poker game when you follow the crypto market? Whales, Bitcoin, Altcoins – the dance never stops. Let's dive into what's been shaking in the crypto sea.

Whale Movements: Big Players Making Big Moves

Recent onchain data reveals some fascinating activity from crypto whales. One whale deposited $20 million in USDC into Hyperliquid, then snapped up $5.97 million worth of HYPE tokens. Another withdrew a hefty 600 BTC (worth $64.22 million) from Binance, adding to their cold wallet stash. A third whale woke up after seven months, moving 5,190 ETH ($12.57 million) to Aave V3. What does it all mean?

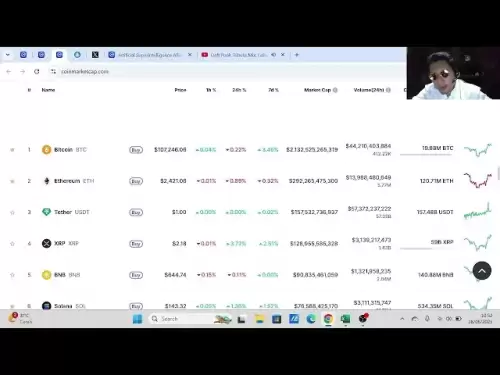

Bitcoin's Balancing Act: $107,000 and Beyond

Bitcoin's been battling to stay above the $107,000 mark. Exchange inflows are surprisingly low, suggesting retail investors are holding back. The big question: can Bitcoin keep climbing without the usual FOMO-driven retail rush? The US economy's mixed signals—slowing growth, stubborn inflation—add another layer of complexity. Some analysts are whispering “stagflation.” If the Fed cuts rates in response, that could supercharge Bitcoin. Long-term holders are accumulating, hinting at a potential breakout in Fall 2025.

Altcoin Season on the Horizon?

Altcoins might be gearing up for some serious rallies. Exchange flow is low, signaling accumulation rather than selling pressure. Crypto analyst Axel Adler Jr. points out that these periods of low exchange flow have historically preceded significant price surges for altcoins. The key is to identify projects with solid fundamentals, active development, and real-world use cases. Diversification is your friend. But remember, even in altseason, volatility reigns, so stick to your investment strategy.

Economic Winds and Crypto Tides

The broader economic picture plays a huge role. Stagflation fears are real. Keep an eye on those Fed rate decisions. Tariffs and trade wars add even more uncertainty. A weaker economy could ironically be bullish for Bitcoin as a hedge. The market seems to lack the broad conviction usually seen in bull cycles, with activity concentrated among sophisticated traders. Still, long-term holders are quietly accumulating.

Final Thoughts

So, what's the takeaway? The crypto market is a complex beast, influenced by whale behavior, economic forces, and investor sentiment. Bitcoin is holding its own, but the lack of retail participation is a wild card. Altcoins could be poised for a rally, but due diligence is crucial. Stay informed, be cautious, and maybe, just maybe, you'll ride the wave to some sweet gains. Remember, don't bet the farm, just enjoy the ride!

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.